WisdomTree and Valkyrie add fee waivers to spot Bitcoin ETF applications

Two more asset managers include quickly waived fees for their living Bitcoin ETFs, Bloomberg ETF analyst James Seyffart acknowledged on Jan. 9.

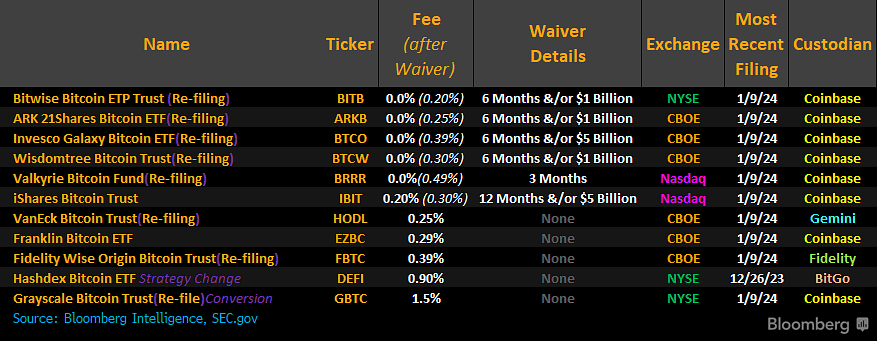

Seyffart indicated that WisdomTree will waive its fees for six months or the first $1 billion of sources, lowering fees from 0.30% to zero all by the waiver duration.

He additionally indicated that Valkyrie Investments will waive its fees for 3 months, lowering its charge from 0.49% to zero all by the waiver duration.

Every company’s most sleek S-1 submitting signifies that its waiver applies to sponsor’s fees. That term describes fees that the sponsor — on this case Valkyrie or WisdomTree — collects from the ETF belief in compensation for companies performed below the belief settlement and for other sponsor-paid companies.

Those waivers additionally raise Valkyrie and WisdomTree in keeping with four other ETF applicants which include in an analogous vogue waived fees: Bitwise, Ark Invest, Invesco, and BlackRock (iShares). All but one amongst these firms intends to waive fees totally all by the waiver duration: very most sensible BlackRock maintains a 0.20% charge after the waiver. 5 other living Bitcoin ETF applicants haven’t announced any waiver.

‘Charge wars’ additionally slashed fashioned fees

As effectively as to introducing waivers, varied firms lowered their fashioned fees in recent days by competitive filings in what became as soon as known as a ‘charge conflict.’

Blackrock, Ark Invest, WisdomTree, and Invesco every lowered or specified their fees in filings on Jan. 8. Grayscale, though its charge is seriously better than others, additionally lowered its charge to 1.5% from 2% on Jan. 8.

Many sources search files from that the U.S. Securities and Alternate Commission (SEC) will approve a living Bitcoin ETF the next day, Jan. 10, and that procuring and selling will originate within the arriving days. Even though approval is no longer definite, the SEC has engaged widely with applicants and must judge on Ark Invest’s application the next day.

Source credit : cryptoslate.com