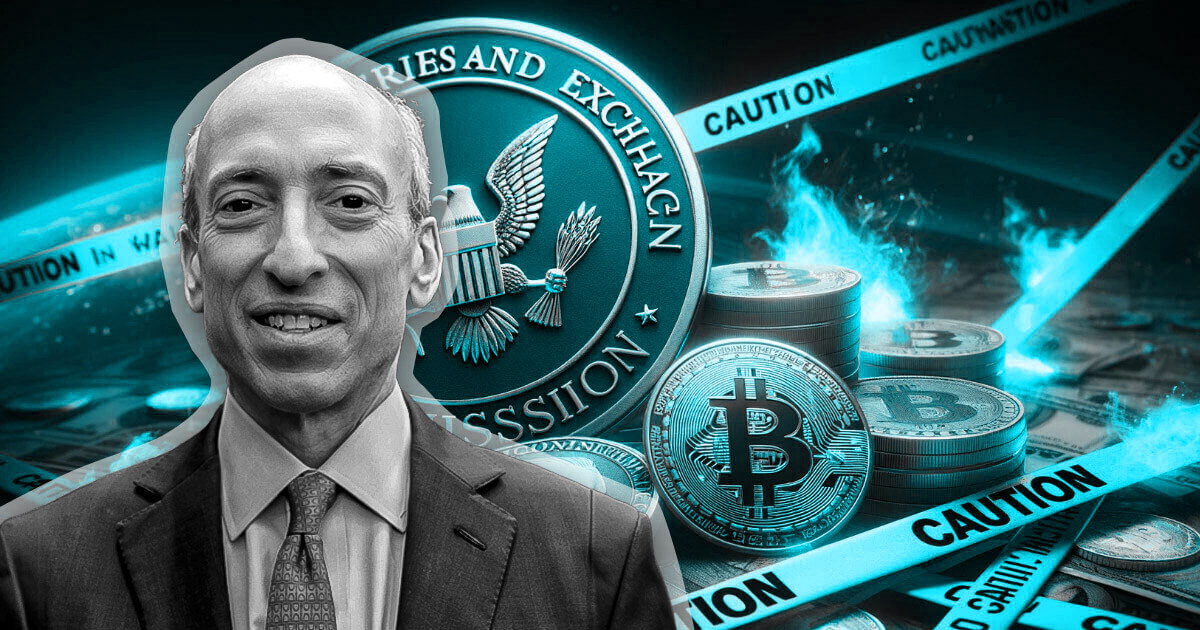

Gensler calls Bitcoin ETFs ‘ironic’ due to their centralized nature, responds to Warren

SEC Chair Gary Gensler stated it is ironic that folks name the approval of topic Bitcoin ETFs a historical 2d alive to by its centralized nature, which is the antithesis of Satoshi Nakamoto’s vision.

He stated:

“Think relating to the irony of of us that instruct this week is historical. This [the approval] became as soon as about centralization and outmoded manner of finance.”

Gensler made the assertion throughout a CNBC “Dispute Field” interview on Jan. 12, the put he delved into the causes at the help of the SEC’s approval and addressed one of the vital worries raised by Senator Elizabeth Warren.

Respecting the courts

Gensler stated that the SEC licensed the 11 topic Bitcoin ETFs as a result of the contemporary court decision within the regulator’s lawsuit in opposition to Grayscale. The court ruled that the SEC did no longer occupy legit grounds to reject a topic Bitcoin ETF since it had licensed products primarily based entirely totally on futures for the flagship cryptocurrency.

Gensler stated that the SEC has the utmost admire for the laws and ought to quiet continuously apply the court’s directives relating to laws. He added that the approval of the ETFs does no longer equate to an endorsement of Bitcoin, and he continues to take care of a vital stance toward the asset.

Per the SEC chair:

“Bitcoin itself we did no longer approve, we get no longer endorse. Right here is a product called any other-traded product that investors can make investments within the underlying non-security commodity asset.”

He added that Bitcoin remains a “hazardous store of worth” that isn’t any longer being former for any legit payments. On the opposite hand, he acknowledged that the underlying skills holds promise and that approving the ETFs became as soon as the “most sustainable direction ahead.”

Gensler moreover clarified that Bitcoin is the right cryptocurrency it considers a non-security commodity, likening it to gold and silver-primarily based entirely mostly products. He added that the regulator continues to take care of the note that the massive majority of crypto tokens are securities.

Response to Warren

Gensler’s remarks moreover touched upon Warren’s criticism of the decision. The senator has been a vocal critic of the cryptocurrency market, arguing that the SEC’s approval became as soon as legally and policy-wise counterfeit.

Responding to those issues, Gensler expressed admire differing opinions nonetheless reaffirmed his dedication to following valid and court directives. He acknowledged:

“While I perceive and admire the worries raised by Senator Warren, our decision is grounded in a rigorous consideration of the valid framework and the present financial realities.”

Whatever the controversy surrounding the SEC’s decision, the approval of these Bitcoin ETFs signifies a doubtlessly new generation for cryptocurrency within the mainstream financial market.

The inaugural purchasing and selling session following the approval witnessed vital job, indicating solid investor hobby and doubtlessly paving the manner for extra popular acceptance of digital resources.

Source credit : cryptoslate.com