BIS urges caution as finance industry embraces asset tokenization

BIS urges warning as finance alternate embraces asset tokenization

BIS urges warning as finance alternate embraces asset tokenization BIS urges warning as finance alternate embraces asset tokenization

The BIS represent, published on Oct. 21, pressured that while the advantages of tokenization are particular, the hazards can't be overlooked.

Quilt artwork/illustration by CryptoSlate. Picture involves combined philosophize material that can additionally simply consist of AI-generated philosophize material.

The Financial institution for World Settlements (BIS) has issued a cautionary represent as faded financial institutions tempo up their exploration of tokenization, raising concerns over governance, stunning frameworks, and financial steadiness.

Tokenization, which converts genuine-world belongings (RWA) cherish property and securities into digital tokens, has drawn attention for its skill to streamline transactions and minimize charges. Mechanisms cherish transport-versus-charge (DvP) and charge-versus-charge (PvP) may maybe well wait on mitigate dangers in financial markets.

In accordance with the BIS:

“Tokenization may maybe well reshape market constructions by cutting transaction charges and bettering settlement processes.”

Nonetheless, the BIS represent, published on Oct. 21, pressured that while the advantages are particular, the hazards can't be overlooked.

Regulatory uncertainty

Irrespective of these promising advantages, the BIS represent emphasised that tokenized belongings face important stunning and regulatory uncertainties. One key scream is whether or no longer or no longer existing criminal tips lengthen to tokenized variations of business merchandise.

As an illustration, within the US, faded repurchase agreements (repos) are shielded by computerized chapter protections â but it’s unclear if tokenized repos would secure the the same stunning remedy.

The represent also raised concerns about how tokenization may maybe well disrupt the roles of central banks in funds, financial protection, and financial oversight.

The BIS pressured that policymakers wish to assess seemingly alternate-offs between a good deal of sorts of settlement belongings and be particular factual regulation of non-public sector initiatives to preserve steadiness.

RWA Tokenization boost

Irrespective of the hazards, financial institutions cherish Barclays, Citi, and HSBC are transferring ahead with tokenization initiatives. Trials such as the UK’s Regulated Liability Community (RLN) are already exploring the feasibility of tokenized deposits and programmable funds.

The sector for tokenized genuine-world belongings (RWAs) is projected to grow dramatically in 2024 and beyond. Tren Finance estimates the market may maybe well swell to wherever from $4 trillion to $30 trillion by the decade’s cease.

Even a median estimate of $10 trillion would signify a broad jump from the recent $185 billion, which involves stablecoins.

As the push for tokenization beneficial properties momentum, the BIS represent serves as a successfully timed reminder that while the expertise holds enormous promise, it comes with charges that require careful regulatory oversight.

The represent mentioned:

âEfficiency beneficial properties is no longer going to near with out important investment and coordination.”

With tokenization poised to reshape finance, collaboration between the final public and non-public sectors will seemingly be important in mitigating dangers and unlocking its fat seemingly.

Mentioned on this text

Source credit : cryptoslate.com

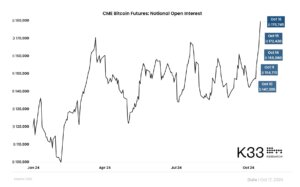

CoinGlass

CoinGlass

Dune Analytics

Dune Analytics

CryptoQuant

CryptoQuant