Non-custodial fiat off-ramp now available in crypto wallets via Visa debit

Crypto and NFT funds infrastructure company Transak has partnered with Visa to mix Visa debit capabilities into its global off-ramp provider. This toddle will increase the recommendations for crypto-to-fiat off-ramps, allowing customers in over 145 worldwide locations to seriously change their crypto holdings into native fiat currencies.

Using a product known as Visa Sing, Transak will allow the fluid conversion of digital property into fiat forex across the replace. This collaboration addresses a fundamental hole on the market: the benefit of crypto-to-fiat conversion. Historically, the level of ardour has been on facilitating the toddle with the stream of fiat into crypto, leaving the reverse process, from crypto relief to fiat, less developed and customarily cumbersome.

This has ended in a reliance on stablecoins or different, less-regulated conversion systems, which would perhaps most doubtless perchance perchance be problematic referring to native compliance. The partnership between Transak and Visa introduces a resolution to this whisper, providing exact-time card withdrawals thru Visa Sing. Yanilsa Gonzalez-Ore, North The US Head of Visa Sing, highlighted the significance of this integration, emphasizing its purpose in providing a more linked and atmosphere friendly abilities for customers.

“By enabling exact-time card withdrawals thru Visa Sing, Transak is popping in a quicker, less advanced and more linked abilities for its customers — making it more straightforward to seriously change crypto balances into fiat, which will also be spent on the larger than 130M provider provider areas where Visa is well-liked.”

A key purpose of Visa Sing is its exact-time transaction processing ability, potentially completing transfers in underneath 30 minutes—a stark distinction to the customarily prolonged procedures in aged banking. Extra, most off-ramps lately are cramped to centralized exchanges, which capacity investors are required to undergo no longer no longer up to a momentary toddle into centralized custody sooner than withdrawing.

The power to seriously change crypto to fiat without lengthen from a pockets permits customers to enjoy the self-sovereign whisper of self-custody in crypto. Transak is integrated into larger than “350 leading Web3 wallets and games, akin to MetaMask, Belief Pockets, Coinbase Pockets, and Ledger.”

Sami Originate, CEO of Transak, views this partnership as a pivotal moment for Web3, commenting,

“We predict about this partnership is an inflection level for Web3 as a entire. Now, millions across the globe enjoy a straightforward capacity to cashout their digital asset holdings to their native forex in exact-time and intuitively.

They no longer must stroll the treacherous route of compliance uncertainty or face dangers of fraud — Transak and Visa enjoy them lined for over 40 cryptocurrencies.”

Sorting out the pockets-basically based fiat off-ramp.

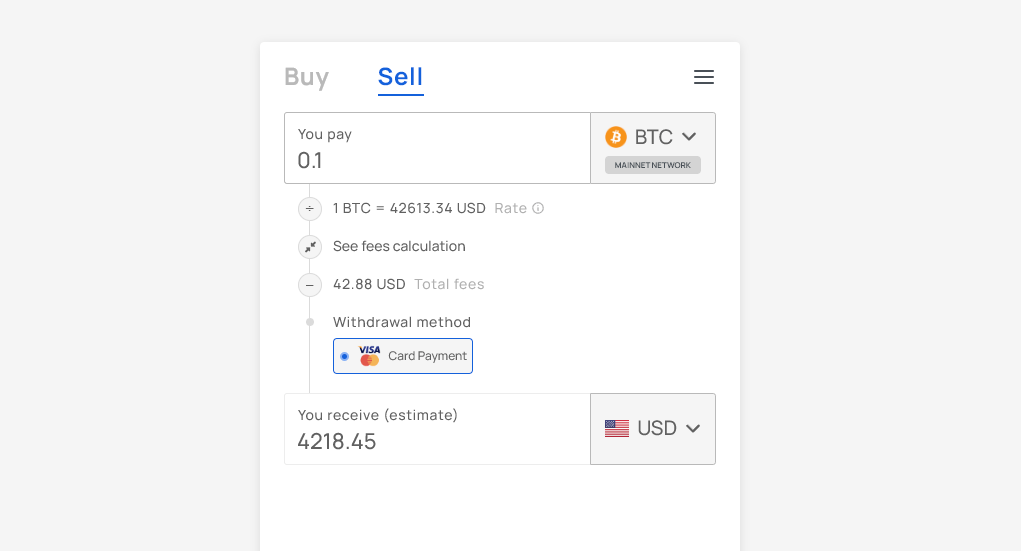

However, such a revelation is no longer without its plan back. As of press time, the worth of Bitcoin is $43,497. However, withdrawing 0.1 BTC would consequence in only $4,218 in fiat landing in an investor’s bank tale, a 3% haircut on the contemporary rate. Transak takes a 1% rate and a nominal processing rate paid to “provider companies.” However, an recordsdata bubble on the page does veil that the cost listed is an estimate, so it is currently unclear whether or no longer there might be a unfold alongside with the cost.

The unfold between the estimated label and the contemporary market label is around 2% across all property reviewed. A 2% unfold is furthermore proven for the ‘buy’ aspect trades from Visa Card, ApplePay, GooglePay, Money App, and bank wire, again with a 0.ninety 9% transaction rate.

While the Transak web set up states a flat 1% rate, the accomplice doctors list the pricing mechanism in larger detail. The unfold is supposed to conceal network expenses and “a small slippage percentage.” Combining expenses into a single variable might most doubtless perchance perchance furthermore blueprint such transactions seem more straightforward to non-native crypto customers. However, each day customers might most doubtless perchance perchance furthermore desire more finite enjoy watch over over the costs. Finally, there might be a rate for consolation.

Harshit Gangwar, Marketing Head & Investor Household Lead at Transak, confirmed to CryptoSlate that the “unfold fluctuates per components like the complexity of sourcing liquidity and the dangers associated with storing assorted cryptocurrencies.” Particularly, he stated,

“[The spread is] variable and determined by our programs and crew per the challenges in storing and sourcing cryptocurrencies.

As an instance, if a cryptocurrency on hand for off-ramping by shock drops greatly, it signals to our crew the increased menace of storing it for a protracted duration, which would perhaps most doubtless perchance enjoy an impact on the unfold percentage for that categorical cryptocurrency.”

Extra, for these hoping that the process would take away the need for KYC steps, this appears no longer to be the case. Title, address, date of birth, ID, and a selfie are all required when establishing an tale for the Transak withdrawal provider. Thus, purchasing for or promoting thru this non-custodial off-ramp will link your own recordsdata to your pockets address.

Those purchasing for an completely compliant technique to buy and promote crypto with fiat without the usage of centralized exchanges now enjoy a approach costing between 0.ninety 9% and 3%, which would perhaps most doubtless perchance perchance be considerably no longer up to other peer-to-peer recommendations.

Finally, the collaboration between Transak and Visa Sing is a decisive step forward in the streak toward the mainstream acceptance of digital currencies. It makes an attempt to simplify converting crypto to fiat and will get rid of obstacles of complexity and uncertainty, potentially accelerating crypto adoption amongst the favored populace.

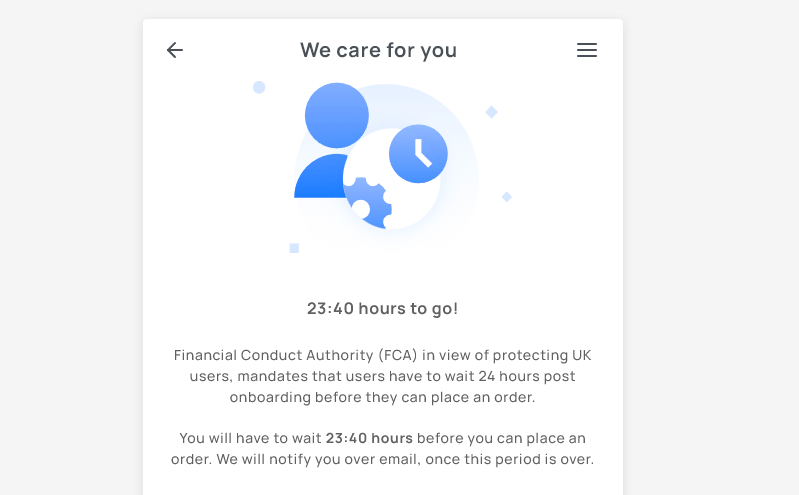

Editor’s Divulge: I tried to behavior a transaction to take a look at the process and take a look at whether or no longer there was a 2% unfold. I intended to off-ramp $100 worth of MATIC, but this was the veil I used to be met with after completing the KYC process which capacity that of sleek FCA promotional guidelines.

Source credit : cryptoslate.com