Grayscale NAV flips BlackRock as IBIT records first discount to Bitcoin since launch

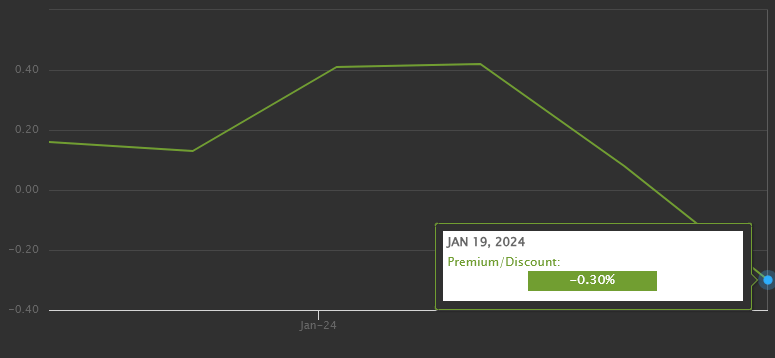

BlackRock’s iShares Bitcoin Believe recorded its first slice worth to its Score Asset Price (NAV) on Jan. 19, shedding to a lowered fee of -0.30%, in step with legit BlackRock records.

“The above desk and line graph level to records about the diversifications between the day-to-day closing worth for shares of the fund and the fund’s get hang of asset worth. The closing prices are obvious by the fund’s checklist replace.” – BlackRock

Conversely, after a prolonged duration at a heavy slice worth, Grayscale’s (GBTC) NAV is now a exiguous bit tighter at stunning -0.27%, in step with Y Charts records. GBTC saw a staggering Forty eight% slice worth to NAV on Dec. 22. On the different hand, as anticipation of its conversion to a convey, Bitcoin ETF rose, the slice worth closed, reaching stunning -1.55% on the day it turned into converted. The slice worth has endured to shut and has surpassed even one of the ‘Unusual child 9’ Bitcoin ETFs, comparable to IBIT.

In its first week, the iShares Bitcoin Believe skilled a various NAV per half, foundation at $26.59 and seeing a lower to $23.87 by Jan. 19. The belief’s prominent shares confirmed a well-known expand from 400,000 to over 50 million within the identical duration.

The NAV top fee/slice worth fluctuated modestly, recording a top fee of 0.16% on launch day, peaking at 0.42% by Jan. 17, sooner than declining to a slice worth. This alternate signifies the investors’ valuation of the shares relative to the underlying Bitcoin sources held by the belief. A top fee suggests shares are valued bigger than the NAV, whereas a slice worth signifies a lower valuation. The reference fee for Bitcoin venerable turned into $41,898, calculated between 8 pm and 9 pm GMT (3 pm – 4 pm EST), as highlighted in the chart below.

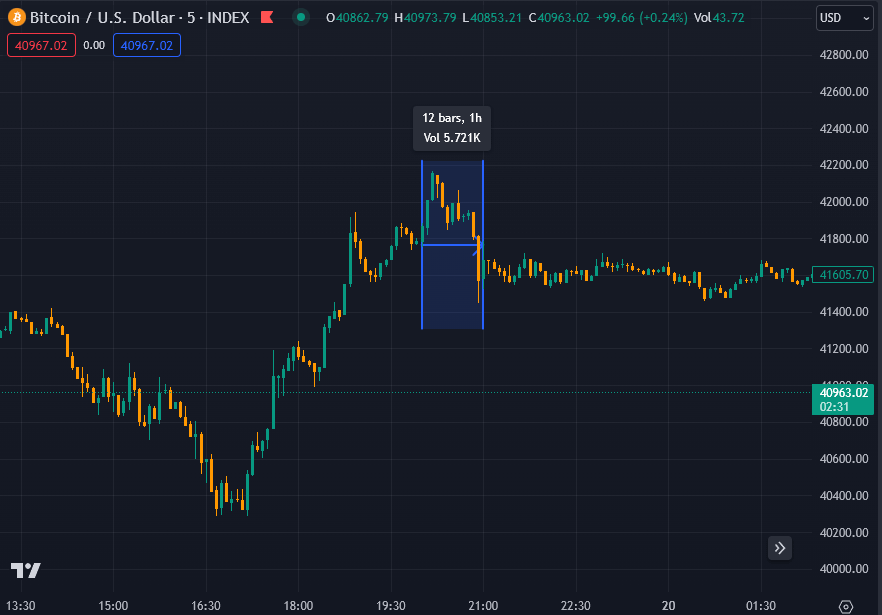

The underlying Bitcoin worth has declined toward the psychological make stronger of $40,000, trading at $40,840 as of press time, whereas IBIT shares are trading at $23.39 pre-market after closing at $23.80 on Friday, Jan. 19.

Attributable to this truth, IBIT shares possess declined 1.72% since Friday’s trading session. In inequity, the underlying asset, Bitcoin, will possess fallen spherical 2.5% if it doesn’t get better sooner than the reference fee (BRRNY) is calculated later nowadays. Ought to tranquil IBIT shares alternate in step with Bitcoin at some level of Jan. 22, this will likely likely reverse the slice worth and upward thrust to a top fee doubtlessly as excessive as 0.7% in step with present calculations. On the different hand, with the valuable market no longer opening for several hours, IBIT could perchance also just shut this gap at some level of legit trading hours.

Given the time go in reporting ETF records, the affect of the reported NAV is particular. In its prospectus, BlackRock talked about it could perchance perchance perchance well put up an intra-day indicative nav (IIV). Amassed, this records isn’t very any longer published on its legit internet place however must tranquil be on hand below IBIT.IIV by Nasdaq trading terminals.

Since its launch, the Property Beneath Administration (AUM) of the iShares Bitcoin Believe possess reached $1,346,912,907.59, with 33,430 BTC below administration, emphasizing the scale at which the belief is working and the stage of funding that it has attracted in a snappy duration. Tied with the expand in prominent shares, the total successfully being of the belief suggests a growing investor pastime as the need of shares is more than tenfold.

Source credit : cryptoslate.com