Global Bitcoin ETP holdings over 900,000 BTC as Grayscale outflows ‘subside’

Crypto funding products seen their 2nd consecutive week of outflow this 365 days, with $500 million leaving the funds, constant with CoinShares’ newest weekly story.

Bitcoin dominate

Bitcoin funding products skilled vital outflows closing week, with a full withdrawal of $479 million.

The end cryptocurrency has faced vital headwinds for the explanation that U.S. Securities and Alternate Commission (SEC) licensed space replace-traded funds (ETF) in the nation. Its price has declined by extra than 12% to round $42,500 as of press time.

This downturn has spurred bearish merchants to turn to rapid BTC products, ensuing in practically $11 million in inflows closing week.

Conversely, infamous different digital resources love Ethereum, Polkadot, and Chainlink also seen outflows, with $39 million, $700,000, and $600,000, respectively. However, Solana defied this pattern by recording a modest inflow of $3 million.

One day of regions, U.S.-basically basically based mostly funds dominated the scene, experiencing accumulate outflows of $409 million. Switzerland and Germany followed with outflows of $60 million and $32 million, respectively. Brazil emerged as the exception, with basically the predominant accumulate inflows of $10.3 million.

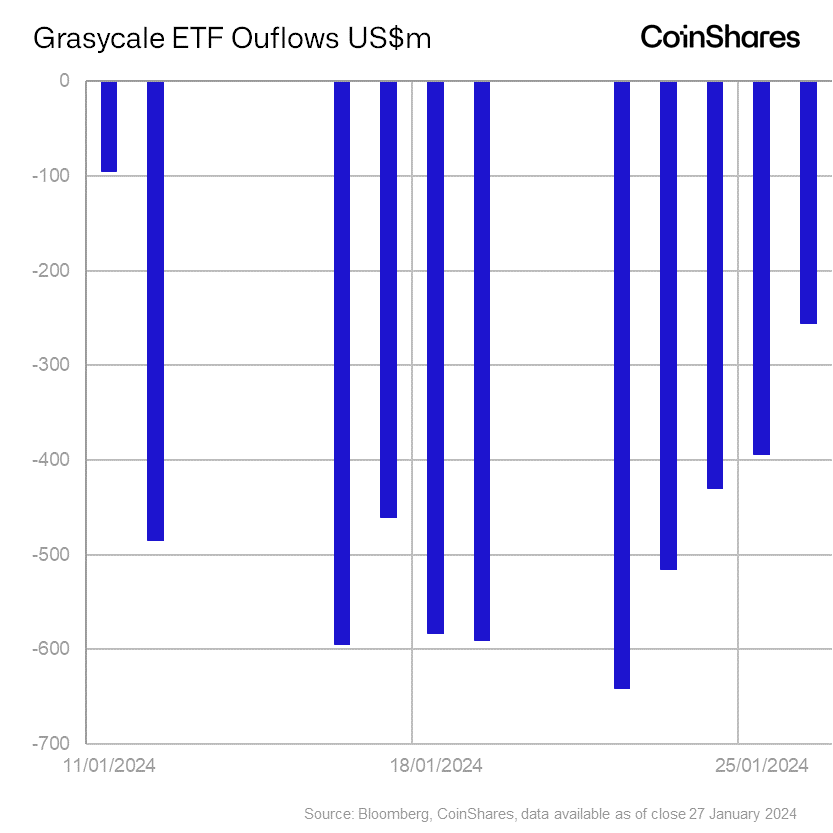

“Most smartly-liked brand declines brought on by the gargantuan outflows from the incumbent ETF issuer (Grayscale) in the U.S. totaling $5 billion, procure doubtless brought on additional outflows from other regions,” CoinShares Head of Analysis James Butterfill defined.

Grayscale outflows ‘subside’

Source credit : cryptoslate.com