Binance’s BUSD loses top five stablecoin spot as supply dips under 1B

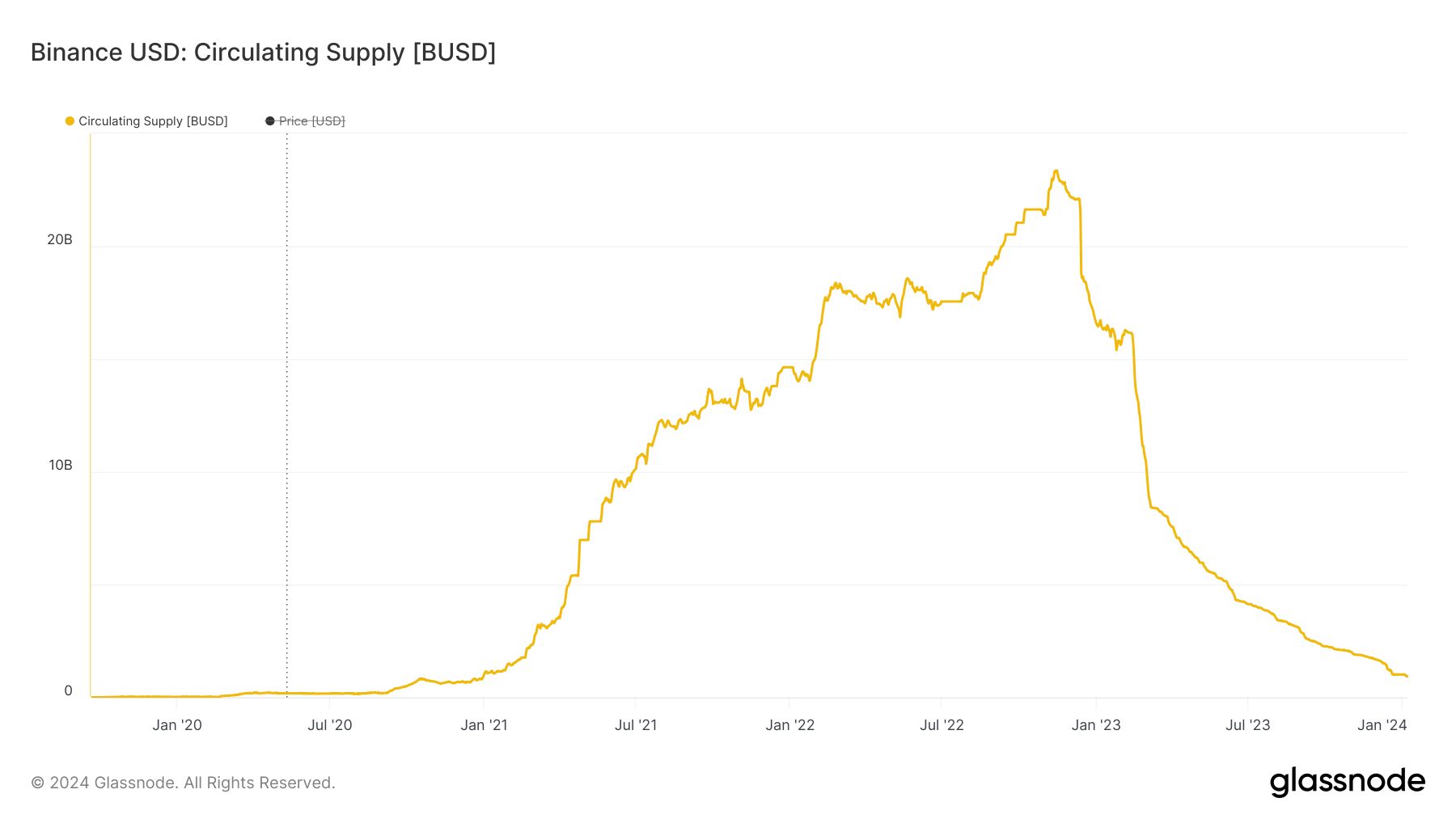

Binance USD (BUSD) slipped out of the extinguish five stablecoins by market capitalization over the weekend after its circulating supply dipped under 1 billion, its lowest point since Dec. 2020.

Recordsdata from CryptoSlate presentations that BUSD’s circulating supply sits at 927 million tokens, marking a staggering 96% decrease from its top supply of 23.45 billion. This decline has furthermore greatly impacted its shopping and selling volume of no longer as a lot as $50 million accurate by the past 24 hours.

The Binance-backed stablecoin troubles began closing 365 days after the U.S. Securities and Trade Rate (SEC) labeled it a security in its accurate actions towards the cryptocurrency change. Moreover that, BUSD issuer Paxos became as soon as pressured to extinguish diversified mints of the asset by the Fresh York Department of Monetary Companies and products. Binance and Paxos vehemently rejected this SEC classification.

These developments caused a swift exodus from the jumpy stablecoin in the midst of the crypto community as Binance today began to push so a lot of stablecoin picks, together with TrueUSD (TUSD) and First Digital USD (FDUSD), to its customers.

On Jan. 5, Binance revealed that it carried out the automatic conversion of eligible customers’ balances in the BUSD token to FDUSD. It extra explained that it no longer supports the withdrawals of BUSD and entreated its customers to manually swap these BUSD tokens for FDUSD tokens at a 1:1 conversion rate on Binance Convert.

Despite this, Binance and Paxos bear committed to supporting BUSD till its total piece-out this 365 days.

USDT, USDC bear stablecoin dominance

With BUSD’s decline, the extinguish five stablecoins market by market capitalization now involves contemporary entrants bask in TUSD and FDUSD—two stablecoins that were heavily promoted by Binance.

On the opposite hand, Tether’s USDT remains the dominant participant in the home, controlling round 70% of the market with a market capitalization of more than $90 billion. It’s miles followed carefully by Circle’s USDC, whose market cap sits at $24.56 billion.

21Shares researcher Tom Wan emphasised that for a stablecoin to contend successfully towards these behemoths, it would require integration into centralized exchanges, incorporation into DeFi platforms, and utility in payment and remittance functions.

Source credit : cryptoslate.com