Binance allows customers to custody trading collateral off exchange as market share recovers

A Binance representative confirmed in a Jan. 30 electronic mail assertion sent to CryptoSlate that the platform is now allowing institutional investors to stable their procuring and selling collateral thru a third-celebration banking associate.

Binance’s solution, described as a “banking triparty” association, has been below pattern for the previous two years and instantly addresses the foremost area of counterparty risk, a huge consideration for institutional investors. This model permits investors to handle risk successfully while optimizing capital efficiency by pledging collateral in former resources.

While small print about the grunt banking partners live undisclosed, Binance emphasised full of life engagement with fairly about a banking entities and institutional investors expressing pastime within the association.

The platform presented the pilot blueprint for this solution excellent November, allowing collateral held with the banking associate to be in fiat equivalents, reminiscent of Treasury Bills.

Before this pattern, Binance purchasers had been restricted to retaining their resources on the alternate itself or thru its custodial service provider, Ceffu. On the other hand, concerns arose following the U.S. Securities and Substitute Price’s lawsuit in opposition to Binance, questioning the alternate’s crypto pockets custody practices and its relationship with Ceffu.

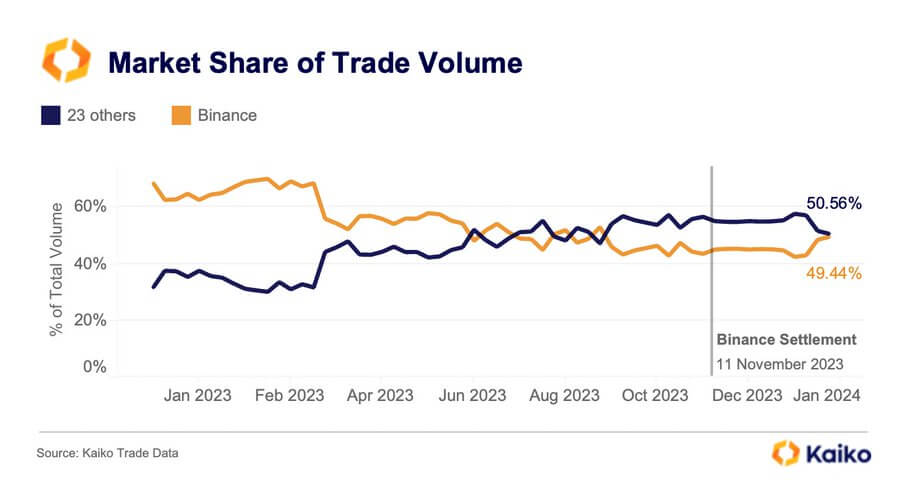

Binance market portion recovers.

Binance market portion is gradually rising to outdated heights after its plod-in with lots of financial regulators at some level of fairly about a jurisdictions impacted its operations excellent Twelve months.

Per this important turnaround, Binance CEO Richard Teng expressed his optimism with a succinct “Comprise Constructing” put up on social media platform X.

Source credit : cryptoslate.com