Binance discontinues leveraged tokens amid a quiet market share rebound

Crypto change Binance offered discontinuing trading and subscription services for its leveraged token choices, collectively with Bitcoin, Ethereum, and its BNB Coin, efficient Feb. 28.

In keeping with the Feb. 19 mumble, the change will delist these tokens and end redemption by April 3. The affected leveraged tokens are BTCUP and BTCDOWN, ETHUP and ETHDOWN, and BNBUP and BNBDOWN.

Users are urged to interchange their tokens forward of the Feb. 28 closing date. Afterward, tokens can tranquil be redeemed in the course of the wallet feature or on its web sites. These sources could per chance be robotically transformed into USDT after the delisting length.

Binance Leveraged Tokens are by-product merchandise representing a basket of perpetual contract positions that give customers leveraged exposure to the underlying asset. Esteem assorted tokens, these sources could per chance also be traded in the course of the command market.

Thus, they enable the change customers to take part in by-product trading with out tweaking their trading concepts. On the opposite hand, these sources additionally carry some inherent dangers.

Though Binance didn’t specify the reason for discontinuing these services, it acknowledged that it grow to be serious about handing over optimal cost to potentialities and maintaining competitiveness.

Binance silent resurgence continues

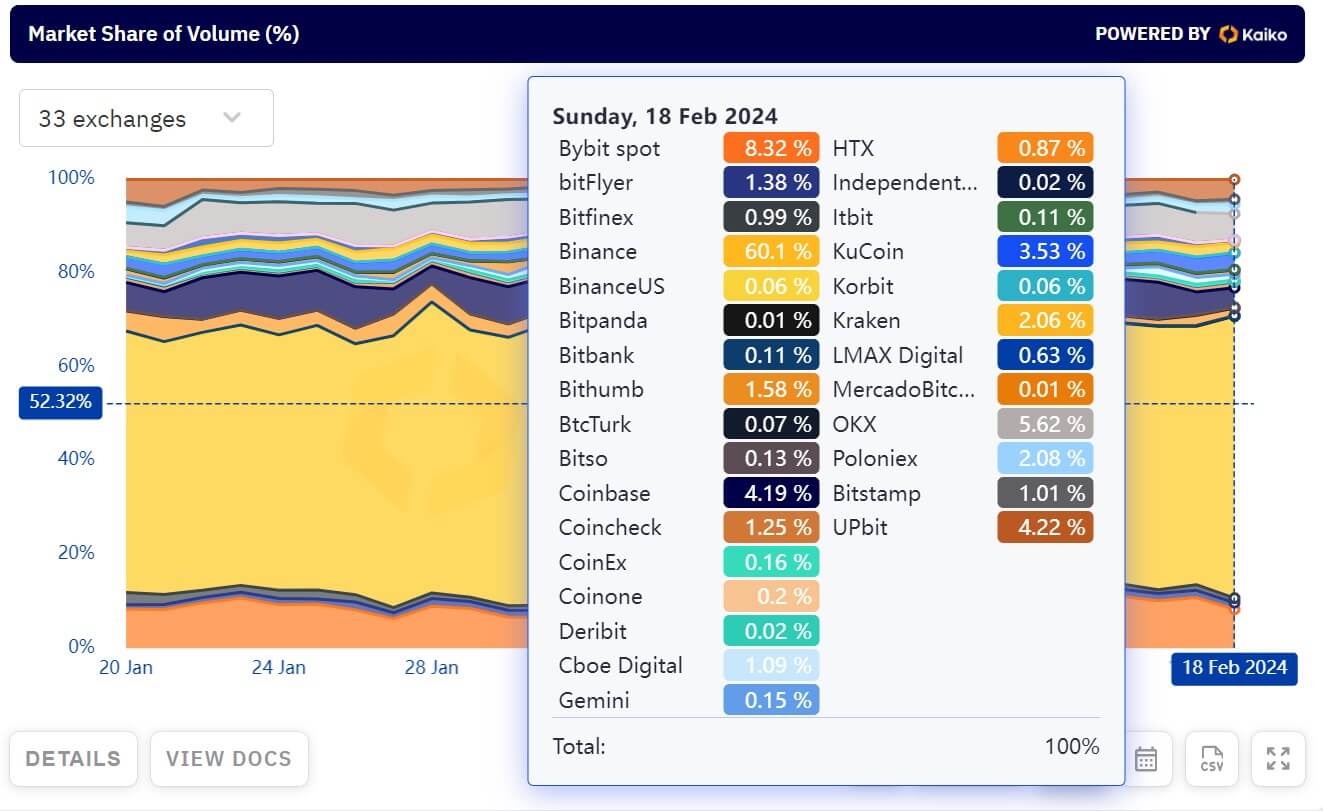

Extra, Binance’s market share is quietly rebounding to outdated peaks following regulatory challenges that affected its operations last yr.

The platform exited, or in part exited, a number of areas, collectively with Canada, the United Kingdom, and a lot of European countries adore Austria, Cyprus, and the Netherlands, as a consequence of these regulatory concerns. Additionally, it settled with US authorities for $4.3 billion, causing its market share to plunge to 44.5% by the discontinue of the yr.

On the opposite hand, Kaiko data show that its numbers are improving, with the change controlling more than 60% of the market share quantity as of Feb. 18. Earlier within the month, CryptoSlate Perception pointed out that the firm had overtaken CME because the main change when it involves Bitcoin futures open ardour.

Source credit : cryptoslate.com