Bitcoin’s safe-haven status strengthened despite recent price crisis: Kaiko

Bitcoin has provided seriously greater returns than ancient safe-haven sources cherish gold, U.S. bonds, or the buck.

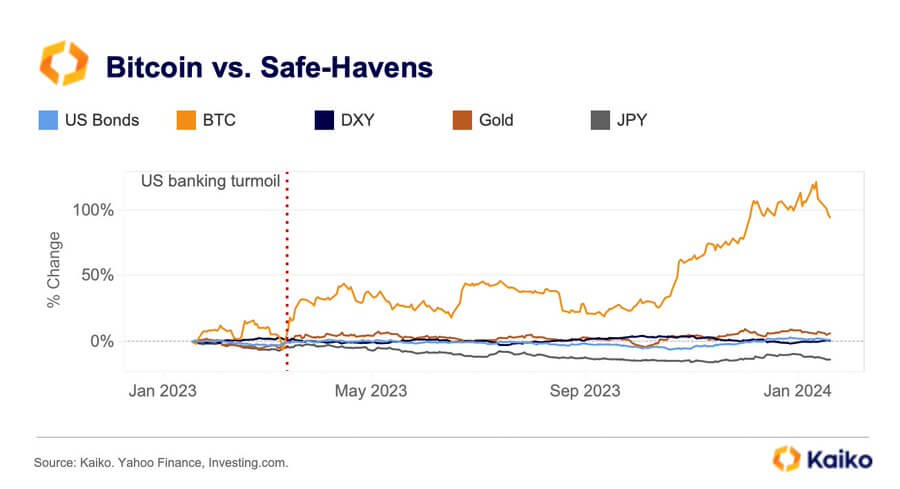

Recordsdata from Paris-primarily primarily based crypto analytical platform Kaiko showed that an investment in the tip cryptocurrency in January final year would have confidence yielded bigger than 100% returns, while identical investments in gold and other sources would have confidence generated seriously lower returns right by the identical length.

“Overall, BTC provides seriously greater returns than other ancient safe-havens much like gold, U.S. bonds or the buck. It has particularly outperformed, attracting safe-haven flows right by the U.S. banking crisis final year,” Kaiko wrote in its recent be taught checklist.

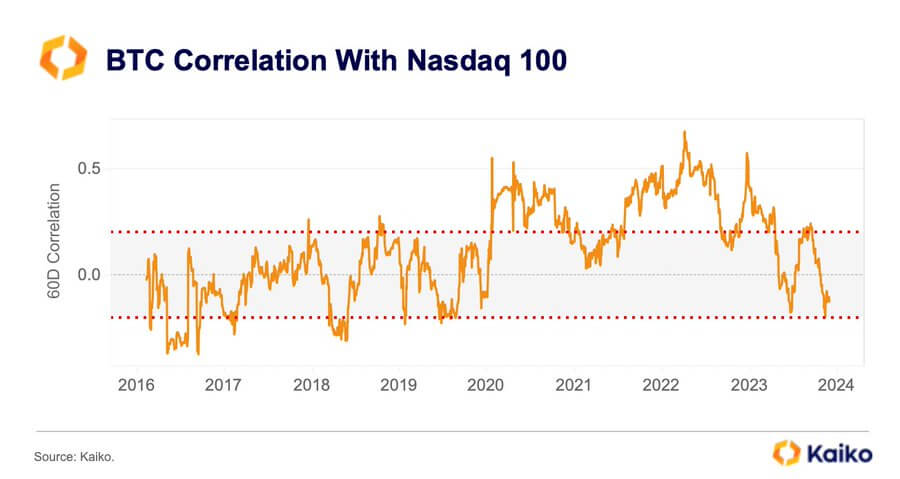

The firm described a pick up haven asset as uncorrelated with equities right by market turmoil.

BTC’s 60-day correlation with the Nasdaq 100 has seriously declined in the previous year, further bolstering the tip asset checklist as a pick up haven asset.

“[BTC correlation with Nasdaq 100] has been terminate to zero on common since June of 2023 as BTC worth movements were pushed by the hype around role U.S. ETFs,” Kaiko mentioned.

The increasing investors’ hobby in Bitcoin as a official safe-haven asset has been further propelled by influential institutional entities cherish BlackRock, who an increasing number of acknowledge the digital asset’s safe-haven traits.

Notably, a CryptoSlate checklist also confirmed this market dynamics. The checklist seen a BTC/GOLD ratio growth, displaying that investors an increasing number of preferred BTC over gold thanks to its perceived attributes as a digital retailer of cost and a hedge towards inflation.

In the intervening time, Kaiko’s prognosis follows BTC’s recent worth struggles beneath $40,000 despite introducing lots of role alternate-traded funds (ETF) in the U.S. On the opposite hand, according to CryptoSlate, the tip cryptocurrency’s cost has risen by bigger than 3% right by the previous day to around $41,150 as of press time.

Source credit : cryptoslate.com