Beyond Hacks: Understanding and managing economic risks in DeFi

Beyond Hacks: Working out and managing economic risks in DeFi

Beyond Hacks: Working out and managing economic risks in DeFi Beyond Hacks: Working out and managing economic risks in DeFi

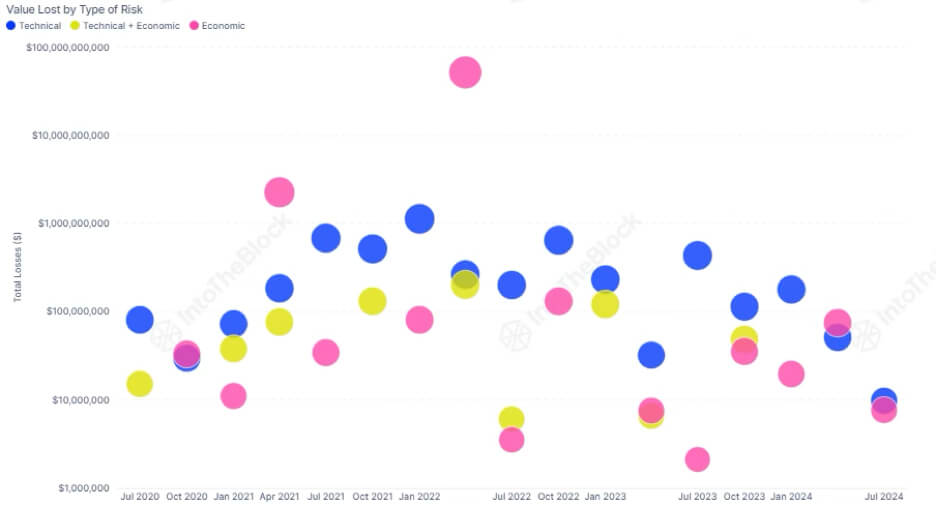

When discussing pain in DeFi, the conversation on the final veers in direction of hacks and safety breaches. This focal level is understandable, given the headlines and the in most cases dramatic fallout from such events. Hack evaluation, autopsy experiences, and suggestions for better safety practices dominate the conversation. Nonetheless, whereas these discussions are mandatory, they on the final overshadow a extra insidious type of pain: economic pain.

Duvet art/illustration by strategy of CryptoSlate. Picture contains combined bid that can consist of AI-generated bid.

The next is a guest article from Vincent Maliepaard, Marketing Director at IntoTheBlock.

Financial risks contain led to virtually $60 billion in losses all over DeFi protocols. While this amount could appear high, it exclusively reflects losses at the protocol level. The specific entire is doubtless grand bigger when factoring in individual user losses in consequence of varied economic pain factors. These non-public losses on the final come up from volatile market conditions, advanced inter-protocol dependencies, and sudden liquidations.

Working out Financial Probability in DeFi

Financial pain in DeFi refers back to the doubtless monetary loss in consequence of antagonistic actions in market conditions, liquidity crises, inaccurate protocol design, or exterior economic events. These risks are multi-faceted and can stem from quite a few sources:

- Market Probability: Volatility within the price of resources can consequence in critical losses. Shall we remark, sudden charge drops in collateralized resources can space off liquidation events, main to a cascade of compelled selling and extra charge drops.

- Liquidity Probability: The lack to instant aquire or promote resources with out causing a critical impact on the price. In DeFi, this could manifest for the length of a market promote-off when liquidity swimming pools dry up, exacerbating losses.

- Protocol Probability: This pain arises from flaws or inefficiencies within the design of DeFi protocols. Impermanent loss, oracle manipulation, and governance assaults are examples of how protocol-specific risks can materialize.

- Exterior Probability: Components exterior the protocol equivalent to actions by unprecedented market gamers or adjustments in macro rates and conditions, can introduce critical risks which would be on the final beyond the management of users or a protocol.

The Layers Within Financial Probability

In DeFi, economic risks are pervasive, but they'll also even be understood on two crawl stages: protocol-level risks and user-level risks. Distinguishing between the two helps users better account for the risks that impact their solutions and music key signals to steal preventative action.

Protocol Level Risks

Protocols enforce safeguards by variable parameters designed to restrict publicity to economic losses. A frequent example is the lending and borrowing parameters space by lending protocols, that are tested and calibrated to cease horrible debt from collecting. These measures are in overall utilitarian, aiming to supply protection to the protocol from economic risks on a ample scale, benefiting the largest amount of users.

While managing economic risks is changing into increasingly extra predominant for stopping unprecedented-scale losses at the protocol level, the key target is narrowâon the protocol itself. They donât address the risks that individual users could introduce by making economically unstable decisions internal their very have solutions.

Shopper Level Risks

Shopper-level risks are on the final reduced to the amount of leverage a individual takes in long or short positions, but this exclusively scratches the skin. Customers face a selection of extra risks, equivalent to liquidations, impermanent loss, slippage, and the chance of locked lending liquidity. These individual risks donât on the final descend beneath the scope of protocol pain management, but can contain a critical monetary impact on individual users.

The steady news is that these user-level economic risks are highly actionable. By belief their very have pain profile, users can actively space up and mitigate the risks specific to their approach. This personalized arrive to pain management remains one of many most underutilized instruments readily out there to DeFi contributors right this moment time.

The interconnected nature of risks all over DeFi protocols

Financial pain management is predominant when addressing risks that span a couple of DeFi protocols. While protocol audits and pain parameters toughen individual protocols, DeFi users on the final have interaction with a couple of protocols of their solutions. This makes user-level pain management mandatory.

Every extra protocol or asset introduces unique pain factors, no longer exclusively from that unique protocol but furthermore from how these protocols contain interplay. Although each and each protocol is secure by itself, risks can emerge from how your approach combines these diverse protocols.

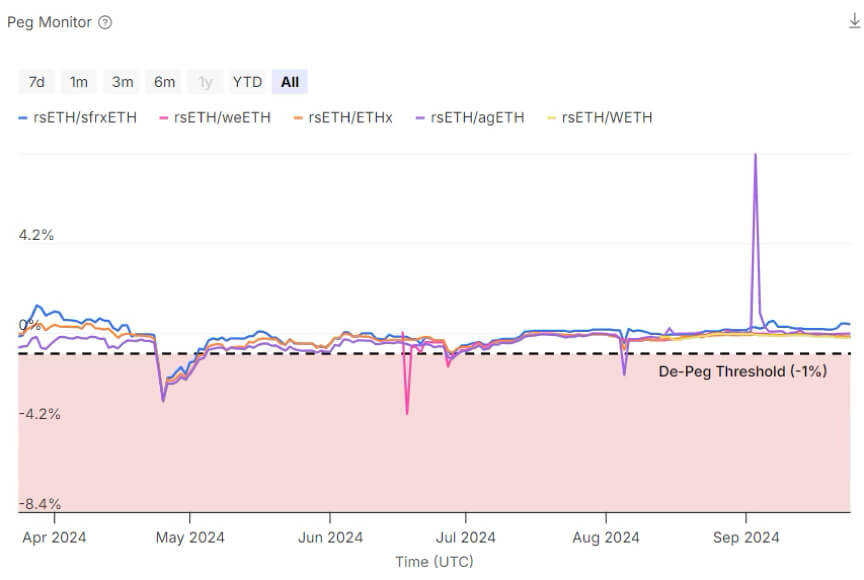

Shall we remark, imagine a scenario the place a user utilizes a Liquid Restaking Token (LRT) as collateral to borrow an asset, which is then deployed in a liquidity pool (LP) on an exterior automated market maker (AMM). The principal notify is perhaps the leveraged borrowing space, but there are extra risks. The soundness of the LRTâs peg could impact liquidation within the lending protocol, whereas the composition of the LP could impact slippage and exit prices, almost definitely causing capital loss when repaying the mortgage. These interconnected risks don’t descend beneath any single protocol’s management and are in consequence of this reality exclusively managed by the user.

Steps to Trace and Manage Financial Probability

Managing economic pain in DeFi requires a properly-thought-out arrive, as the complexity of multi-protocol solutions can introduce unforeseen vulnerabilities.

- Deep Dive into Protocol Mechanics: Working out the underlying mechanics of a protocol is step one in figuring out doubtless economic risks. Merchants and developers could still seek for the economic fashions, assumptions, and dependencies for the length of the protocol.

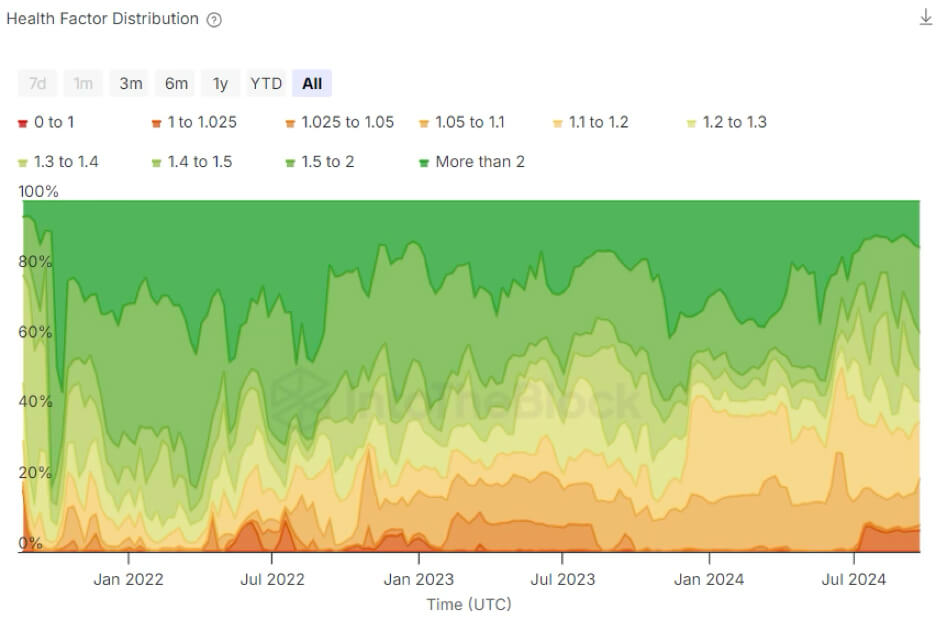

- Show screen Market Indicators: Conserving an seek for on market signals, equivalent to asset volatility, liquidity, and overall sentiment, is predominant. Examining on-chain facts specific to the protocols youâre using is a helpful manner to end informed. For occasion, must you’re enticing with a lending approach on Benqi, monitoring the properly being ingredient of loans on the platform is mandatory. This offers insights into how secure your lending space is and helps you rely on doubtless concerns earlier than they escalate.

- Make a holistic pain profile: Working out how interconnected risks could impact your overall approach is key to effective pain management. While individual solutions fluctuate, pain analytics can abet in figuring out areas of notify. Shall we remark, if youâre using a Liquid Restaking Token (LRT) as collateral to borrow resources, monitoring the steadiness of the LRTâs peg is predominant to lead particular of sudden liquidations. Unexpected spikes or volatility within the peg could signal a necessity to steal precautionary measures, equivalent to reducing publicity or growing collateral.

In summary, managing economic pain in DeFi is ready being proactive. By belief protocol mechanics, keeping a shut seek for on market indicators, and building a holistic gaze of doubtless risks, users can better navigate the challenges of multi-protocol solutions and provide protection to their positions.

Source credit : cryptoslate.com