Bitcoin Cash hash rate hits yearly peak as Phoenix dominates 90% of the network

Bitcoin Cash hash rate hits yearly high as Phoenix dominates 90% of the community

Bitcoin Cash hash rate hits yearly high as Phoenix dominates 90% of the community Bitcoin Cash hash rate hits yearly high as Phoenix dominates 90% of the community

Bitcoin Cash's BCH token designate has slumped to a four-month low amid the broader crypto market struggles.

Duvet art/illustration by capacity of CryptoSlate. Image contains blended recount material which would possibly maybe also encompass AI-generated recount material.

Bitcoin Cash’s hash rate soared to a yearly high this week after an unknown miner captured round 90% of its blocks within two days.

This surge comes as the community’s native BCH token hit a four-month low following a broader market shatter and the defunct Mt. Gox BCH repayment plans.

Phoenix mines 90% of BCH blocks

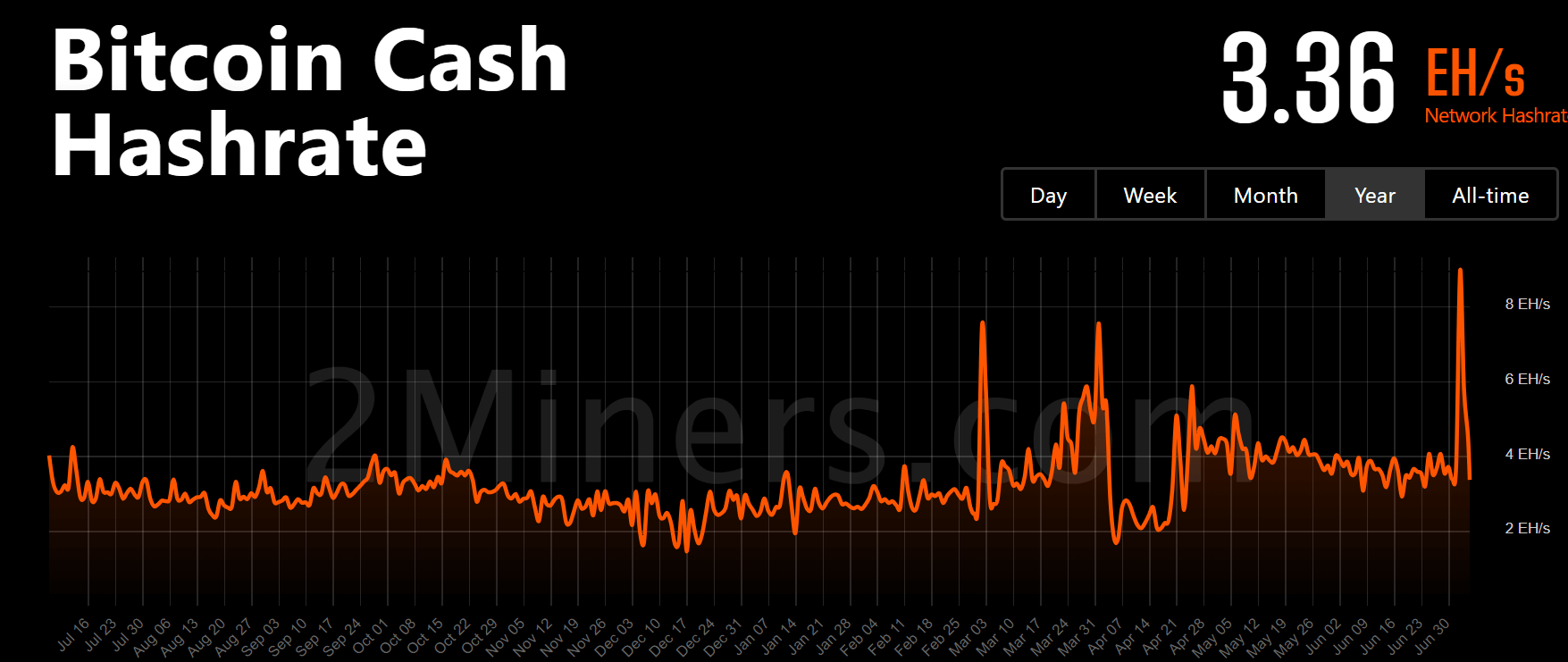

Constant with 2miners knowledge, the Bitcoin Cash community saw a extensive hash rate surge between July 2 and July 4, rising from 3.6 EH/s to a yearly high of 9.4 EH/s earlier than declining abet to the weekly sensible of 3.3 EH/s as of press time.

The hash rate is a excessive measure of a blockchain community’s health. It measures the computational vitality feeble to mine and route of transactions. A greater hash rate map a safer community, requiring more computational vitality to alter the blockchain and making it more proof in opposition to assaults.

Conversely, a decrease hash rate signifies less computational vitality for mining and processing transactions, reducing the community’s total safety.

So, whereas BCH’s dramatic soar in hash rate indignant the crypto community, it additionally sparked speculation about its causes and implications for the community.

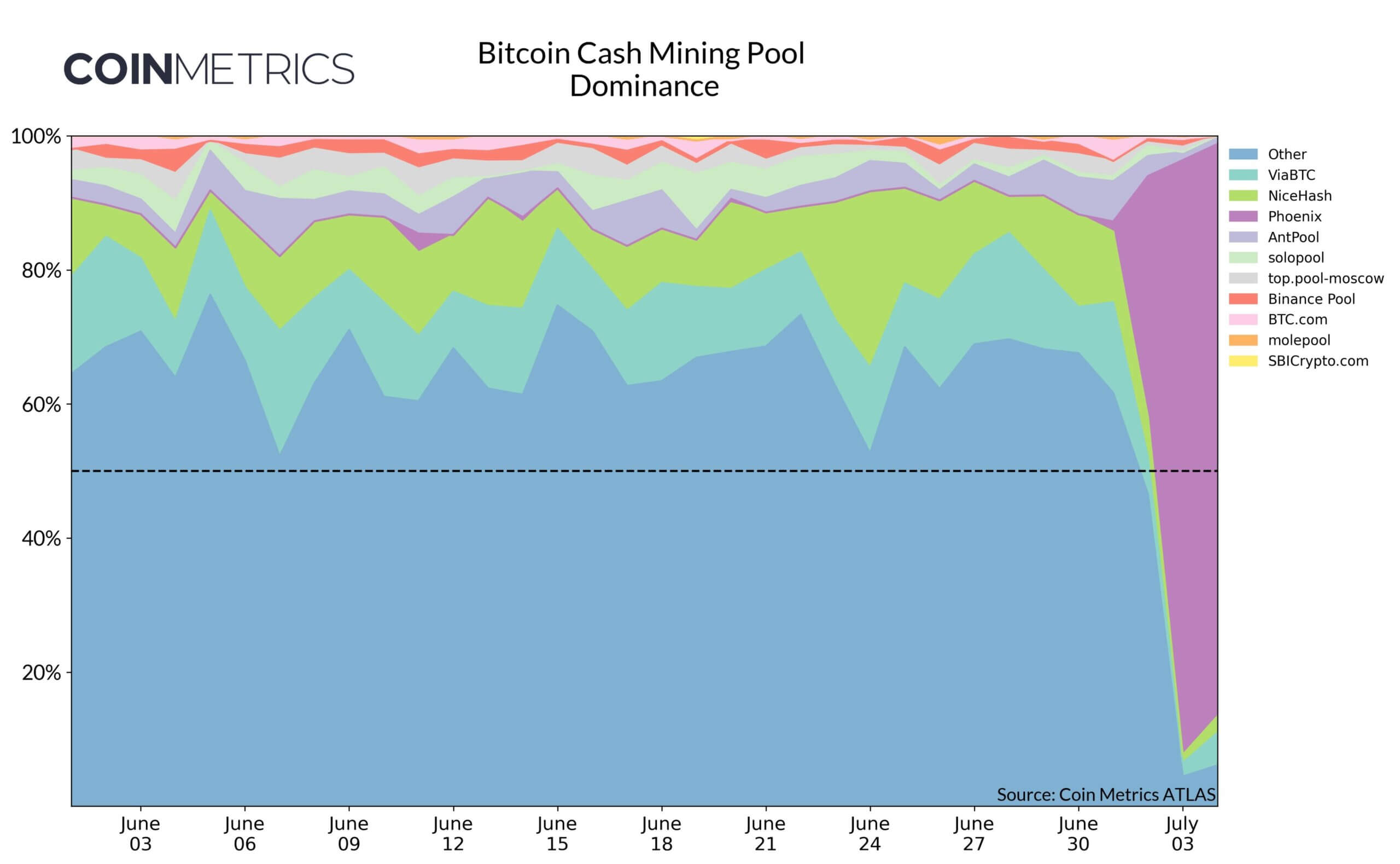

The Bitcoin Cash Podcast attributed the surge to a unique miner named “Phoenix, ” which captured many of the unique BCH offers. Records displays this miner produced about 90% of the blocks during these two days, although its dominance has fallen to 29% at press time.

Parker Merritt, a researcher at CoinMetrics, supported this judge about. He urged the miner used to be linked to the Phoenix Community, an Abu Dhabi-listed Bitcoin mining firm that not too lengthy ago launched a mining pool carrier for BTC and BCH networks.

Extra, Merritt famend that Phoenix’s actions would possibly maybe well also very successfully be an strive to highlight the “risks of mining centralization.”

Label declines to 4-month low

Bitcoin Cash mining concerns surfaced when the community’s native BCH token plunged to a four-month low of $305.

Market observers attributed the decline to the broader market decline that saw fundamental digital resources love Bitcoin topple by round 7% in the past day to below $55,000. At the similar time, Ethereum additionally lost the $3,000 mark throughout the reporting duration.

Additionally, Merrit pointed out that BCH’s designate would possibly maybe well face heavy selling exercise as Phoenix would possibly maybe well also not HODL their earnings.

Talked about on this article

Source credit : cryptoslate.com