Identifying potential ETF wallet addresses as Coinbase leads weekly BTC trading with $11.4 billion volume

Coinbase Top, the crypto platform explicitly designed for institutional patrons, trusts, and excessive-procure-value participants, has viewed a dramatic dangle better in trading process following the U.S. assert Bitcoin ETFs open.

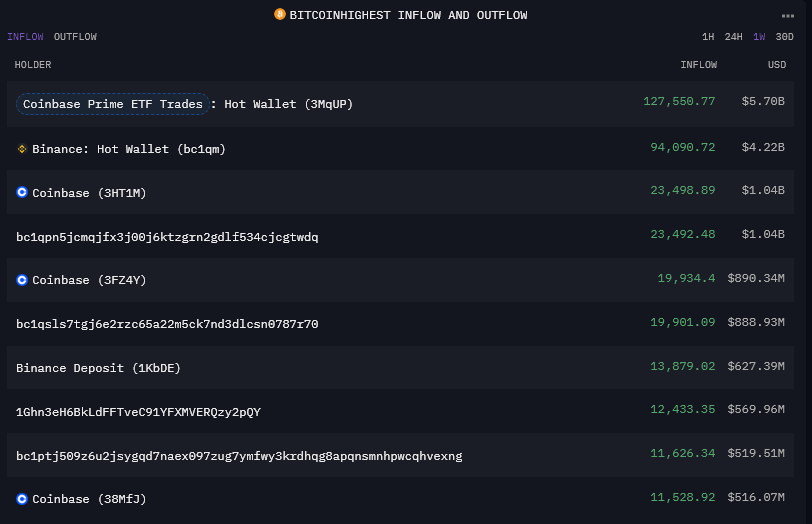

CryptoSlate analysis known a hot pockets at Coinbase Top that has surged to the tip of the Bitcoin inflow chart accurate by the last week. This pockets, used for trading actions all around the platform, saw modest inflows and outflows in the a total bunch of millions over the route of a month all over 2023. On the other hand, accurate by the last week, it has viewed $5.7 billion in inflows and an identical quantity of outflows. Historically, Binance’s hot pockets has dominated the waft leaderboard, and from the suggestions analyzed, this appears to be like to be the essential time Coinbase Top has surpassed Binance over 7 days.

Over the last 30 days, Binance mute leads with around $14 billion in inflows and outflows, while Coinbase Top flags a shrimp bit in the attend of at around $12 billion. It is miles value noting that other trading wallets are tagged as belonging to Coinbase Top on Arkham Intelligence. On the other hand, this pockets appears to be like to handle dapper transactions.

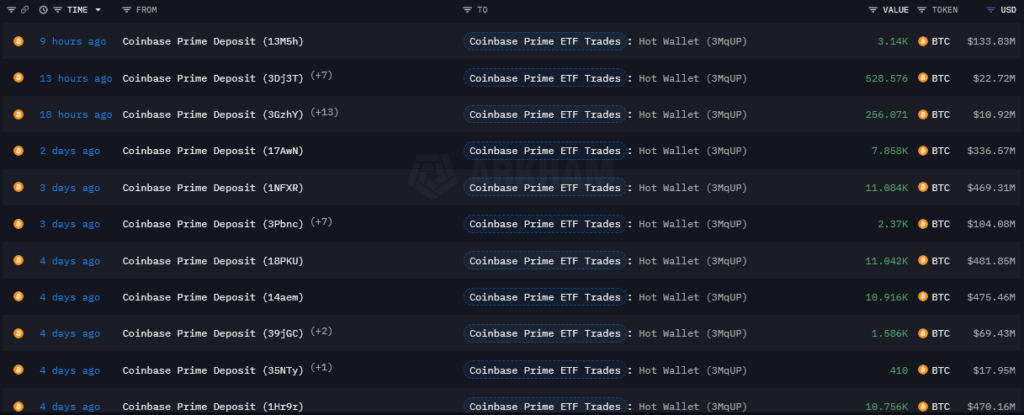

The surge in process will also merely furthermore be viewed by the desk underneath, which presentations splendid transactions increased than $10 million. In the previous 4 days on my own, there were several deposits of over $400 million in a single transaction.

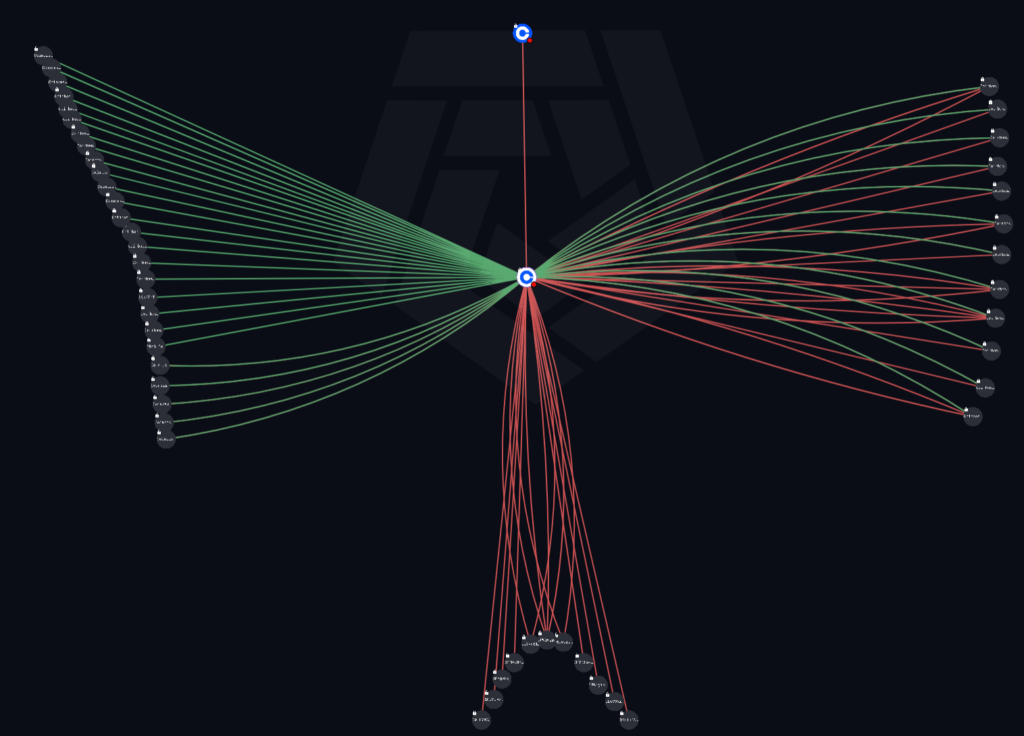

The underneath visualization presentations the waft of transactions over $50 million for the Coinbase Top hot pockets. The left cluster is tagged as Coinbase Top deposit addresses, which all waft into the contemporary pockets. The cluster to the real contains wallets furthermore tagged as Coinbase Top deposit addresses but presentations inflows and outflows. The wallets in the bottom cluster are untagged and demonstrate splendid outflows from the contemporary pockets. The cease outlier is the Coinbase alternate, which presentations a single $78 million outflow.

Speculatively, the left cluster will also merely demonstrate deposit addresses for institutions, the real wallets will also maybe be the trading wallets, and the bottom wallets will also maybe be chilly storage. Presently, none of right here’s verifiable, but it would doubtlessly align with the suggestions said in the ETF prospectuses referring to how Bitcoin trading works for the funds. Be conscious, the above splendid presentations transactions increased than $50 million, or around 1,100 BTC.

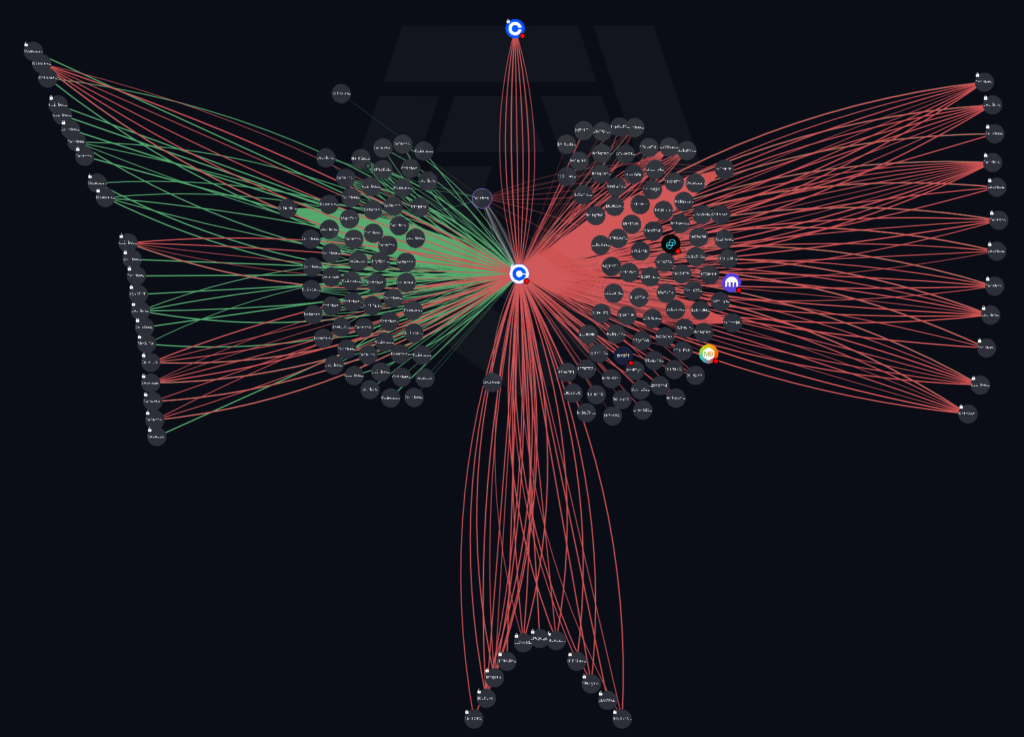

The underneath arrangement contains transactions as low as $1,000 with all of the above wallets locked into plot. Seriously, the bottom cluster mute presentations no inflows, while dozens of new wallets personal entered the sector at these lower values.

Making an strive to call and analyze wallets associated to ETF process will also merely give distinguished insights into the Bitcoin market will personal to trading volumes proceed to apply the open recordsdata. With CoinShares reporting around $17.5 billion in trading volume amongst crypto financial merchandise last week, this process will affect the assert Bitcoin rate otherwise.

The value at which the ETFs price Bitcoin day-to-day is calculated by the CF Benchmarks Index, BRR, which stands for the Bitcoin Reference Price. This rate is calculated between 3 pm and 4 pm GMT on a day-to-day foundation by inspecting a form of transactions in the course of several exchanges. The BRR is then used to calculate the procure asset price for the funds and, thus, the value of the Bitcoin it holds. This rate and the proven reality that portion creations and redemptions happen open air of usual trading hours add a brand new dynamic to Bitcoin trading that has no longer been a part except now.

Source credit : cryptoslate.com