Bitcoin and Ethereum exchange balances hit record lows as spot ETFs drive withdrawals

Bitcoin and Ethereum change balances hit myth lows as home ETFs pressure withdrawals

Bitcoin and Ethereum change balances hit myth lows as home ETFs pressure withdrawals Bitcoin and Ethereum change balances hit myth lows as home ETFs pressure withdrawals

Consultants possess predicted that the rising ask for Ethereum and Bitcoin could also trigger a present crunch.

Hide art work/illustration by CryptoSlate. Image involves blended disclose material that may perhaps encompass AI-generated disclose material.

Bitcoin and Ethereum provides on centralized exchanges possess hit myth lows following the introduction of crypto-associated home change-traded funds (ETFs) in america.

Essentially based on Glassnode files, Bitcoin balances on exchanges possess fallen to 11.6%, the lowest since December 2017. Ethereum balances are even decrease at 10.6%, the lowest since October 2015.

Space ETFs trigger withdrawals

Market consultants possess defined that the declining change balances coincide with the Securities and Substitute Rate’s (SEC) approval of ETF products for Bitcoin and 19-b filings for Ethereum.

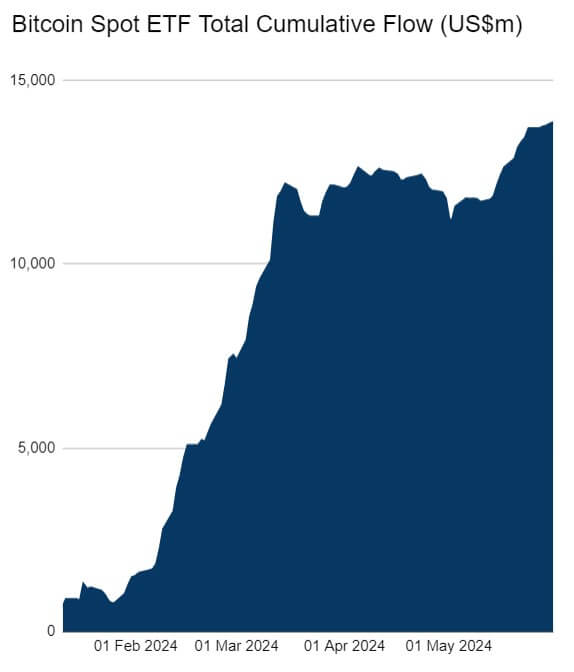

HeyApollo files finds that home Bitcoin ETFs possess gathered 857,700 BTC, valued at $58.5 billion, in beautiful five months. BlackRock’s IBIT ETF leads this acquisition with round $20 billion in sources, adopted by Constancy’s FBTC, with approximately $11 billion.

Whereas home Ethereum ETFs possess not but begun trading, investor anticipation has driven valuable withdrawals. Essentially based on CryptoQuant files, 777,000 ETH, price about $3 billion, were pulled from exchanges since the SEC’s approval.

Additionally, the likelihood to stake ETH has influenced its declining change steadiness. Nansen reviews that 32.8 million ETH, or 27% of its total present, are at the moment staked to beef up the network.

Is a present crunch on the potential?

If the declining change steadiness style continues, market consultants possess predicted ask for Bitcoin and Ethereum could also lead to a present crunch.

In a present social media put up, BTC Echo editor Leon Waidmaan instructed patrons to brace for a “present squeeze” and the possible of “the subsequent enormous slide.”

Historically, when digital sources are withdrawn from exchanges, it suggests patrons thought to defend as adverse to promote, reflecting bullish sentiment and expectations of future yelp. A present squeeze could also vastly impact prices by limiting the obtainable present, doubtlessly resulting in enormous sign increases if present accumulation trends persist.

Mentioned on this text

Source credit : cryptoslate.com