Grayscale transfers $200M Bitcoin to Coinbase Prime hinting at possible ETF redemption activity

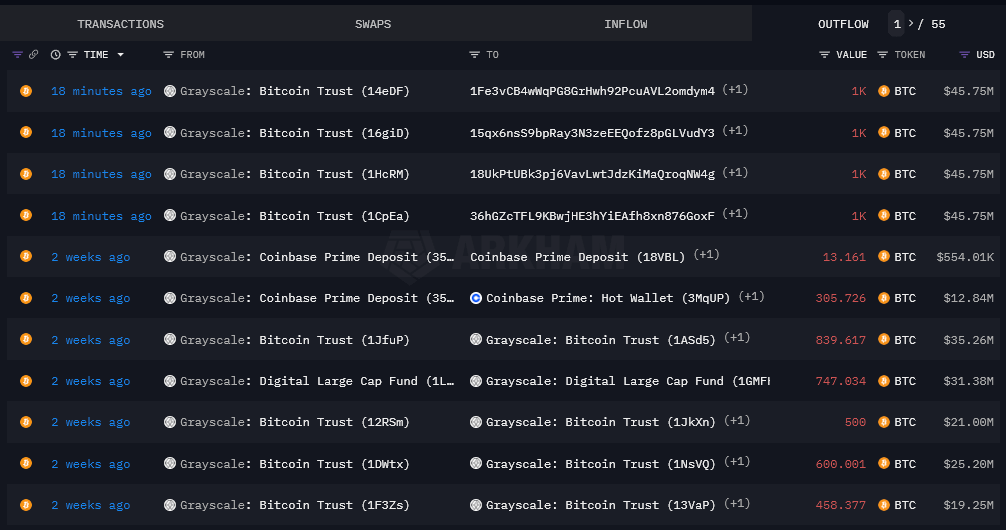

Grayscale has begun transferring Bitcoin out of its belief and sending it to Coinbase as of two p.m. GMT, Jan. 12. A entire of 4,000 BTC (roughly $200M) has been despatched as of press time, with all Bitcoin going to Coinbase Prime, one of many well-known people within the series of Bitcoin ETFs launched the day earlier to this.

Coinbase acts because the broker and buying and selling counterparty for nearly all ETF issuers, along with Grayscale. Thus, it’s likely that this transfer signifies outflows from the belief from gross sales the day earlier to this. The closing outflows earlier than this day were around 2 weeks again, the build there hang been just a few transactions internal and out of the Grayscale Bitcoin wallets.

Whereas the placement Bitcoin ETFs tune the associated payment of Bitcoin at present, they compose no longer require issuers to aquire and sell Bitcoin are living correct by buying and selling hours. The well-known times when Bitcoin is purchased or sold in regards to the introduction and redemption of ETF shares within the Grayscale ETF, as an instance, could be summarized as follows:

Introduction of Baskets (Attempting for Bitcoin):

- The Approved Participants space introduction orders for Baskets with the Transfer Agent by 1:59:59 p.m., Fresh York time, on any enterprise day.

- The Sponsor determines the Total Basket Earn Asset Ticket (NAV) and any Variable Fee as soon as practicable after 4 p.m., Fresh York time.

- The Liquidity Supplier transfers the Total Basket Amount (in Bitcoin) to the Belief’s Vault Stability on T+1 or T+2, reckoning on the divulge placement time.

Redemption of Baskets (Promoting Bitcoin):

- The Approved Participants space redemption orders with the Transfer Agent no later than 1:59:59 p.m., Fresh York time, on every enterprise day.

- The Sponsor determines the Total Basket NAV and any Variable Fee as soon as practicable after 4 p.m., Fresh York time.

- The Liquidity Supplier delivers the Total Basket NAV (much less any Variable Fee) to the Money Myth on T+2 (or T+1 on a case-by-case basis, as authorized by the Sponsor).

In each and each eventualities, the wanted time for initiating orders is earlier than 2:00 p.m., Fresh York time, on a enterprise day. The explicit transfer of Bitcoin (both to the Belief’s Vault Stability within the case of creations or from the Custodian to the Liquidity Supplier within the case of redemptions) occurs on T+1 or T+2, reckoning on the particular conditions of the divulge.

These transactions could potentially influence the placement tag of Bitcoin, especially if substantial orders are positioned. Nonetheless, the true influence on the placement tag would rely on diverse components, along with the size of the orders relative to the popular day after day buying and selling volume of Bitcoin and the market stipulations at the time of the transactions.

The transfers of Bitcoin from the belief and the timing align with the introduction and redemption processes, suggesting that perhaps fair appropriate $200 million in redemptions became as soon as deemed crucial by Grayscale following the well-known day of buying and selling. It is miles well-known to existing that that is extremely speculative, however one who it’s likely you’ll perhaps furthermore imagine cause within the support of the outflows said above.

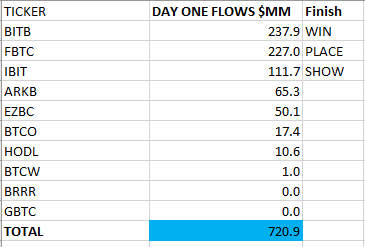

Bitcoin ETF flows.

Furthermore, BlackRock’s day-one inflows were around $112 million, with simplest $10 million in seed capital. This capability the fund ought to aloof require at the least $90 million in Bitcoin to match the portion purchases.

Bloomberg’s Eric Balchunas shared estimates of around $720 million in inflows into Bitcoin ETFs on day one. Nonetheless, as of the finish of buying and selling, he could no longer title how worthy of these flows could be offset by promoting out of the Grayscale belief, which has the superb payment by some margin among the many novel situation Bitcoin ETFs. Grayscale charges 1.5% every twelve months, whereas others are as low as 0.2%, with some providing zero charges for a promotional interval.

As with Grayscale, the above inflows would require the funds to match shares with Bitcoin, however all portion creations should always be performed with cash. This capability that Bitcoin can not be extinct to make shares. If an investor sells shares in one ETF and buys shares in one other, one fund can not give Bitcoin to 1 other if outflows stride into one other. Money should always be extinct for introduction and redemption per the novel SEC rulings.

For any funds the utilize of a T+2 settlement, with Monday being a bank holiday within the U.S., Bitcoin could no longer be settled till Tuesday, leaving room for a thrilling weekend of Bitcoin tag action.

Source credit : cryptoslate.com