Bitcoin breaks past $42k, hitting a five-day high

The worth of Bitcoin surpassed $42,000 on Jan. 26 amidst vital situation Bitcoin ETF flows and an pork up to Coinbase’s stock ranking.

Bitcoin (BTC) used to be valued at $42,040.36 with a market cap of $824.4 billion at 8:05 pm UTC on Friday. That marks 5.3% growth over 24 hours.

Bitcoin’s new mark also represents a five-day high, as prices were end to $40,000 on Jan. 24 and 25 and as little as $38,678 on Jan. 23

The cryptocurrency market in its entirety used to be up 4.6% over 24 hours. Totally different prime ten sources saw associated mark positive aspects at present: Avalanche (AVAX) used to be up 7.3%, Solana (SOL) used to be up 5.9%, XRP used to be up 3.7%, BNB used to be up 3.5%, Cardano (ADA) used to be up 3.3%, and Ethereum (ETH) used to be up 1.9%.

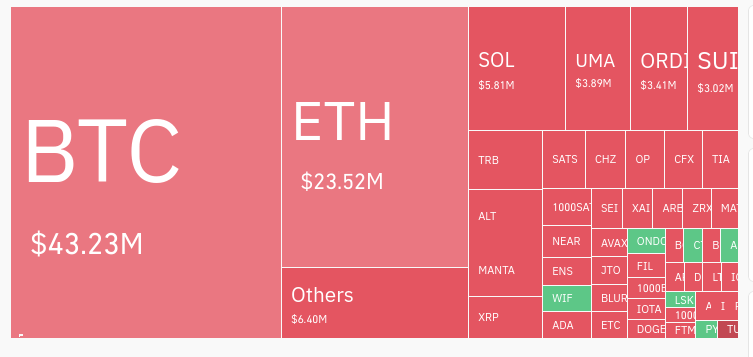

The market saw $116 million in liquidations over 24 hours, primarily primarily based on Coinglass files, with Bitcoin (BTC) accounting for $43.23 million of liquidations and Ethereum (ETH) accounting for $23.52 million of liquidations.

Good points will doubtless be resulting from ETF flows, Coinbase ranking

Although it is rarely fully recognized why Bitcoin has obtained mark at present, situation Bitcoin ETF inflows and outflows are one main have an effect on on the market.

Outflows from Grayscale’s GBTC ETF are indisputably slowing and could perhaps need largely concluded, primarily primarily based on a checklist from JP Morgan on Jan. 25. Excessive GBTC outflows set aside more Bitcoin (BTC) onto the market, providing an even bigger provide in comparison with investor request. Such outflows doubtless contributed to falling Bitcoin prices within the weeks following diverse situation Bitcoin ETF approvals on Jan. 10.

Conversely, inflows into completely different funds get taken Bitcoin off the market and will doubtless be serving to to seize prices. Although most situation Bitcoin ETFs get clear inflows, BlackRock’s iShares Bitcoin Believe (IBIT) notably crossed $2 billion in total inflows on Jan. 26. Obtain inflows for all situation Bitcoin ETFs amount to $744 million.

Totally different clear inclinations could per chance even get influenced crypto prices besides. Yahoo! Finance analysts principal that Coinbase (COIN)’s stock ranking has been upgraded by Oppenheimer & Co. The worth of COIN can also be up 3.40% at present.

Source credit : cryptoslate.com