Altcoins drop, Bitcoin flat as spot ETF denial chance falls to 5%: Bloomberg Analysts

Bloomberg analyst Eric Balchunas has diminished the risk of the SEC denying a pickle Bitcoin ETF to precise 5%, with fellow Bloomberg reporter James Seyffart indicating simplest black swan interventions from Gary Gensler or the Biden administration that probabilities are you’ll presumably presumably be ready to middle of attention on of routes to denial.

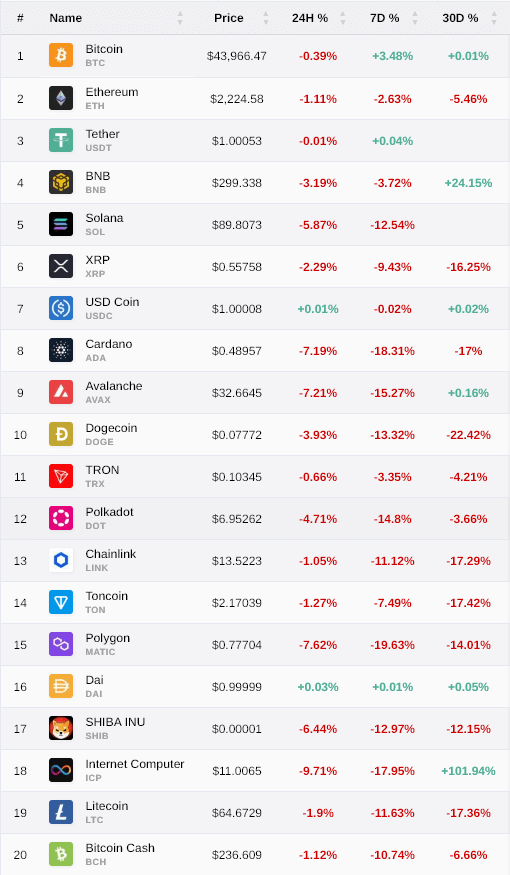

Curiously, over the weekend, with the veteran markets closed, crypto endured to commerce as original, with Bitcoin trading sideways and the the rest of the market recording a essentially wide sell-off. Bitcoin traded between $43,500 and $44,400, showing a mere 2% swing. As of press time, the very finest digital asset by market cap is bang within the course of this differ at $44,000 per CryptoSlate knowledge.

Nonetheless, altcoins such as BNB, Solana, Cardano, Avalanche, Dogecoin, Polkadot, Polygon, Shiba Inu, and ICP are all down on the least 3% and as principal as 9.7% as of press time.

Doubtlessly the most resilient altcoins seem like Ethereum, XRP, Tron, Chainlink Litecoin, and Bitcoin Money, which, while all tranquil down, enjoy recorded now not up to a 3% decline all the procedure thru the last 24 hours.

Since Saturday, Jan. 6, Bitcoin dominance has risen by 1.5%, reaching a peak of 54% before retracing a little this morning, indicating the leading digital asset is solidifying its space within the market sooner than a doable landmark approval this week.

Considered one of the most very finest losers of the weekend, Solana, fell as principal as 13% against Bitcoin over the weekend and is tranquil down around 9%. Solana peaked at $126 on Dec. 26, 2023, yet it has fallen 28% within the 13 days since to commerce, as of press time, at $90.

Bitcoin has recovered from its cycle low of 38% dominance within the crypto market in mid-2023 to claw lend a hand to 54% on the hype of a that probabilities are you’ll presumably presumably be ready to middle of attention on of pickle Bitcoin ETF. This 39% surge puts its dominance on the perfect stage since April 2021, erasing the entire ground the the rest of the altcoin market made on the asset all the procedure thru the closing bull bustle.

Since Ethereum’s start in 2015, Bitcoin dominance peaked at the starting up up of 2021 at 75% before falling dramatically all the procedure thru the bull market, indirectly trading within the 39% – forty eight% differ for around 760 days. Nonetheless, following the previous two Bitcoin halves, BTC dominance has fallen consistently, with a fall of 64% and 38%, respectively, marking bottoms after around 510 days.

Most curiously, as highlighted on the indicator on the bottom of the above chart, Bitcoin dominance has had a shut to-very finest correlation with Bitcoin’s mark for the reason that start up of 2023, the longest length of correlation since Ethereum’s entrance into the market.

This week is space to be one of the most very finest ever for Bitcoin as all eyes are on the pickle Bitcoin ETF approval process. A decision either procedure is sure to enjoy an operate on the total market with volatility expected all the procedure thru the board.

Source credit : cryptoslate.com