Exploring SynFutures V3 and the Oyster AMM

SynFutures, a decentralized perps exchange, has been waking waves in DeFi for the past few years. It has prominent merchants, a huge individual noxious, and an spectacular trading volume, which manner it has the total factors that would additionally admire it a conducting to gape in 2024 and past. On this article, let’s dive into SynFutures to hang the conducting and note at what’s so special about its unique product releases and campaigns.

Early Stage

SynFutures is a multi-chain decentralized derivatives exchange. The conducting has the backing of diverse huge VCs, including Pantera, Polychain Capital, DragonFly, and Frequent Crypto, and the DEX recently raised over $22 million in a Sequence B funding round. SynFutures V1, the predominant iteration of the platform, launched in June 2021 and presented the thought that of single-token liquidity thru the Synthetic Computerized Market Maker (sAMM) model. This allowed LPs to fund any pool on the protocol with factual one token, usually a stablecoin.

Single-token liquidity brought grand attention and curiosity to the conducting, which hastily followed up on its success with the originate of SynFutures V2. V2 presented permissionless list, permitting LPs to checklist any crypto tokens, money, NFTs, and indices in 30 seconds with out prior approval. With permissionless list and single-token liquidity, the conducting targets to develop to be the predominant derivatives vacation disclose for vast and diminutive resources.

In line with reports from Messari, V1 and V2 personal a cumulative volume of more than $23 billion, with over 10,000 users and practically 250 pairs listed for exchange. The fulfillment is spectacular, pondering the conducting has but to declare a token. As soon as that announcement is made, we are going to gain a procedure to quiz elevated trading job from new users and airdrop farmers, which is able to doubtless boost its trading metrics, and the costs earned thru these actions can even shoot up.

Commence of V3

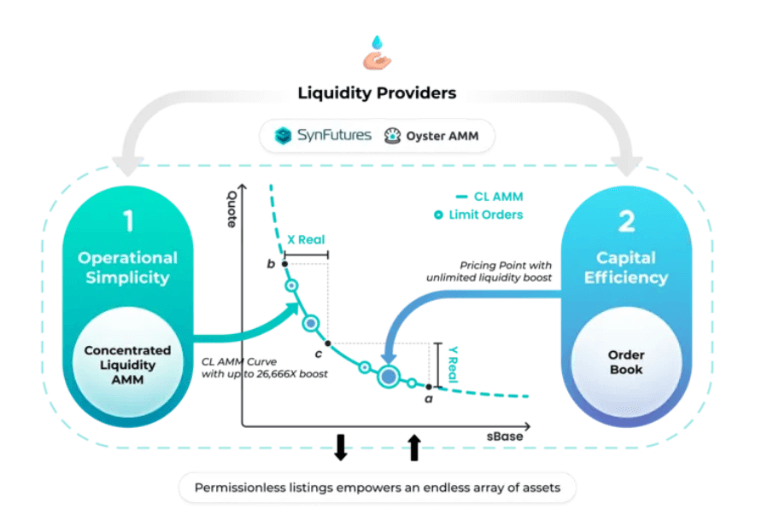

The protocol factual launched SynFutures V3 on Blast mainnet. Take care of the outdated versions, V3 introduces an toughen that can majorly affect liquidity companies (LPs) and merchants. The brand new version comes with a new AMM model known as Oyster AMM (or oAMM), permitting LPs to admire concentrated liquidity for any spinoff pair listed on the platform. LPs can already present single-token liquidity, nonetheless with the new AMM, LPs will also be ready to admire single-token concentrated liquidity. This new characteristic might well perhaps additionally toughen capital effectivity for liquidity companies and rep them larger returns while reducing slippage for merchants; it’s a rep-rep solution for all parties involved.

How V3 works

In line with the SynFutures V3 whitepaper draft, the Oyster AMM model used to be impressed by the synthetic Computerized Market Maker (sAMM) model from SynFutures V1 and the Concentrated Liquidity Market Maker (CLMM) model from Uniswap V3.

In the expose book model, liquidity is typically concentrated around the asset’s unique value, while the AMM model spreads it all the procedure in which thru the total value differ. This makes AMMs less efficient for LPs and outcomes in more slippage for merchants. To steer sure of this, Oyster introduces concentrated liquidity that permits LPs to settle a ramification around the unique value where their liquidity would be active. As well to, Oyster also will enable merchants to space limit orders the usage of the expose book model. These orders are then positioned on the AMM curve as one other source of liquidity.

While Oyster AMM is no longer any longer the predominant time a conducting has tried to mix AMM with an expose book, the outdated attempts personal mostly followed a hybrid machine where some parts of the transaction happen off-chain while others happen on-chain. The kind of machine one procedure or the other is dependent upon the centralized directors who regulate the off-chain share of the transaction, thereby making it neither decentralized nor trustless. Such methods are also uncovered to doable backdoors and varied vulnerabilities. Oyster, on the assorted hand, is totally on-chain, making sure transparency and elevated safety.

Combining AMM and Orderbook on-chain is a flowery job. Therefore, to admire sure the two forms of liquidity complement each varied, Oyster uses a construction known as ‘Pearl,’ which is a series of the total concentrated liquidity covering a value level and all originate limit orders at the same value. The image and the reason below present a step-by-step story of how the model works and how an expose gets done in Oyster AMM.

- When a market taker locations a new expose, Oyster first assessments the Pearl at that value level.

- It then takes liquidity from the limit orders blow their personal horns at that Pearl. The transaction is performed if the liquidity within the limit orders is ample to gain the market taker’s expose.

- If no longer, Oyster AMM then takes liquidity from the AMM. This will increase the value and strikes it alongside the AMM curve.

- If the expose gets fulfilled on the curve, the transaction ends. If no longer, the value keeps increasing except the subsequent Pearl is reached.

- The same job is followed one more time, where the liquidity from the limit expose is filled first, after which liquidity from the AMM is taken.

- This job continues except the total expose is filled.

This twin manner allows SynFutures V3 to personal significantly larger capital effectivity than most of its peers within the derivatives plot. It even presents higher capital effectivity than a disclose Dex delight in Uniswap V3. The desk below, taken from their whitepaper, exhibits the capital effectivity comparison between UniSwap V3 and SynFutures V3 at a explicit differ.

| Mannequin | Range | Capital Effectivity Boost |

|---|---|---|

| Oyster AMM | ninety 9.ninety 9% to 100.01% | 39,997.0x |

| UniSwap v3 | ninety 9.ninety 9% to 100.01% | 20,000.5x |

SynFutures & Oyster Odyssey

To celebrate the originate of V3 and Oyster AMM, SynFutures has presented ‘Oyster Odyssey’ campaign that rewards users with factors for offering liquidity on the protocol, the machine is designed to reward individual engagement and contribution to SynFutures ecosystem.

The factors machine is designed to reward users who present liquidity and lift new users to the platform. There is known as a mystery field mechanism and a whisk-the-wheel machine which adds an bid of top doubtless fortune and enjoyable to the campaign.

Trade on SynFutures V3 to be taught more.

Conclusion

Ambiance friendly employ of capital is main in DeFi, significantly within the early stage, where the total liquidity readily obtainable is proscribed. While AMM fashions democratized liquidity provision, it suffers from decrease capital effectivity. Bettering upon it’s a chief step in taking DeFi mainstream. SynFutures’ Oyster AMM is one such enchancment that permits a trader to theoretically rob a exchange with zero slippage while restful being totally on-chain; that would additionally very smartly be a welcome kind.

Source credit : cryptoslate.com