Bitcoin and Ethereum take a hit as $1.2 billion in crypto liquidated

Bitcoin and Ethereum rob a success as $1.2 billion in crypto liquidated

Bitcoin and Ethereum rob a success as $1.2 billion in crypto liquidated Bitcoin and Ethereum rob a success as $1.2 billion in crypto liquidated

Merchants everywhere in the market saw foremost losses in the wake of Fed's most modern monetary policy change.

Cowl work/illustration by diagram of CryptoSlate. Image contains blended bid that may possibly possibly encompass AI-generated bid.

The crypto market continues to face a sharp downturn, shedding around 10% previously 24 hours after the Federal Reserve’s most modern policy change.

Bitcoin’s put plunged nearly 10%, hitting a low of $93,000. This marks a stark reversal from its most modern high of $108,268 earlier this week.

The drop brings Bitcoin to its lowest level since mid-November, when it was riding a bullish wave spurred by market optimism following Donald Trump’s election victory.

Ethereum faced an even sharper fall, losing by nearly 15% and reaching $3,100âits weakest location since gradual November.

Binance Coin (BNB), Solana (SOL), Dogecoin (DOGE), and Cardano (ADA), moreover recorded double-digit losses, with files exhibiting drops exceeding 10%.

Market analysts attribute this frequent promote-off to the Federal Reserve’s tightened stance on monetary policy. Even supposing the Fed made anticipated adjustments to borrowing charges, it reduced its forecast for price cuts in 2025 from four to unbiased two. This hawkish outlook has added rigidity to an already fragile market.

Moreover, the Federal Reserve clarified that it has no plans to toughen any proposed executive Bitcoin reserve technique, further dampening market sentiment.

Markus Thielen, the head of research at 10x Be taught, acknowledged that Bitcoin’s most modern put level serves as a serious marker for risk administration. He famed that the Fed’s firm policy stance and doable liquidity adjustments anticipated from the US Treasury in 2025 have increased market uncertainty.

Liquidation frenzy hits the market.

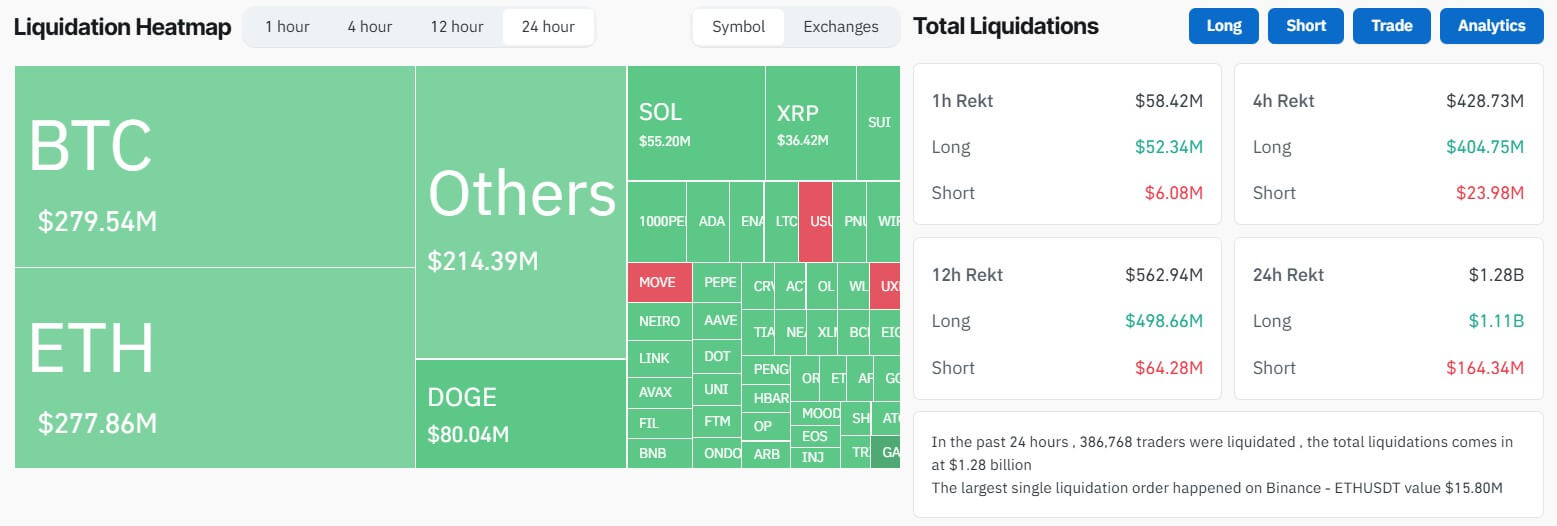

In step with files from CoinGlass, the most modern market turbulence introduced on over $1.2 billion in liquidations, impacting 377,618 merchants.

Lengthy tradersâthose making a wager on put increasesâtook the brunt of the losses, shedding roughly $1.07 billion. This marks one in all an necessary setbacks for long merchants this yr.

Within the intervening time, short merchants wagering on falling prices misplaced $163 million at some point soon of the reporting length.

Speculators on Bitcoin put suffered an necessary losses, with $279 million liquidated, alongside side $227.5 million in long positions. Ethereum merchants adopted closely with $277 million in liquidations, alongside side $248.7 million from long positions and $28.2 million from short positions.

Merchants making a wager on Solana, XRP, and Dogecoin moreover suffered losses of $55 million, $36 million, and $80 million, respectively.

Basically the most crucial single liquidation took place on Binance, intriguing a $15 million ETH-USDT transaction, further highlighting the intensity of the market’s most modern volatility.

Talked about in this text

Source credit : cryptoslate.com