Binance challenges SEC lawsuit crypto classification in court motion

Binance challenges SEC lawsuit crypto classification in court movement

Binance challenges SEC lawsuit crypto classification in court movement Binance challenges SEC lawsuit crypto classification in court movement

Binance argued that SEC unnoticed court ruling, which clarified secondary market crypto resales are not securities transactions.

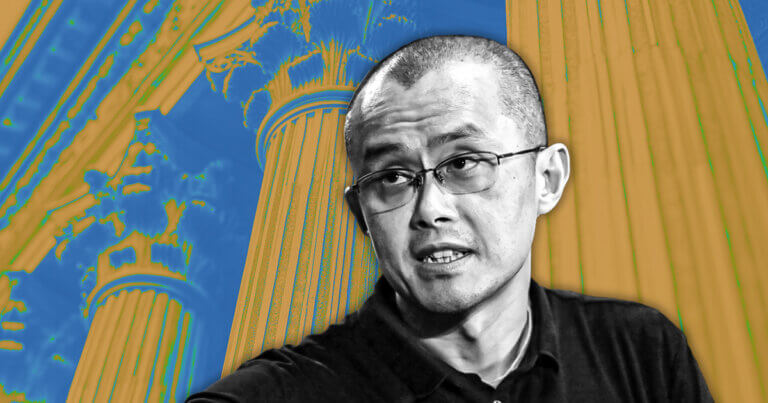

Net Summit / CC BY 2.0 / Flickr. Remixed by CryptoSlate

Binance and its founder, Changpeng Zhao, agree with filed a movement to dismiss the US Securities and Trade Commission’s (SEC) amended complaint.

In a Nov. 4 court submitting, Binance and Zhao’s simply team argued that the SEC has absolute top superficially acknowledged a earlier court ruling, which clarified that crypto will not be inherently categorized as a safety.

In accordance with them, the SEC’s expanded lawsuit contradicts an current court ruling that eminent crypto from securities. The commerce highlighted that the SEC’s explain disregards the logical implications of that ruling, which potential that secondary market resales of digital assets elevate out not constitute securities transactions after their builders before the entirety disbursed the assets.

The defendants extra argued that the amended complaint lacks a sure simply foundation to repeat aside between assets inquisitive about investment contracts and the investment contracts themselves.

The submitting acknowledged:

“Assetsâwhether or not oranges, Beanie Infants, or crypto assetsâelevate out not change into investment contracts in perpetuity simply on fable of they were before the entirety offered and offered to possibilities as phase of a kit of guarantees and expectations that collectively qualify as ‘investment contracts’ under the Howey take a look at.”

Binance extra outlined that token gross sales over exchanges are on the general impersonal. When one occasion locations an insist to purchase and one other locations an insist to promote, the transaction is carried out by matching utility without command interplay. In these cases, patrons lack any cheap expectation that their funds are invested into a joint project geared in opposition to producing profits. With out this expectation, the transaction fails to fulfill the necessities of an investment contract under securities law.

So, Binance is seeking the dismissal of the amended complaint and desires instruct parts of the SEC’s requested reduction removed from consideration.

Blind gross sales

Furthermore, Binance and Zhao contested the SEC’s classification of alleged blind gross sales of BNB by Binance Holdings Restricted (BHL) as investment contracts. They argued that these gross sales resemble resales, the place patrons had minimal info about the seller, making them not going to qualify as investment contracts.

Within the period in-between, Binance’s movement to dismiss additionally involves a requirement to reject the monetary regulator’s demand for disgorgement and efforts to bar Zhao from collaborating within the securities market. The submitting acknowledged:

“After an intensive pre-breeze smartly with investigation and 16 months of ‘expedited be conscious’ into BAMâs custody of purchaser wallets and assets, ECF 71 at 9, the Amended Criticism restful conspicuously lacks any allegations that the challenged habits by BHL or Mr. Zhao harmed possibilities, as is required for the SEC to see disgorgement.”

Earlier within the 365 days, the SEC expanded its fashioned lawsuit against Binance to encompass extra digital assets. Within the modification, the SEC additionally maintained that on the subject of all crypto transactions, including secondary market trades, qualify as securities transactions.

This vogue happens amid ongoing debate about the SEC’s inconsistent diagram to defining the safety place of digital assets. Over time, the SEC has faced criticism for its conflicting stances and perceived contradictions with court rulings.

Talked about in this text

Source credit : cryptoslate.com

Farside Investors

Farside Investors

CoinGlass

CoinGlass