Old Cobie post surfaces predicting the Bitcoin ETF run up scenario almost on the dot

Cobie, a prominent figure within the crypto shopping and selling circles known for his insightful and in overall unbiased correct predictions, made a post on Aug. 23, 2023, that outlined the set Bitcoin ETF scenario to a frighteningly unbiased correct level.

Cobie’s post, which delved into the intricacies of Bitcoin (BTC) and the predicted approval of a Bitcoin ETF, showcased his deep concept of the market dynamics.

His prediction of a necessary rise in BTC’s designate, doubtlessly reaching $50,000 by the year’s pause, alongside an intensive prognosis of the seemingly impact of the ETF approval, reflects a level of prognosis that few within the realm can match.

Foresight

The vendor also predicted when the SEC would approve the ETFs and talked about on the time that it became most regularly “free” to long Bitcoin till then and instructed promoting once the approval came in, or shortly earlier than that.

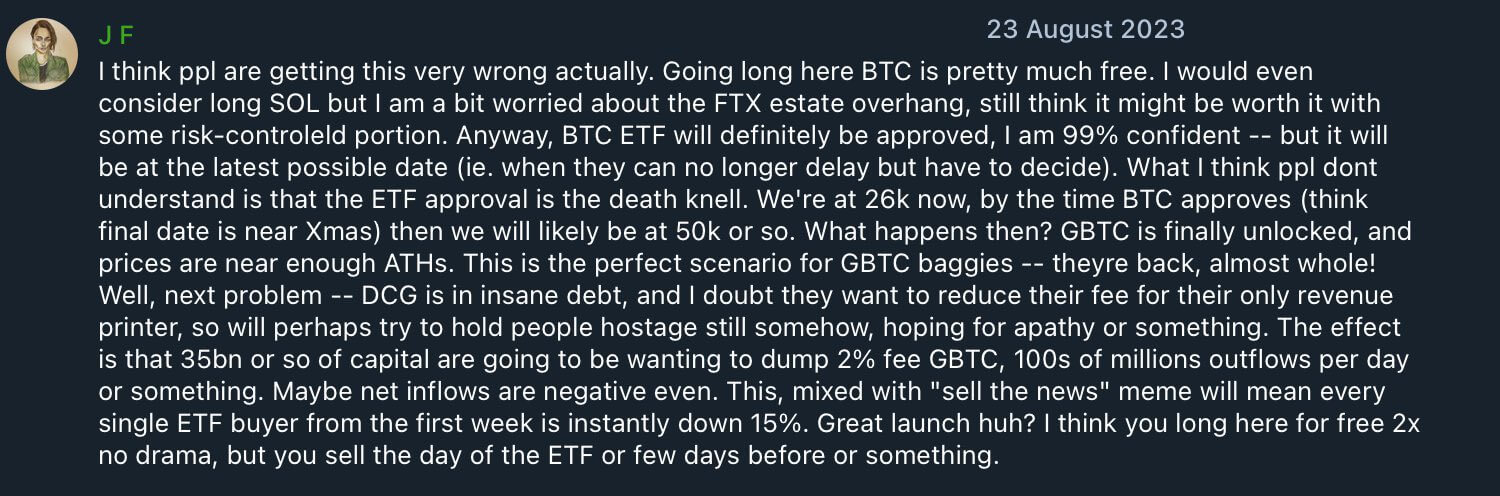

Cobie wrote:

“Anyway, BTC ETF will absolutely be authorized, I’m ninety nine% assured on the choice hand it’ll be at essentially the most contemporary ability date (ie. after they’ll no longer extend but absorb to determine).”

He added that after the ETFs absorb been authorized, it’d be a “loss of life knell” which may perhaps well well seemingly drive the worth down due to high ranges of promote strain coming in from Grayscale’s GBTC holders, who absorb been ready for another option to promote once they are near being total again.

Fervent on the worth action, following that advice would absorb been the correct transfer in hindsight. This has drawn in fashion admiration from crypto Twitter. Nevertheless, Cobie feels the admiration is undue.

Cobie’s reflective response

In a candid response to the social media ruckus, Cobie emphasised financial predictions’ dynamic and in overall unsure nature.

“I will be able to’t even be conscious, man,” he began, highlighting the verbalize of keeping track of ever-altering market views. He pointed out how straightforward it is to to find past predictions that seem unbiased correct in hindsight, given the frequent shifts in opinions and market conditions.

He cautioned towards over-reliance on isolated predictions, mentioning:

“The screenshot in isolation ‘seems wintry’ but doesn’t point out very grand in actual fact, you know, misses most regularly half a year of shit and completely different components that pollute the taking into account.”

His feedback provide a humble reminder of the transient nature of market prognosis. Despite his prognosis, he talked about he did no longer stick to that thesis within the ensuing months. Cobie added:

“The reality (as a minimal for me) is that it’s beautiful straightforward for me to void my dangle opinions 3 weeks later, attain up with new solutions that I feel counter them, and plenty others., so it’s correct a total mess of doubt and indecision and stuff along the advance.”

This angle resonates deeply within the cryptocurrency group, the set rapid changes and volatility are the norms. Cobie’s reflection on the path of of forming and reforming opinions in response to new recordsdata and market shifts highlights the advanced, non-linear nature of financial forecasting.

Cobie’s rotund post is on hand to read under:

Source credit : cryptoslate.com