Record $1.6 billion of staked Ethereum redemptions led by Celsius and Figment

Over 650,000 items of staked Ethereum, valued at approximately $1.6 billion, were redeemed final week—the biggest quantity of redemption since the Shanghai Upgrade used to be performed final year.

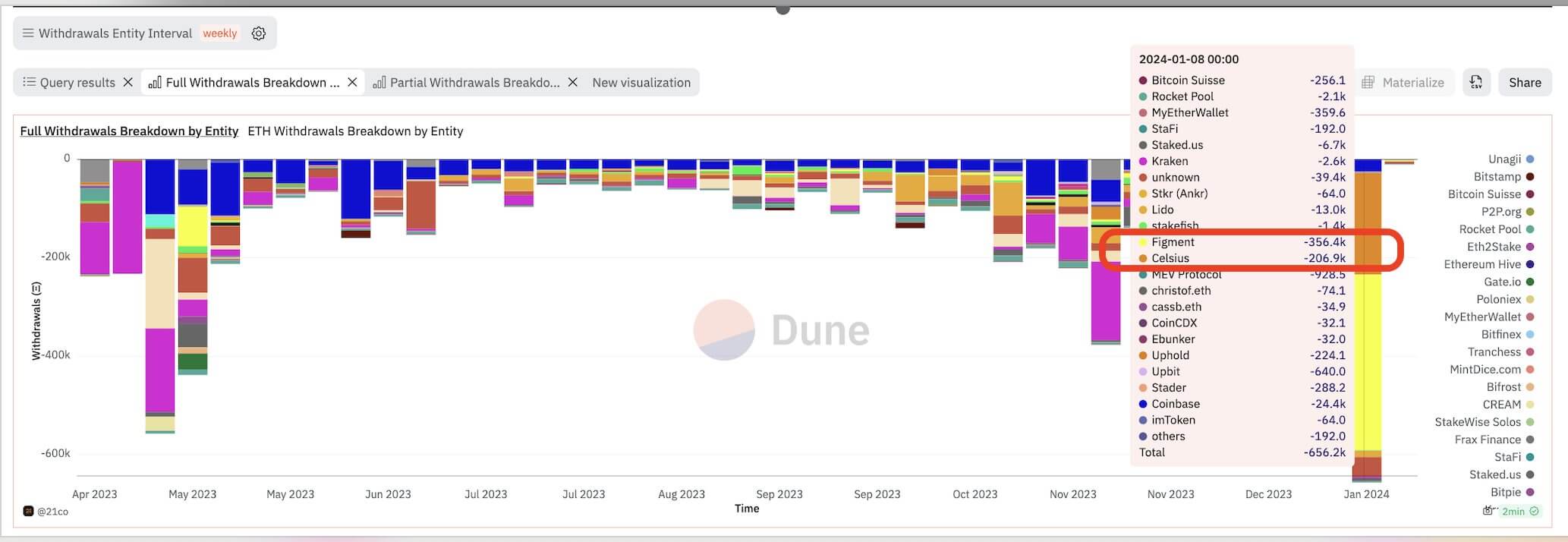

A Dune Analytics dashboard shared by Tom Wan, an analyst at 21 Shares, confirmed that the bankrupt crypto lender Celsius and staking provider provider Figment were the predominant contributors to this great redemption surge. Together, they orchestrated withdrawals totaling 563,300 staked ETH, constituting a formidable 85% of the full redemptions at some stage in the reporting duration.

CryptoSlate highlighted these companies’ position in pushing Ethereum’s validator exits to a document excessive of over 16,000 validators on Jan. 5. On the time, the two companies made up roughly 75% of the full withdrawals in the queue as they deliberate to hang away extra than 550,000 staked Ethereum.

Celsius previously printed plans to unstake 206,300 ETH, value around $470 million, as share of efforts for its financial spoil process. The failed lender said the withdrawals would possibly perchance well be inclined to facilitate the distribution of resources to its creditors.

On the other hand, Figment used to be also making great withdrawals of over 350,000 staked ETH on its customers’ behalf.

Following these great withdrawals, the full quantity of staked Ethereum now sits at 28.9 million, in step with Nansen’s Ethereum Shanghai (Shapella) Upgrade dashboard.

ETH’s tag unaffected

The staked Ethereum withdrawal enlighten didn’t negatively impact ETH’s tag performance at some stage in the previous week, because the digital asset’s cost rose by around 12% to a height of $2700, its very most realistic cost since Could per chance presumably 2022.

Suggestions that the U.S. Securities and Alternate Commission can also approve a area Ethereum commerce-traded fund (ETF) following identical approvals granted to Bitcoin ETFs delight in contributed to this upward tag whisk.

Larry Fink, the CEO of asset administration firm BlackRock, additional fueled the optimism when he said he saw “cost in having an Ethereum ETF” at some stage in an interview with CNBC.

Knowledge from Polymarket reveals that around 55% of bets on the platform wait for an Ethereum ETF approval by the discontinue of Could per chance presumably.

Source credit : cryptoslate.com