Arbitrum DEXs daily transaction volume eclipse Ethereum, Solana

Decentralized exchanges (DEX) transaction volume on Arbitrum, a layer2 network, surpassed that of Ethereum for basically the most well-known time one day of the past day, in step with DeFillama knowledge.

Right by intention of the reporting length, DEXs on Arbitrum noticed their volume flit to $1.843 billion, surpassing Ethereum’s $1.444 billion and Solana’s $683.59 million.

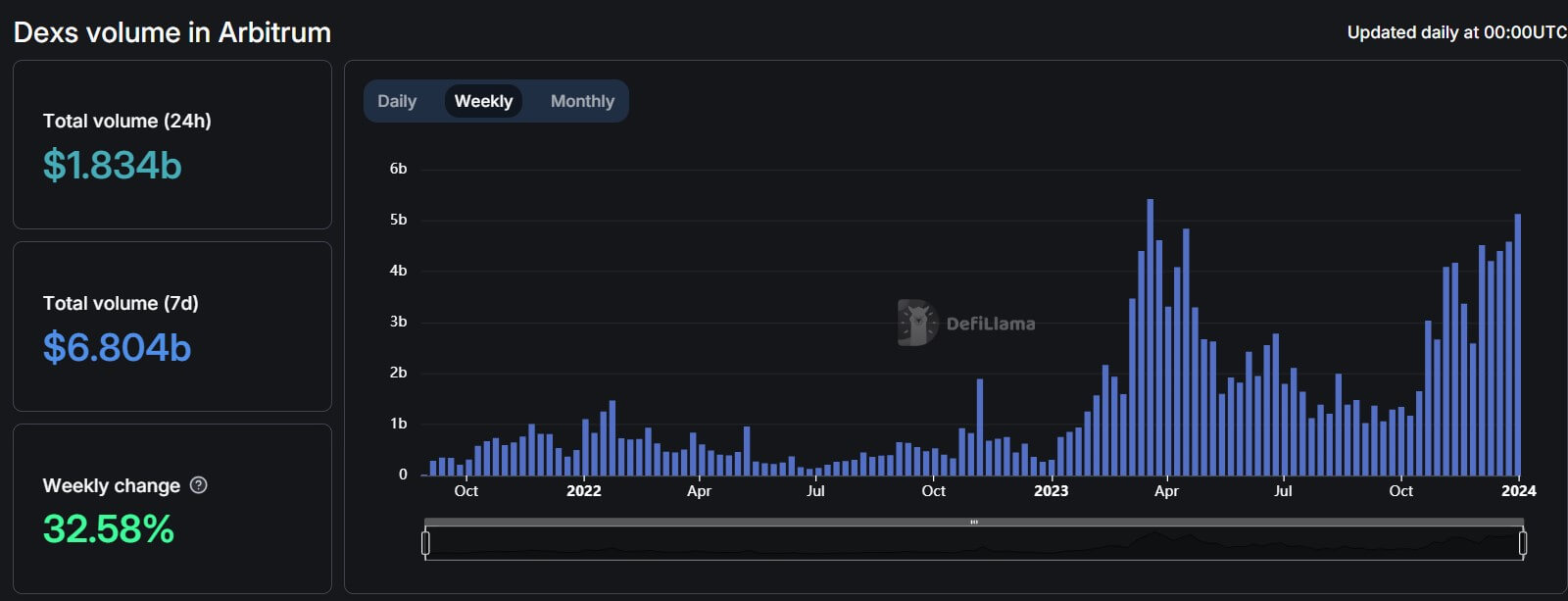

This surge aligns with Arbitrum’s continuous weekly boost, rising by 32.58% to $6.804 billion, a novel all-time high, though restful trailing Ethereum’s $9.581 billion. Alternatively, it surpasses Solana’s $5.039 billion and notably exceeds Binance Neatly-organized Chain’s on each day foundation volume by nearly fourfold.

The rising DEX volume also coincided with high-network pronounce on the layer2 network. Right by intention of the past day, Arbitrum’s on each day foundation transaction per 2d stood at 14.05, while Ethereum mainnet’s used to be 12.92, in step with L2beat knowledge.

Uniswap dominates

The increased trading volume could possibly well moreover moreover be attributed to heightened pronounce on Arbitrum’s DEXs love Uniswap, Camelot, Ramses Exchange, and Trader Joe. Files from DeFillama shows that these protocols have enjoyed double-digit boost to novel highs one day of the past week.

Uniswap Labs, the developers of the favored decentralized trading protocol Uniswap, published that Arbitrum become basically the most well-known layer2 network to tainted a thousand million in on each day foundation volume on the platform on Jan. 4.

Uniswap is basically the most nice looking DEX protocol by trading volume one day of all chains, with a median volume of larger than $1.5 billion one day of the past week.

Arbitrum’s rising TVL

The rising DEX volume has also coincided with a fascinating magnify in the total charge of resources locked on the Ethereum-basically basically based layer2 network.

Files from DefiLlama shows the TVL on Arbitrum-basically basically based capabilities has increased by round $1 billion in the closing six months to nearly $2.5 billion, with the dominant DeFi protocol being GMX, a decentralized role, and perpetual alternate, which controls about 20% of the network’s complete TVL.

Additionally, Arbitrum’s native ARB token as of late reached a novel all-time high of larger than $2 on Jan. 4 but has retraced to $1.94 as of press time, in step with CryptoSlate’s knowledge.

Source credit : cryptoslate.com