Abracadabra Finance’s MIM stablecoin falls from peg after $6.5M hack

Digital belongings connected with the decentralized finance (DeFi) venture Abracadabra Finance, along with its Magic Cyber web Money (MIM) stablecoin, values fell after its crew confirmed an exploit of the platform.

In a Jan. 30 post on social media platform X (beforehand Twitter), the venture’s crew acknowledged an ongoing exploit inviting sure Ethereum cauldrons. “Our engineering crew is triaging and investigating the distress,” they added.

Recordsdata from CoinMarketCap reveals that the safety incident resulted within the ecosystem’s MIM stablecoin deviating from its $1 peg. The asset’s rate fell to as low as $0.77 earlier than getting greater to $0.92 as of press time.

The crew assured that its decentralized self reliant organization (DAO) would strive to aid the stablecoin obtain its peg.

“To the certainly of its Capacity, the DAO treasury shall be procuring aid MIM from the market to then burn.” the crew stated.

Equally, the protocol’s SPELL reward token declined 2.43% to $0.00051 as of press time, consistent with CryptoSlate info.

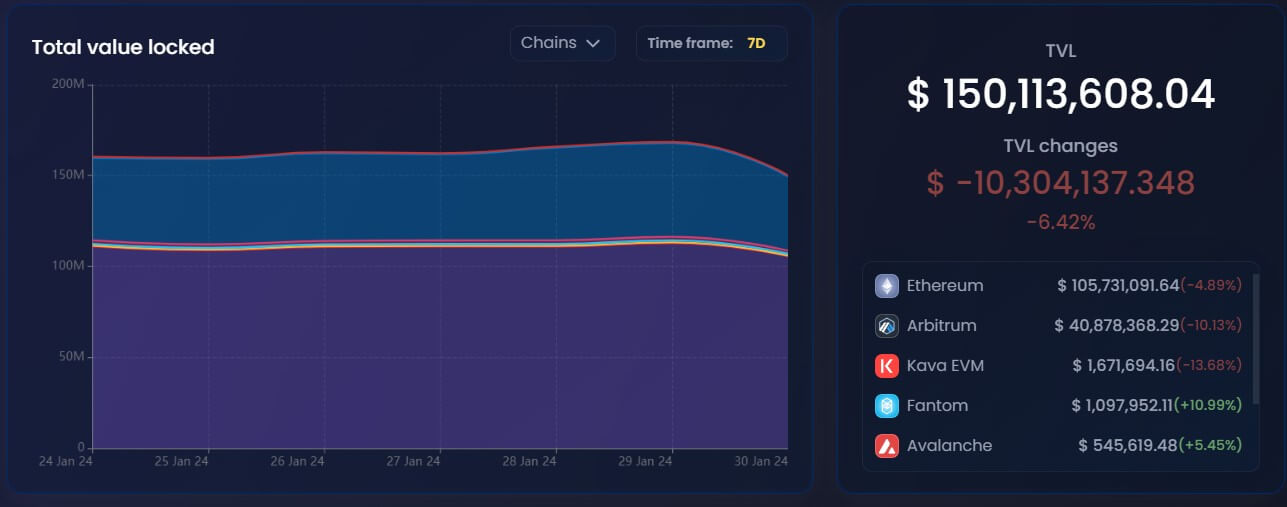

Furthermore, the safety incident has all of a sudden dropped the total rate of belongings locked on the platform. Recordsdata from DeFillama reveals that the protocol’s belongings below management all of a sudden fell by spherical $23 million to $139 million.

Nevertheless, info from Abracadabra’s web pages pegs the total outflow to $10.3 million and its TVL at $150 million as of press time.

Abracadabra Finance is a DeFi lending protocol allowing users to borrow its Magic Cyber web Money (MIM) stablecoin using various cryptocurrencies as collateral.

$6.5M hack

Blockchain security agency CertiK informed CryptoSlate that the protocol used to be exploited for $6.5 million.

Essentially based fully totally on CertiK, the attacker used to be funded during the crypto-mixing tool Twister Cash and created an assault contract that exploited a rounding error area on the platform.

“The exploiter frequently called userBorrowPart() and repay() from the venture’s V4 Cauldrons with early indications pointing to a rounding area,” CertiK furthered.

As a consequence, the attacker used to be ready to siphon $6.5 million in MIM and directly remodeled the stolen belongings into Ethereum that were sent to 2 externally owned addresses,

Source credit : cryptoslate.com