Ark Invest’s aggressive accumulation of its Bitcoin ETF propels it into top 5 of ARKW portfolio

Ark Make investments’s persisted accumulation of the Ark 21Shares Field Bitcoin ETF (ARKB) has elevated the asset to a high-five put apart all the plot via the firm’s Ark Next Generation Cyber web ETF (ARKW) portfolio.

The firm’s most up-to-date trading file considered by CryptoSlate showed that it bought 267,804 shares of ARKB, value $12.3 million, basically based mostly totally on the Jan. 24 closing label of $46.27.

Conversely, it liquidated 282,975 ProShares Bitcoin Approach (BITO) shares, valued at an estimated $5.4 million basically based mostly totally on the closing label of $19.11.

This trading process follows Ark Make investments’s most up-to-date development of divesting from BITO and actively amassing its BTC-basically based mostly mostly situation ETF. Contemporary studies by CryptoSlate published how the investment firm has made indispensable purchases of its ARKB shares for the reason that fund went live this month.

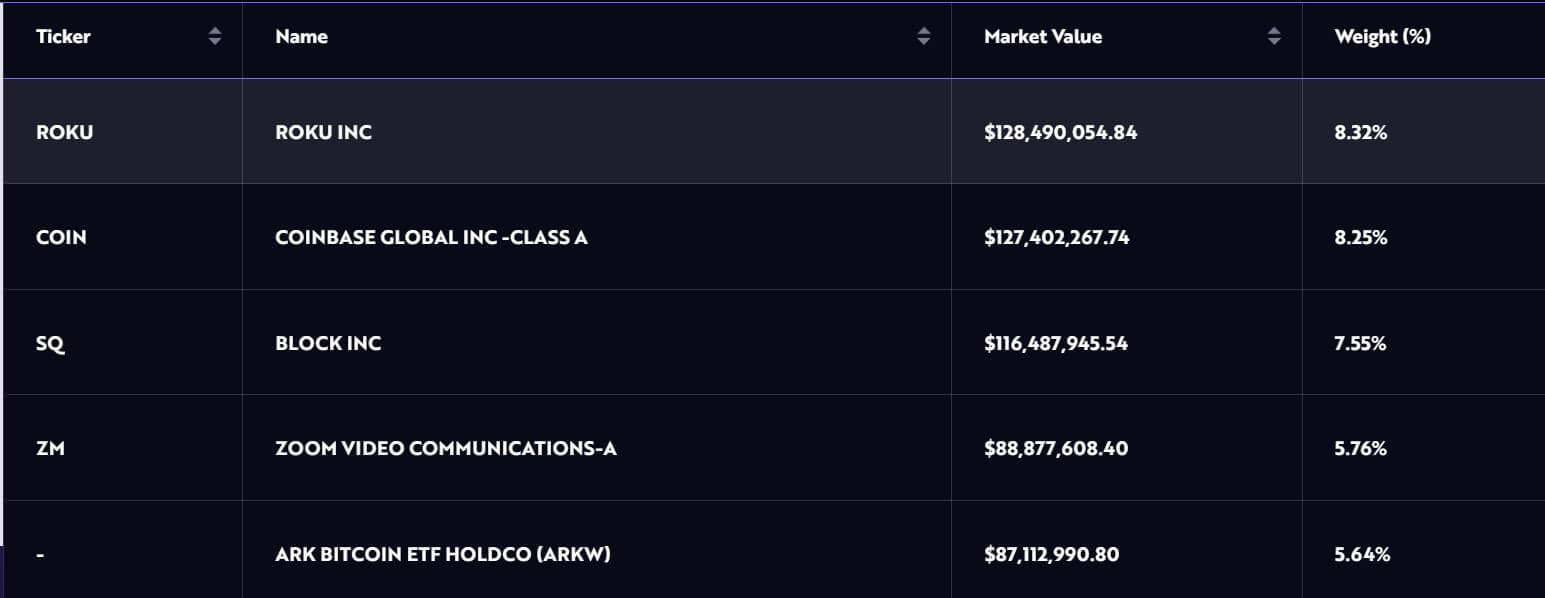

As a results of those strategic strikes, ARKB has now secured the fifth put apart among the many property in ARKW’s portfolio.

The ARKW fund currently holds 2.1 million ARKB shares, valued at over $87 million, comprising 5.64% of the complete portfolio. Notably, ARKB surpasses holdings in properly-identified entities such as Tesla, Robinhood, and DraftKings, though it trails in the support of crypto-focused companies Block and Coinbase all the plot via the ARKW portfolio.

In distinction, Ark Make investments’s retaining in BITO has diminished to 566,285 shares, valued at $10.8 million. BITO is the first BTC futures ETF in the US, launched in October 2021.

Meanwhile, the Cathie Wood-led firm’s strategic reallocation of funds aligns with market expectations, as observers anticipated the firm would shift away from BITO and redirect the capital into ARKB to give a boost to the fund’s asset scandalous.

These maneuvers score propelled the Ark 21Shares Bitcoin ETF to third put apart among the many “Unique child nine” situation Bitcoin ETFs, trailing BlackRock’s IBIT and Fidelity’s FBTC. Based totally on Bloomberg Intelligence records, the fund’s property under administration now exceed $500 million.

Source credit : cryptoslate.com