Are Bitcoin forks advancing progress or threatening stability?

Are Bitcoin forks advancing progress or threatening balance?

Are Bitcoin forks advancing progress or threatening balance? Are Bitcoin forks advancing progress or threatening balance?

Bitcoin intriguing forks fight to balance decentralization and scalability while addressing rising transaction costs.

Quilt art/illustration thru CryptoSlate. Image entails combined vow material that can presumably maybe presumably moreover consist of AI-generated vow material.

The next is a visitor post from Shane Neagle, Editor In Chief from The Tokenist.

Bitcoin pushed the monetary innovation envelope in many instructions. As a disbursed digital ledger, it unfolded region for transparency and provided a viable different to banking. Counting on its proof-of-work algorithm, Bitcoin established digital scarcity. Digital nevertheless easy anchored to the physical world of hardware resources and energy requirements.

All this while being originate-supply. And Bitcoinâs originate-supply nature birthed over a hundred intriguing forks. These are ledgers governed under assorted rulesets, so powerful in advise that they're incompatible with old blocks, ensuing in a brand fresh blockchain version.Â

When a brand fresh intriguing fork is created, propelled by assorted visions of P2P money and incentives, a brand fresh version of Bitcoin is born. By market cap, the largest ones are Bitcoin Cash (BCH), Bitcoin SV (BSV), Bitcoin XT (BTCXT) and Bitcoin Gold (BTG). Though none of them come even shut to the big Bitcoin (BTC) market cap of $1.47 trillion, they've injected many strategies which will most doubtless be relevant to Bitcoinâs future.

What Are Bitcoin Forks All About?Â

From the very onset of Bitcoin mainnet originate in January 2009, with the principle mined genesis block, it grew to turn out to be obvious that changes will must rob pickle to assemble Bitcoin A Be taught about-to-Be taught about Electronic Cash System as Satoshi Nakamoto within the foundation supposed.

For that roughly imaginative and prescient to work on the earth of advance-rapid on-line funds, Bitcoinâs community would must invent on par with Visa or Mastercard networks. The anguish is, those networks count on centralized databases (ledgers), equivalent to VisaNet, emphasizing effectivity in transaction processing above all else.Â

After all, as a money middleman between banks, Visa is not fascinated about any roughly monetary sovereignty, in distinction to Bitcoinâs imaginative and prescient.

But how would that be which that you simply can instruct with a decentralized computer community? To remain so, every transaction must be verified by assorted nodes to advance on the proof-of-work consensus. Bitcoinâs present efficiency is around 7 transactions per second, because it takes 10 minutes to ascertain every block stuffed with transactions (3,347 transactions per block at this time).

There are several implications of this formula to ledger administration:

- With the magnify in transactions, Bitcoin transaction costs scramble up. Bitcoin miners inject this friction due to they bag to plot the fresh stage of price priority within the readily accessible Bitcoin mempool region, because the effect a query to for the Bitcoin mining community will increase.

- If the repute of Bitcoin will increase transaction costs, it makes Bitcoin a downhearted change for âday-to-day moneyâ which ideally must beget minimal friction to be adopted at mass scale.

- If the evident resolution of accelerating transaction block sizes is applied, the Bitcoin community would bag extra centralized due to extra computing and storage would be required to path of transactions.

In assorted words, Bitcoin intriguing forks had been mainly fascinated about the balancing act of block sizes. Case in level, when Mike Hearn launched Bitcoin XT as a fork of Bitcoin Core in August 2015, this version of Bitcoin became alleged to magnify block dimension from 1 MB to at final 8 MB, which can presumably maybe presumably double extra every two years.

If we rob a seek at assorted Bitcoin intriguing forks, we gaze an identical sample of failure.

How Are Laborious Forks Created?

Bitcoin intriguing forks are created by the introduction of fresh Bitcoin Development Proposals (BIPs). Alongside malicious program fixes, they're the staging ground for price fresh aspects. Alternatively, those fresh aspects are applied handiest if an activation threshold is reached, constituting ~95% miner give a snatch to.

Successfully, the final 2,016 blocks (about two weeks of mining) would must keep their give a snatch to for a brand fresh BIP to be applied.

When Mike Hearn and Gavin Anderson provided their BIP 101 proposal to magnify maximum block dimension, from 1 MB to 8 MB, it failed to pass the activation threshold. This caused some controversy as Hearn declared that âBitcoin has failedâ, nevertheless handiest his BIP 101 failed. The following intriguing fork, Bitcoin XT, is the aborted version.

Forks admire these lead to fresh coins, unlike tokens – the latter of which will most doubtless be customarily created on pre-present blockchains. In turn, it became Bitcoin Basic (BXC) that therefore emerged from Bitcoin XT, because the block dimension became reverted from XTâs 8 MB to 2 MB. As soon as extra, this showcases that Bitcoin intriguing forks manifest the balancing act of block sizes.

From these âblock warsâ, Bitcoin Cash (BCH) also emerged in August 2017, having at final increased block dimension to 32 MB. Out of the entire intriguing fork, BCH remains primarily the most a hit one, at the moment at a $7.26 billion market cap.

Even such pretty a hit splits beget their possess forks. Australian entrepreneur Craig Wright provided a BCH fork called Bitcoin Satoshi Vision (BSV) a three hundred and sixty five days later, in November 2018. Claiming to be the person on the back of the pseudonym Satoshi Nakamoto, he became later published as a fraud within the UK Excessive Court, having leveraged intensive forgery and lawfare ways against critics.

Solid Within the Crucible of Adversity

On condition that Gavin Anderson became once a key member of Bitcoin Core, the principle framework for Bitcoin, it's a long way dazzling to declare that even failed BIP contributions within the bag of intriguing forks motivate their cause.Â

Though Block Size Wars ended up on the aspect of âdinky blockersâ, the contested debate did consequence in Segregated Search for (SegWit) implementation as a cozy fork, having been activated at block 477,120 in August 2017.Â

Thru BIPs 91, 141, and 148, SegWit made Bitcoin transactions extra efficient by segregating seek metadata from the principle transaction. This effectively increased the block dimension by introducing block weight, which allowed for 4x extra transactions per block.

Most seriously, SegWit paved the road for Bitcoinâs possess layer 2 scaling resolution, Lightning Community, due to it enabled Schnorr signatures. These not handiest assemble it which that you simply can instruct to beget Atomic Multi-Path Funds (AMP) for LN, which splits dapper funds into exiguous bits, nevertheless they reduce on-chain data footprint with extra efficient, smaller signatures.

The AMP feature also permits users to optimize price routing thru LN channels, because the payer handiest has to know the final public key of the recipient. Within the raze, what began as a series of Bitcoin intriguing forks, with most failing to realize traction, facilitated one other style of Bitcoin scaling.

The frictionless scaling enabled by LN, combined with vivid contracts, may maybe presumably maybe presumably even lead to futures contracts circuitously, as they'd require such scamper and deeper liquidity. Even the Federal Reserve Monetary institution of Cleveland identified that Lightning Community will get Bitcoin closer to âday-to-day moneyâ within the paper titled The Lightning Community: Turning Bitcoin into Cash.

âOur findings counsel that the off-chain netting advantages of the Lightning Community can assist Bitcoin to scale and feature better as a strategy of price. Centralization of the Lightning Community doesn't appear to assemble it powerful extra efficient, even though it could presumably maybe presumably magnify the percentage of low price transactions.â

Within the funds arena, it's a long way doubtless to be doubtless that without a doubt goal correct intriguing forks may maybe presumably maybe presumably get their arena of interest. There's constantly a necessity for on-line bill factoring or obtaining change credit score for dinky to medium industry (SMBs).

However the indisputable truth that Bitcoin remained with a conservative block dimension while in conjunction with Los angeles a scaling resolution is not that gorgeous in hindsight.

Security Risks and Community Vulnerabilities

Within the preliminary phases of Bitcoinâs pattern and adoption, as a first-rate monetary novelty, it became important to assist a conservative strategy. If the final public is to hunt Bitcoin as sound money, it has to assist core aspects, no pun supposed.

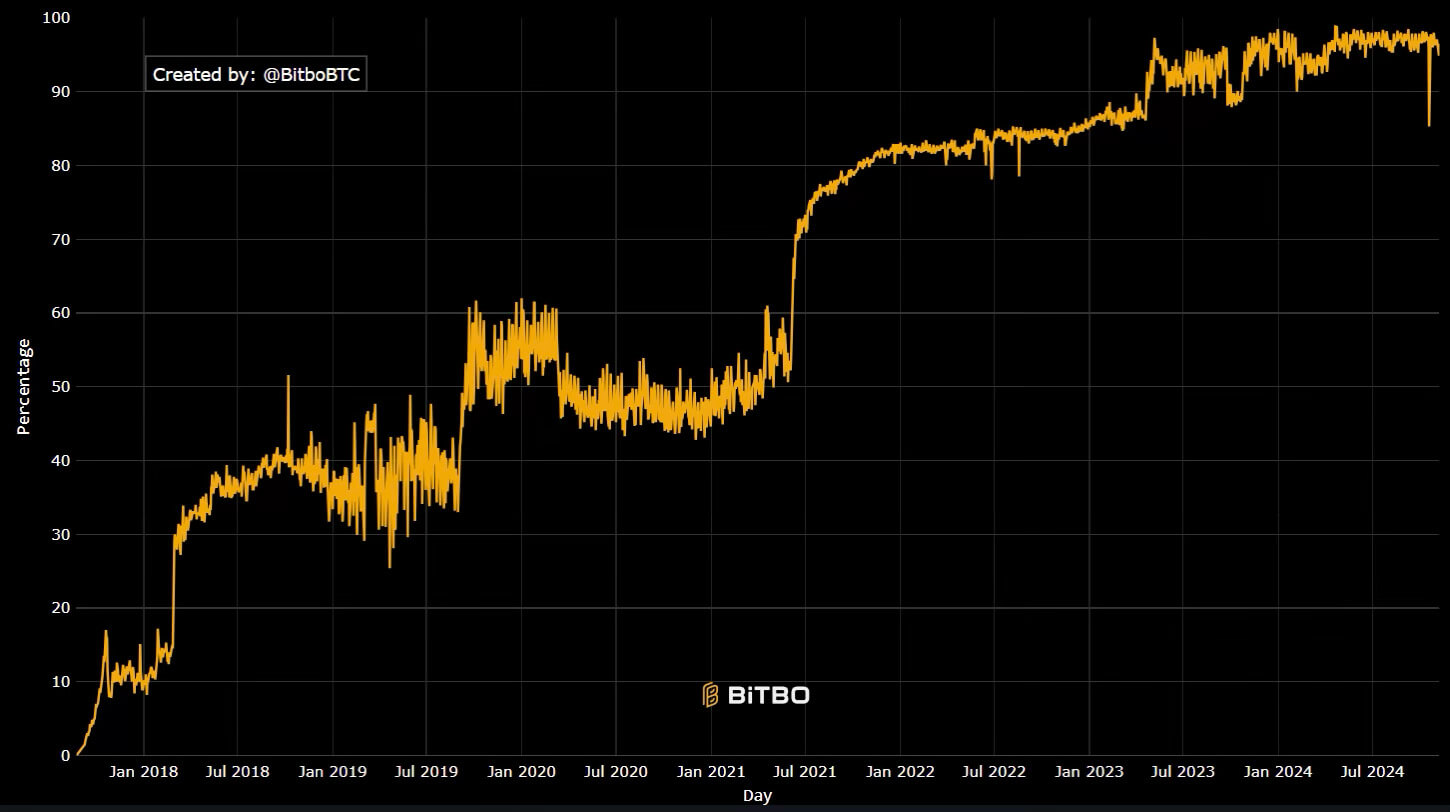

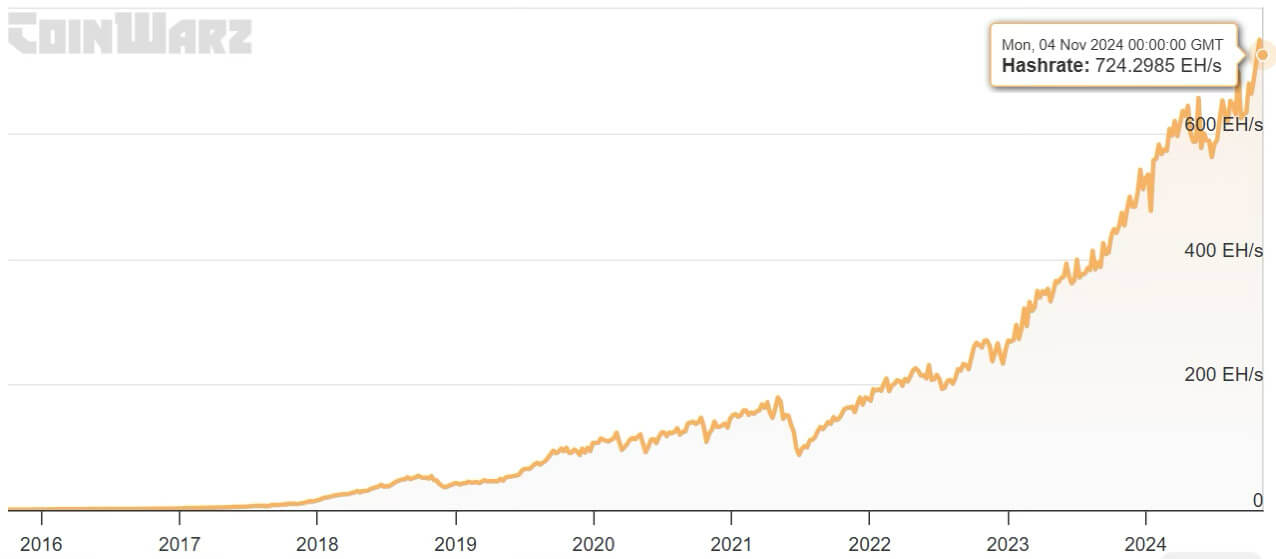

Inherently, by diluting the hash charge energy, intriguing forks introduce a security vulnerability. The underlying price of Bitcoin comes from the mining networkâs hash charge energy. It's the measure of calculations wanted for mining rigs to solve cryptographic puzzles and add a sound transaction block, in return for BTC as block reward.

Within the path of this mining competition, those with increased hashrate beget a increased likelihood to construct BTC. And as extra computing energy is added to the community, Bitcoinâs community venture auto-adjusts every 2,016 blocks, or around two weeks.

Conversely, a plunge in hash charge energy would assemble it extra doubtless for a 51% community attack strive and prevail. A brand fresh intriguing fork wouldn't handiest siphon away computing energy, nevertheless this divergence and dilution would invent a heightened direct of possibility at some level of the fresh version rollout.

What this portions to is that Bitcoin miners are biased against community security over innovation.

After all, even supposing there may maybe be a single publicized instance of a a hit hack of the Bitcoin community, this may maybe maybe motivate as a price-deflating force in perpetuity. And if that occurs, any innovation would rob a back seat. Accordingly, the Bitcoin hashrate has handiest one trajectory – up.

At this deadline, Bitcoin mainnetâs computing energy is so great that even a severe BTC tag plunge wouldn't express a vulnerability. In this kind of scenario, it's a long way feasible that some mining operations may maybe presumably maybe presumably exit the community due to losses, thus ending up lowering the mining venture.

But due to prior conservative strategy and bias against security, the Bitcoin community would weather it.

Market Volatility and Investor Sentiment

Seven years ago, the aforementioned Bitcoin Cash (BCH) had its all-time excessive tag of $4,355, as primarily the most a hit intriguing fork originate. Having launched in August 2017, the peak came about on the cease of that three hundred and sixty five days. Following the destiny of many altcoins, alongside Bitcoin SV, the sample is familiar:

- Initial speculative enhance.

- More a long way-off, ever more inexpensive tag peaks from the old ones.

Notably, at some level of the length of +$6 trillion M2 money supply enhance by the Federal Reserve in 2020 and 2021, alongside stimulus assessments, both intriguing forks mirrored that spike. But after the liquidity spigot became changed into off with the foundation of the hobby charge rock climbing cycle in March 2022, BSV and BCH returned to excessive possibility-off territory.

This makes sense pondering the following components:

- In total, there may maybe be handiest so powerful capital to scramble around.

- There's even much less capital within the crypto sphere.

- As digital monetary novelty, cryptocurrencies are perceived as riskier than shares.

This means that, the beneficiary of most capital would scramble to the celebrated and most stable cryptocurrency – Bitcoin.

Conclusion

As this valuation sample turns into extra obvious, it's a long way exceedingly unlikely that future Bitcoin intriguing forks, or present ones, would attain traction over Bitcoin. Within the eyes of traders, altcoins are juxtaposed against shares which will most doubtless be in step with companies with intriguing resources and earnings.

The distinctive Bitcoin is the exception right here, exactly thanks to its mountainous computing community that brings intriguing resources into play. Though intriguing forks tried the identical, they pale when put next, which levels them with generic proof-of-stake altcoins.

Inside of that ecosystem, heavyweights admire ethereum beget turn out to be the heart of capital gravity. At most efficient, Bitcoin intriguing forks may maybe presumably maybe presumably receive a non permanent tag enhance, due to their lower market caps when put next with Bitcoin. This holds speculative means for profit, nevertheless the identical holds dazzling for the altcoin ecosystem as a total.

Mentioned on this article

Source credit : cryptoslate.com

Farside Investors

Farside Investors

CoinGlass

CoinGlass