Bitcoin bull run could continue for 200 days before possible US recession – Report

Bitcoin bull skedaddle might per chance additionally continue for 200 days sooner than that you just might per chance per chance additionally mediate of US recession â Story

Bitcoin bull skedaddle might per chance additionally continue for 200 days sooner than that you just might per chance per chance additionally mediate of US recession â Story Bitcoin bull skedaddle might per chance additionally continue for 200 days sooner than that you just might per chance per chance additionally mediate of US recession â Story

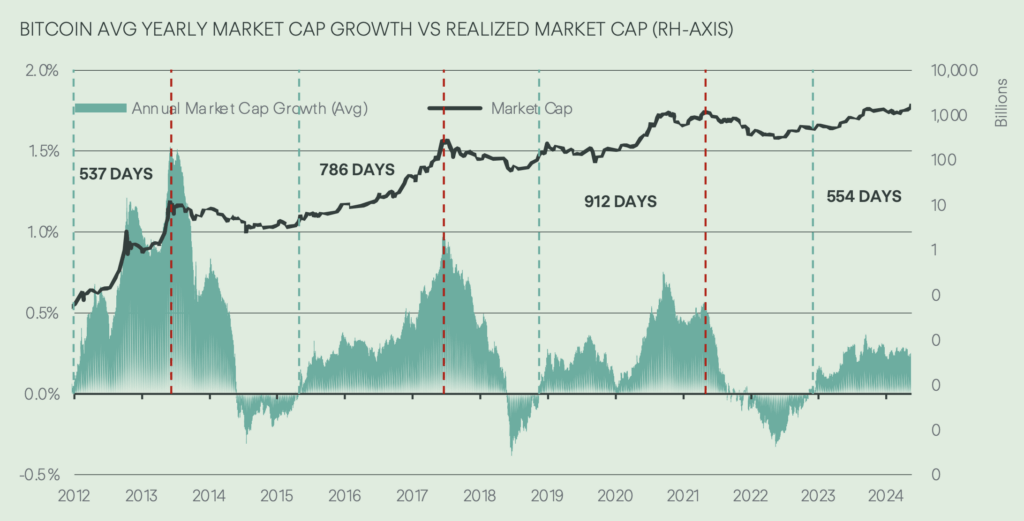

As Bitcoin reaches day 554 of its cycle, Copper.co suggests a peak is aligned with attainable mid-2025 US recession forecasts.

Quilt art/illustration by CryptoSlate. Image involves mixed train that will well perhaps encompass AI-generated train.

Bitcoin’s latest market cycle indicates a attainable peak in about 200 days, coinciding with forecasts of a that you just might per chance per chance additionally mediate of US recession by mid-2025. In step with latest learn from Copper.co, this alignment emerges as Bitcoin reaches day 554 of its cycle.

Historically, Bitcoin’s market cycles moderate 756 days from the level when the annual moderate enhance of its market capitalization turns obvious till it hits a tag peak. Copper.co assesses that the latest cycle started spherical mid-2023, rapidly sooner than BlackRock filed for a Bitcoin alternate-traded fund. Bitcoin might per chance additionally peak spherical mid-2025, approximately 200 days from now, if the pattern holds.

Copper.co makes tell of JPMorgan’s estimate of a 45% likelihood of a US recession going down within the second half of of 2025 to showcase a attainable overlap of Bitcoin’s peak with economic downturn predictions, including a layer of complexity to market expectations. Investors might per chance additionally fair gather this intersection fundamental when involving by portfolio techniques amid macroeconomic uncertainties.

Realized volatility for Bitcoin currently stands at 50%, reflecting the identical outdated deviation of returns from the market’s mean return. Implied volatility, which gauges market expectations for future volatility, recently hit its most realistic doubtless level of the twelve months. This implies ongoing market turbulence as 2025 approaches, with a that you just might per chance per chance additionally mediate of bullish undertone influencing trading behaviors.

Bitcoin’s Relative Energy Index (RSI) is at 60, significantly decrease than old bull market highs. Copper.co’s document highlights that by extending the RSI’s hit upon-succor interval to four yearsâa timeframe that reduces rapid-time-frame noiseâthe indicator reveals gargantuan room for enhance. This metric implies that Bitcoin might per chance additionally procedure momentum into the new twelve months, doubtlessly reaching elevated valuation ranges.

Lazy Bitcoin offer, representing cash held without lumber for prolonged classes, is increasing amid document costs. This pattern indicates that long-time-frame holders take care of their positions, however vigilance is told. Must restful these traders launch up to pass assets, it will per chance well additionally signal shifts in market forces or income-taking actions.

Per Copper.co’s prognosis, combining these elements paints a nuanced image of Bitcoin’s trajectory. The interaction between market cycles, volatility measures, and macroeconomic forecasts illustrates the significance of monitoring a few indicators.

Source credit : cryptoslate.com

CryptoQuant

CryptoQuant

Farside Investors

Farside Investors

CoinGlass

CoinGlass