Bitwise CIO says Bitcoin’s dip driven by ETF overenthusiasm, not Grayscale outflows

Bitwise chief investment officer Matt Hougan attributed essentially the most up-to-date decline in the crypto market to overinflated expectations relating to the functionality influence of the newly launched Bitcoin commerce-traded funds (ETFs).

In a Jan. 23 put up on X (beforehand Twitter), Hougan outlined that essentially the most up-to-date market sell-off is pushed by what he phrases an “ETF Expectations-led” phenomenon.

In accordance to him, investors awaiting “better to find flows into (these) ETFs” front-ran the approval news by piling into every plight and derivatives positions on the flagship digital asset. On the bogus hand, with the expected inflows no longer materializing, these investors are now “unwinding that wager,” prompting essentially the most up-to-date market say.

“Correct because the market hyped up the transient influence of ETFs, it is underestimating the long-time-frame influence,” Hougan concluded.

For the rationale that Securities and Alternate Commission (SEC) accredited the launch of several plight Bitcoin ETFs in the U.S., the designate of the tip cryptocurrency has been on a downturn. The digital asset fell to as low as below $39,000 on Jan. 23 nonetheless has recovered to $40,389 as of press time, in accordance with CryptoSlate’s data.

This downward kind raised considerations within the crypto neighborhood, with some attributing it to the outflows from Grayscale’s Bitcoin Have confidence ETF (GBTC).

Contrary to this sentiment, analysts, including CryptoQuant founder Ki Younger Ju, fragment a standpoint aligned with Hougan’s.

Younger Ju recently emphasised that Bitcoin operates in a futures-pushed market, making it less inclined to plight-selling actions from GBTC-connected disorders.

“BTC falls due to derivative market selling, no longer GBTC. OTC (over the counter) markets are very inspiring, nonetheless no designate influence,” he added.

ETFs are BTC to find investors.

In the meantime, the Bitwise investment chief furthermore clarified that the recently launched ETFs are to find investors of Bitcoin despite the outflows emanating from GBTC.

Hougan identified that whereas GBTC capabilities as a to find vendor, the cumulative BTC acquisitions from the fresh ETFs surpass that being offloaded by Grayscale.

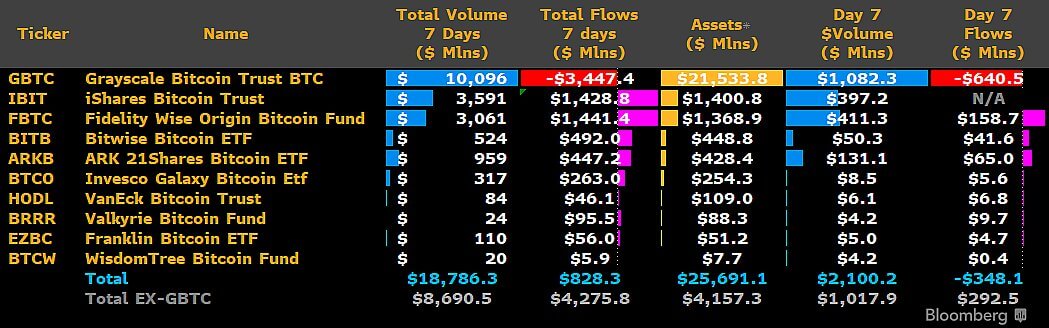

Bloomberg data corroborates Hougan’s gape. As of Jan. 23, GBTC’s outflows stood at $3.forty five billion, whereas the newly launched 9 ETFs had a blended influx of bigger than $4 billion in sources below administration.

This info stresses a compelling legend—that the ETFs win considered gargantuan hobby from the neighborhood, resulting in a swift and demanding accumulation of the main cryptocurrency.

Source credit : cryptoslate.com