Analyzing the US Government’s Bitcoin holdings: What you need to know

Analyzing the US Executive’s Bitcoin holdings: What or now now not it'll be essential to know

Analyzing the US Executive’s Bitcoin holdings: What or now now not it'll be essential to know Analyzing the US Executive’s Bitcoin holdings: What or now now not it'll be essential to know

The U.S. executive holds over 1% of the Bitcoin supply, making it regarded as one of the essential essential Bitcoin holders globally. This fact might possibly well shock some, however it undoubtedly shows essential enforcement actions and upright interventions over the years.

Duvet art work/illustration by arrangement of CryptoSlate. Checklist contains mixed mutter that might possibly consist of AI-generated mutter.

The next is a visitor publish from Vincent Maliepaard, Marketing Director at IntoTheBlock.

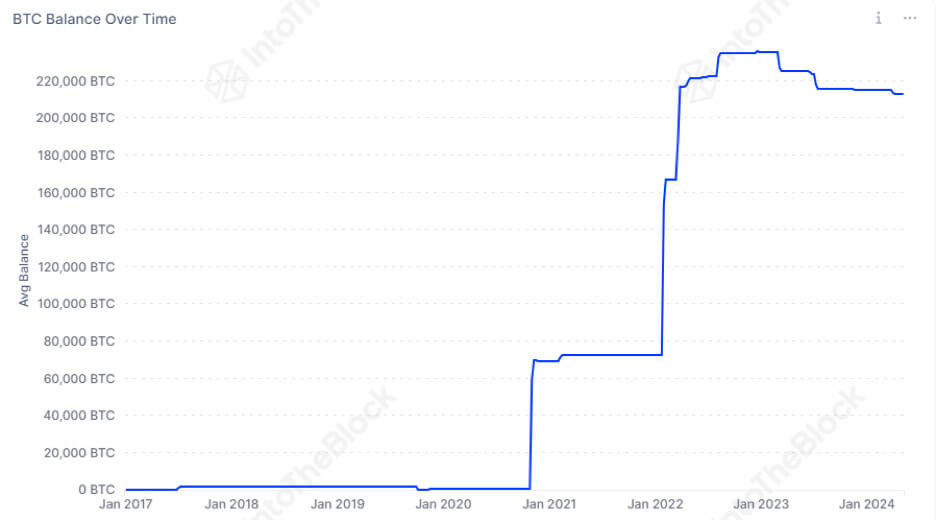

Per the latest data from IntoTheBlock, the U.S. executive holds over 1% of the Bitcoin supply, valued at a plucky $13.16 billion. These holdings salvage tripled since 2021, demonstrating a consistent amplify over the years.

Why the US executive holds Bitcoin

It’s main to elaborate that the U.S. executive’s Bitcoin holdings are now now not the final consequence of purchases however enforcement actions. These seizures in general happen in step with illegal activities.

Spikes in the amount of Bitcoin held by the US executive are connected with the largest BTC-connected enforcement actions. Principal cases consist of the Silk Street vase and the Bitfinex hack.

Silk Street (2013):

One in all the most famous cases concerned the seizure of approximately 174,000 bitcoins from Silk Street, a darkish web marketplace. The FBI shut down Silk Street and arrested its founder, Ross Ulbricht. In a dramatic twist, the US executive later seized over $1 billion price of Bitcoin linked to Silk Street, hide in a beforehand undiscovered pockets preserving approximately 69,370 bitcoins.

Bitfinex Hack (2016):

In August 2016, hackers breached Bitfinex, a famed cryptocurrency alternate, stealing approximately 120,000 BTC, valued at around $72 million.

Years later, in February 2022, the Division of Justice announced the recovery of a essential fragment of the stolen Bitcoin, valued at over $3.6 billion. This marked the most essential recoveries of stolen crypto in history.

Other famous seizures

Whereas Silk Street and Bitfinex are among the many most famed cases, just a few so much of essential seizures salvage came about. In 2017, the US seized bitcoins price $4 million (for the time being valued at over $60 million) from the BTC-e alternate at some level of a multi-company investigation into alleged money laundering activities. Alexander Vinnik, the alleged operator of BTC-e, turned into once arrested.

One other famous case entails the 2020 seizure of property from the founders of the BitMEX alternate for violations of the Bank Secrecy Act. Though direct quantities of Bitcoin werenât disclosed, BitMEX handled substantial volumes of Bitcoin transactions.

Implications of Executive Holdings

Monitoring the holdings of substantial Bitcoin stashes, corresponding to those held by the U.S. executive, is basic for just a few reasons.

At the origin, the alternatives surrounding whether or now now not and when the manager moves these Bitcoins might possibly well tremendously affect market dynamics. The procedure of their releaseâbe it by arrangement of recount sale, public sale, or every other approachâcan both mitigate or exacerbate market affect.

For instance, auctioning off the coins might possibly well attract institutional investors who price the transparency and legitimacy of âexecutive-sanctionedâ Bitcoin. This reassurance is in particular main for those inquisitive concerning the origins of their crypto holdings, as procuring from revered sources avoids the dangers connected with funds tied to illegal activities.

Equally, the US executive holds sufficient Bitcoin to electrify market prices tremendously upon releasing their holdings, which would possibly perchance lead to speculative habits among smaller investors seeking to count on or react to those moves.

Nonetheless there might possibly be extra to the yarn. A major fragment of the Bitcoin supply is controlled by executive and ETF entities, posing a capability threat. Per Juan Pellicer, Senior Researcher at IntoTheBlock:

The latest ownership levels of Bitcoin among U.S. executive and ETF entities pose a capability risk to the perception of Bitcoin as an asset past the regulate of executive forces or main financial institutions. The US executive holds over 1% of the Bitcoin supply, valued at over $13.16 billion, whereas Bitcoin ETF issuers regulate $50.6 billion, accounting for over 4% of the BTC supply. This high focus of holdings challenges the parable of Bitcoin’s decentralization and might possibly well salvage to electrify market dynamics and investor habits in the waste.’

Thus, monitoring these essential holdings is about figuring out latest market values and foreseeing capability market shifts.

Source credit : cryptoslate.com