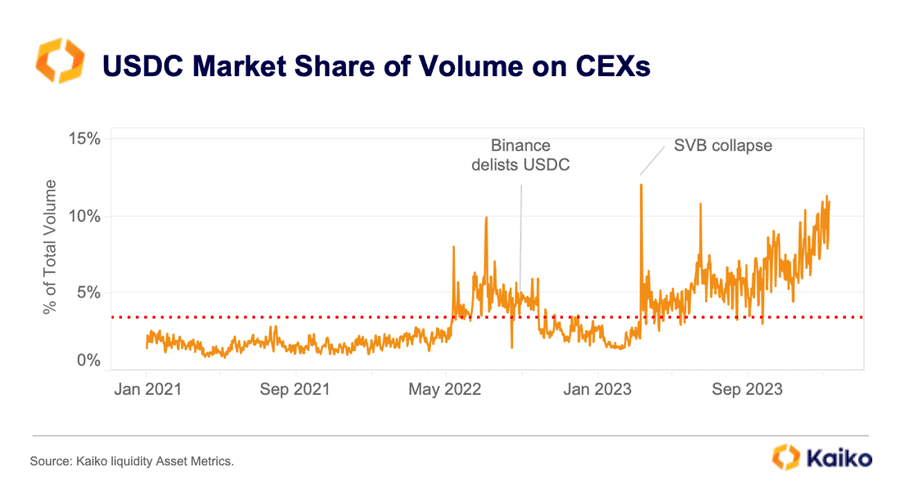

USDC doubles market share on centralized crypto trading platforms to over 10%

USD Coin (USDC), the 2d-largest stablecoin by market capitalization, has seen its market part on centralized crypto buying and selling platforms develop a great deal in all places in the past months.

Recordsdata from Paris-primarily primarily based mostly crypto intelligence platform Kaiko showed that USDC’s market part doubled to over 10% from round 5% in September 2023, primarily as a result of rising volumes recorded on Bybit.

Why USDC’s market part is rising

Bybit has emerged because the largest marketplace for USDC, likely due to its introduction of a 0-charge buying and selling incentive for its USDC buying and selling pairs in February final year.

Binance’s relisting of the USDC stablecoin, following the honest troubles that emerged with Binance USD (BUSD), furthermore doubtlessly played a feature in helping to toughen USDC’s market part in all places in the interval.

Coinbase, the largest crypto buying and selling platform within the U.S., furthermore steadily elevated the hobby rates on USDC, ranging from 2% and incrementally transferring it to 6% all the arrangement by arrangement of ultimate year. This a great deal incentivized users of the platform to relieve the stablecoin.

Additionally, Circle, the stablecoin issuer, has essential partnerships with well-known monetary establishments like Eastern monetary massive SBI Holdings and licensing in well-known jurisdictions like Singapore, which additional helps to enhance USDC’s circulation and presence.

USDC’s provide

Despite these improved numbers, USDC’s fresh circulating provide remains a great deal below its all-time high of $forty five billion.

Circle attributed this decline to plenty of issues, including “rising hobby rates, regulatory crackdowns, bankruptcies, and outright fraud.”

As successfully as, USDC faced well-known headwinds final year after one in every of its banking companions, Silicon Valley Bank, collapsed. This resulted in USDC in transient shedding its peg and an enormous outflow from the digital asset.

Within the intervening time, Circle now no longer too long within the past published its map to switch public again by arrangement of an preliminary public offering (IPO) filed with the U.S. Securities and Trade Charge.

Source credit : cryptoslate.com