If BlackRock continues 6k BTC daily buys we get a supply crunch within 18 months, here’s why

Building on CryptoSlate’s contemporary evaluation of the competing Bitcoin inflows and outflows between BlackRock and Grayscale, I extrapolated the records even extra to verify precise how prolonged BlackRock may maybe defend its contemporary realistic Bitcoin accumulation.

At a high level, BlackRock’s entry through Bitcoin ETFs is a if truth be told intensive 2d for Bitcoin’s reputation within the US. At the side of the diversified ‘Newborn 9‘ ETFs, BlackRock’s endorsement is seemingly to lower the liquid and extremely liquid presents as more investors maintain get admission to to Bitcoin as a prolonged-length of time funding. Extra, this may maybe magnify investor confidence for those tantalizing with blockchain and increase the credibility of Bitcoin as an asset class, thereby affecting its liquidity and volatility profiles.

Sooner than I am going any extra, I need so that you just can add a if truth be told clear disclaimer here. The evaluation under is a hypothetical compare at that you just may maybe imagine accumulation ranges from tell Bitcoin ETFs. I truly have oldschool the debut inflows for BlackRock because the yardstick. There just isn’t always a guarantee these ranges will persist, and if they did, it would very seemingly consequence in an magnify within the cost of Bitcoin. The query for Bitcoin is unlikely to remain consistent at any worth, so assuming the same BTC inflows over a prolonged length is unbelievable.

That talked about, wanting on the numbers from a purely theoretical standpoint does mask some extraordinarily headline-noteworthy records facets, which is ready to then be oldschool alongside diversified analyses to establish if and when a present crunch is on the horizon for Bitcoin.

The longer these unusual ETFs continue to build up Bitcoin at these elevated ranges, the simpler for prolonged-length of time HODLers and laser eyes.

In my look, now, bigger than ever, HODLing Bitcoin has a genuine motive. The less Bitcoins readily available for buy within ETFs, the nearer we approach to a MOASS (Mother Of All Supply Squeezes) the place aside Bitcoin moons, no longer on memoir of shorts need to duvet, but on memoir of institutions need to buy Bitcoin on the initiating market cherish the remainder of the realm.

Liquidity in Bitcoin and BlackRock’s quick impact.

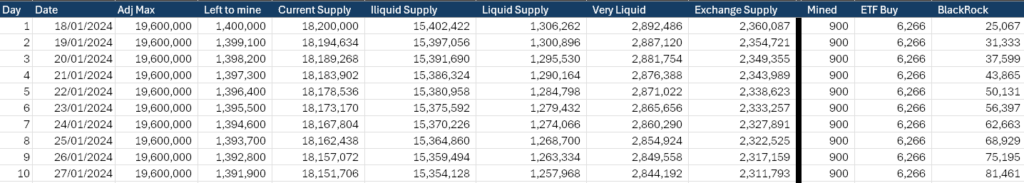

Since the debut of tell Bitcoin ETFs within the US final week, BlackRock has bought an realistic of 6,266 BTC on a normal basis for a cumulative total of 25,067 BTC as of press time. The entire bought by the Newborn 9 over precise four buying and selling days is now at 70,000 BTC ($2.9 Billion.) When we consist of Grayscale, the final Bitcoin under administration is 660,540 BTC ($27.6 billion.)

To realize the evaluation, I’ll first define the buckets oldschool, as defined by Glassnode records.

“The liquidity of an entity is defined because the ratio of cumulative outflows and cumulative inflows over the entity’s lifespan. An entity is believed-about to be illiquid / liquid / highly liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively.”

Extra recordsdata on calculating L may maybe very successfully be chanced on on Glassnode’s blog.

- Recent Supply: The entire quantity of bitcoins that have been mined and are currently in circulation.

- Illiquid Supply: Bitcoins held in wallets without vital movement, suggesting a prolonged-length of time funding technique.

- Liquid Supply: Bitcoins that are actively traded or spent, indicating increased market assignment.

- Very Liquid Supply: This category represents bitcoins that need to no longer precise traded but are readily readily available for getting and selling on exchanges within a transient timeframe.

- Trade Supply: Bitcoins held in trade wallets, willing to be traded or sold.

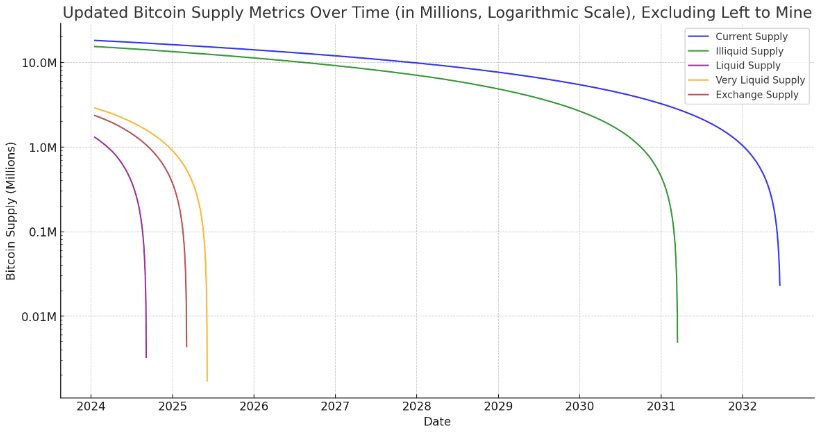

The chart under shows the diversified liquidity cohorts for Bitcoin all over time. The illiquid present is by some distance the splendid sector. Nonetheless, interestingly, the highly liquid share is increased than the liquid share, indicating a dichotomy amongst investors. Bitcoin holders are either hodlers or merchants, with entirely about a on the fence about whether to defend or transact with Bitcoin.

Now we realize the liquidity wretchedness, let’s compare at how the diversified cohorts stack up. The reliable max present of Bitcoin is 21,000,000 coins. The unusual circulating present is nineteen,600,000. Fixed with Glassnode, the final quantity of lost coins is roughly 1,400,000; this involves Satoshi’s coins, amongst others. There are diversified increased estimates of lost coins; nonetheless, given that this quantity has remained moderately consistent since 2012, I reflect it’s some distance the most reliable quantity.

Interestingly, this capacity that after we eradicate the lost coins from the most present, we no longer sleep with the same quantity because the hot circulating present. Whereas here is exclusively coincidental for this trusty 2d in time, it presents an belief of how this may maybe feel when your entire coins have been mined, on the least by system of market liquidity. Obviously, after all coins are mined, the shortcoming of block rewards for miners will add one other aspect to the mix I won’t get into factual now. I could say that I imagine costs will seemingly be bigger than ample to continue to staunch the network given the hot path Bitcoin is heading in.

| Metric | Sign |

|---|---|

| Max Supply | 21,000,000 |

| Recent Supply | 19,600,000 |

| Adj. Max Supply | 19,600,000 |

| Adj. Recent Supply | 18,200,000 |

| Illiquid Supply | 15,402,422 |

| Liquid Supply | 1,306,262 |

| Very Liquid Supply | 2,892,486 |

| Trade Steadiness | 2,360,087 |

The unusual present may maybe even be adjusted to eradicate lost coins. The three well-known cohorts to analyze are the liquidity ranges, as defined under, and the balance of Bitcoin on crypto exchanges. The entire liquid and extremely liquid coins quantity to precise 4,198,748 BTC ($175 billion,) which accounts for round 21% of the $815 billion Bitcoin market cap.

What if BlackRock retains buying up your entire Bitcoin?

Now, for the stress-free phase that you just’re all reading for What if BlackRock inflows have been to continue on the level viewed true through its debut? Whereas some have bemoaned the open of tell Bitcoin ETFs as a failure, and Bitcoin’s worth has even dropped to $0.0413 million from its contemporary high of practically $49,000, I reflect they are going to no doubt no longer sleep with the ‘egg on their face,’ as we say within the UK. Right here’s why!

Presently, 900 unusual Bitcoins are mined on a normal basis, and this may maybe drop to 450 BTC round April 18, 2024. Additionally, as I talked about previously, BlackRock is acquiring round 6,266 BTC on a normal basis. If BlackRock have been to strive and buy straight from miners, this is in a position to consequence in a get deficit of 5,266 BTC.

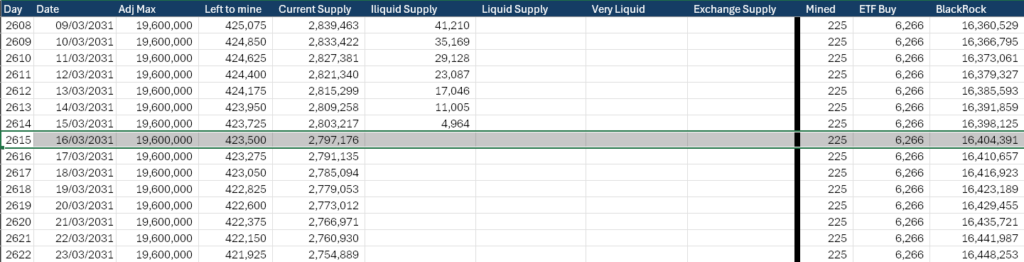

So, it needs to get Bitcoin from in diversified places. Thus some distance, the Coinbase OTC desks have had ample liquidity to soak up the requirement. Nonetheless, this may maybe’t final without kill; there just isn’t one of these thing as a never-ending liquidity. The table under shows what would happen if BlackRock sold from every cohort with miner participation.

At its contemporary charge, over the next 10 days, BlackRock would stay round 81,481 BTC with little to no vital impact on any cohort. So, the open is a failure?

I don’t reflect so.

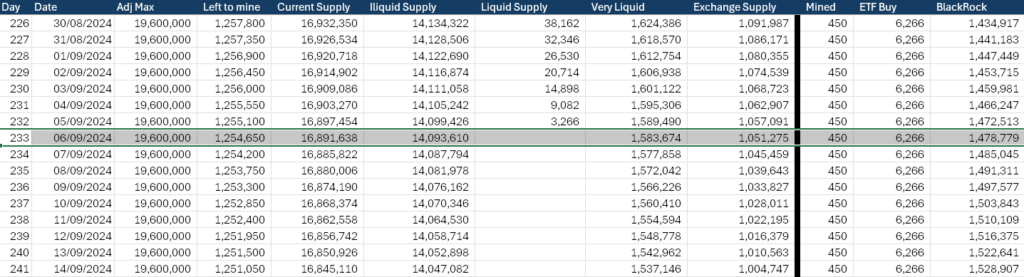

If we lengthen this down to Sept. 6, 2024, and BlackRock is most effective buying from the liquid present, with miners adding to this cohort and reducing the impact, your entire cohort will be absorbed.

Let’s elevate on.

To place it nice and clear, every table going forward will seemingly be under the next hypothetical scenario.

What if BlackRock sold completely from this cohort on the charge it has true through the first four days and newly mined Bitcoin modified into also incorporated, thus reducing the impact of BlackRock’s buying?

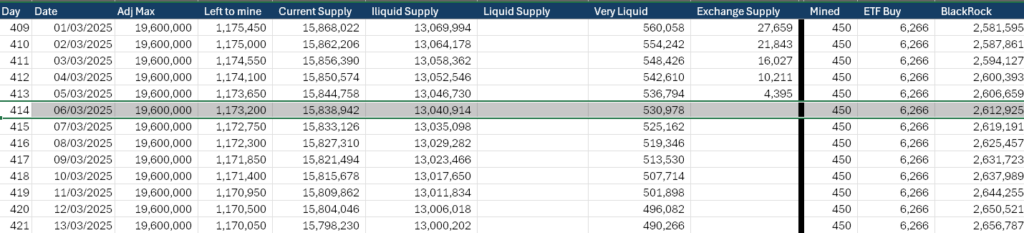

By March 3, 2025, the Bitcoin held on exchanges will be gone, and BlackRock would have 2.6 million BTC.

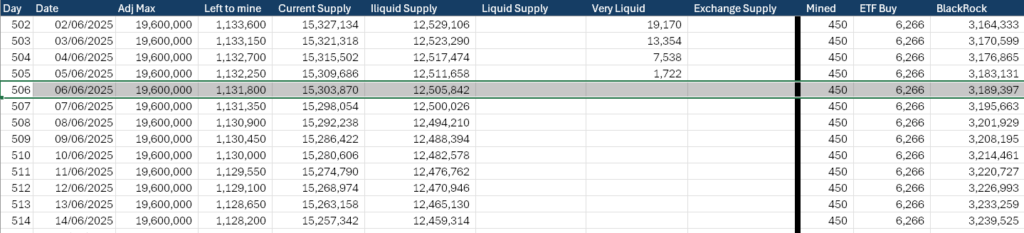

The ‘very liquid’ cohort will be absorbed by June 6, 2025. This neighborhood is the most without bother accessible for BlackRock to procure liquidity, and it’s soundless precise 18 months away.

In only eight years, by 2032, BlackRock’s Bitcoin conserving will be rate $686 billion by this day’s standards and consist of 16,404,391 BTC. This would require it to have chanced on a technique to buy all of the Bitcoin from the ‘illiquid’ present and give it round seventy nine% of all Bitcoin in circulation under administration.

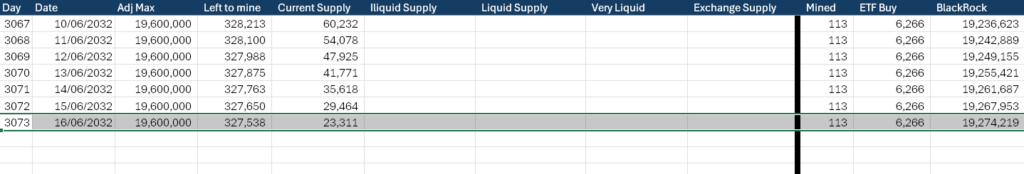

Ultimately, in barely 3,073 quick days, on June 16, 2032, BlackRock would have sold all of the Bitcoin in circulation and finally need to end its 6,266 BTC per day buy. Going forward, there would most effective be 113 BTC readily available day after day from newly mined Bitcoin, of which there’ll be 327,538 BTC left to mine.

Obviously, few of the above eventualities are going to happen. BlackRock is unlikely in an effort to defend these ranges of inflows in Bitcoin terms without Bitcoin’s worth either falling critically or query increasing alongside with worth.

As an instance, 6,266 BTC is rate $262 million at $0.04184 million per Bitcoin. At $0.2 million per Bitcoin, this quantity becomes $1.25 billion on a normal basis. Conversely, at $0.01, it’s most effective $62.6 million.

So except Bitcoin stays round $0.04 million for the next eight years, BlackRock is ready to persuade investors to buy its ETF on the same lope, and it would procure HODLers willing to promote, we aren’t going to verify BlackRock rob custody of your entire Bitcoin.

Nonetheless, we will have the capability to now open to verify what form of an impact consistent Bitcoin ETF inflows can have on diversified factors of the provision. For my share, my Bitcoin is illiquid and remains that system. I see the advantages of tell Bitcoin ETFs, and I also see the provision crunch that’s coming in some form or originate. Positively no longer this day, potentially no longer this quarter, but after that…

CryptoSlate will continue to dig into the numbers and nerd out on chain for you, so while you enjoyed this exploration into Bitcoin present, please allow us to clutch on our X memoir @cryptoslate or attain out to me straight @akibablade. Additionally, sob out to Samson Mow for the ‘M’ notation for Bitcoin!

Source credit : cryptoslate.com