Australian Bitcoin miner Iris sets 20 EH/s hash rate target as US mining falters

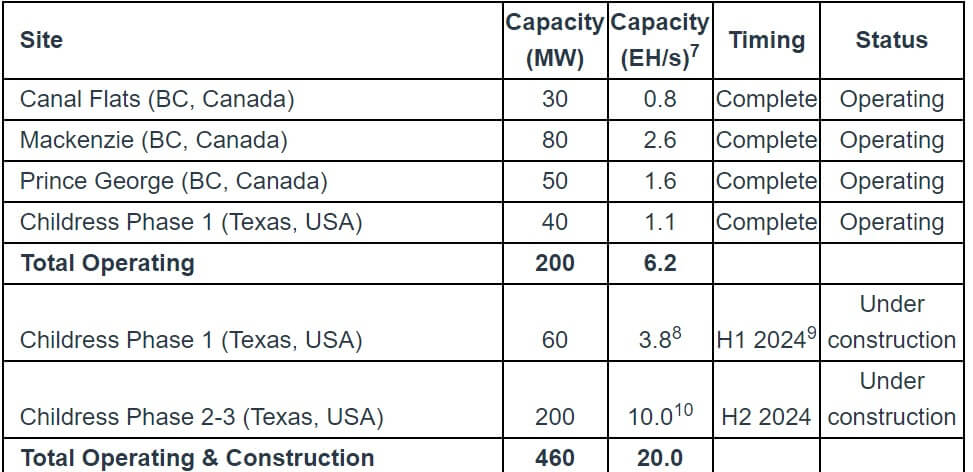

Australian Bitcoin mining company Iris Energy has outlined fearless plans to ramp up its hash rate to 20 exahashes per second (EH/s) by the latter piece of this 365 days, as detailed in a Feb. 7 update.

To function this significant milestone, Iris agreed with Bitmain to proper 10 EH/s of fresh T21 miners at a mounted rate of $14/TH/s. This agreement encompasses 1 EH/s of speedy extra miner acquisitions and grants alternatives for 9 EH/s of miner purchases exercisable within the latter piece of the 365 days.

In the intervening time, Iris wants to take its operational capability by a serious 222% to function its centered hash rate, which might maybe maybe well space it as a number one BTC mining entity in realized hash rate, surpassing opponents enjoy RIot Platforms, Marathon Digital, and Core Scientific, as per recordsdata from theminermag.

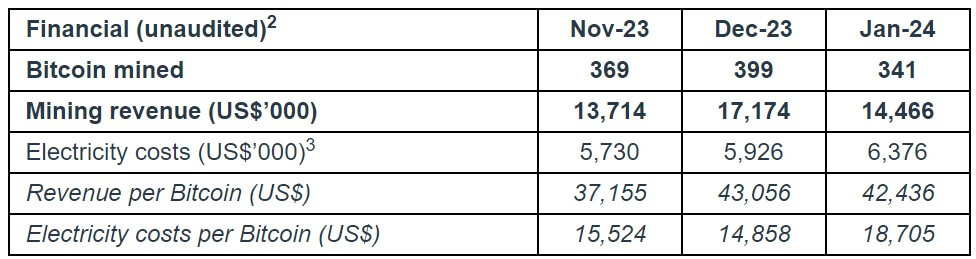

As of Feb. 6, Iris has already enhanced its operational capability to 6.2 EH/s from 2.2 EH/s in Nov. 2023, boasting a mining effectivity of 24.8 joules per terahash (J/TH) all over January.

Declined BTC production

Despite Iris’s fearless targets for the 365 days, the miner Bitcoin production dropped by 15% to 341 BTC in January. The decline in earnings used to be basically ensuing from reduced transaction charges on the network, elevated electricity charges, and lowered market volatility at indubitably one of its mining centers.

“The extend in electricity charges per Bitcoin mined ($18.7k vs. $14.9k in December) used to be basically attributable to decrease network transaction charges as effectively as elevated electricity costs and reduced market volatility at Childress,” Iris explained.

This downturn in Bitcoin production mirrors traits noticed amongst other main BTC miners basically based utterly out of the US.

Marathon Digital reported a substantial 42% month-over-month decrease in Bitcoin production, citing immediate disruptions equivalent to weather-associated considerations and equipment screw ups ensuing in dwelling outages. Which potential, it utterly mined 1,084 BTC in January, down from 1,853 BTC in December.

Riot Platforms also experienced a decline in monthly Bitcoin production, from 619 BTC in December 2023 to 520 BTC in January. CEO Jason Les attributed this decrease to the firm’s efforts to stabilize the grid by curtailing energy usage amidst heightened electricity search recordsdata from following erroneous frosty weather in Texas.

Core Scientific, currently relisted on Nasdaq, recorded a drop in Bitcoin production in January. Despite an extend in its energized hash rate, the firm’s monthly production lowered from 1,177 BTC in December to 1,027 BTC in January, marking a essential decline in spite of its stable performance all over 2023.

Source credit : cryptoslate.com