Terraform Labs launches claims portal for algorithmic UST stablecoin crash victims

Terraform Labs launches claims portal for algorithmic UST stablecoin rupture victims

Terraform Labs launches claims portal for algorithmic UST stablecoin rupture victims Terraform Labs launches claims portal for algorithmic UST stablecoin rupture victims

Terraform Labs units deadline for UST creditors to file claims, requiring proof of asset possession and eligible tokens.

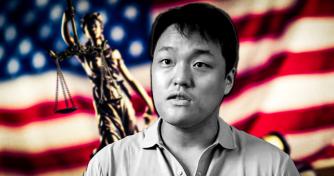

Veil paintings/illustration thru CryptoSlate. Image entails blended vow that may well include AI-generated vow.

Terraform Labs, the bankrupt agency in the assist of the failed TerraUSD (UST) stablecoin, has launched a crypto claims portal.

This platform is designed to compensate users stricken by the projectâs dramatic rupture in 2022. Creditors can put up claims between March 31 and April 30, 2025. Claims submitted after the deadline may well no longer be conception to be.

To file a voice, users need to explain asset possession by providing info that entails wallet addresses, learn-simplest API keys, and diversified supporting paperwork.

A Wind Down Trust will assess the claims created correct thru Terraform Labsâ ongoing financial damage job.

Within the meantime, no longer all sources will qualify for compensation. Crypto holdings with on-chain liquidity below $100 and explicit tokens cherish Luna 2.0 on the Terra 2.0 blockchain are excluded.

UST creditors can search data from an preliminary determination of their voice amount interior 90 days after the submission deadline. They are going to have the selection to collect or dispute the finish consequence.

Nevertheless, if a voice is rarely any longer contested, disbursements will originate as almost today as practicable, and all payouts shall be dispensed knowledgeable rata.

Enthusiastic on this, Terraform Labs urged creditors to uncover in regards to the loyal Crypto Loss Claim Procedures on the claims portal to form sure their submissions meet the specified standards.

Terraform filed for Chapter 11 financial damage in January 2024, years after the fallout from the UST rupture. In September 2024, a US court licensed the submitting following a $4.47 billion settlement with the Securities and Replace Commission (SEC).

$200 Million LUNA settlement

In a separate construction, investment firm Galaxy Digital reached a $200 million settlement with the Novel York Approved knowledgeable Frequent.

In line with the regulator, the asset administration agency and its founder, Michael Novogratz, promoted the LUNA token whereas quietly offloading great amounts with out telling merchants. It pointed out that Galaxy obtained LUNA in 2020 and later marketed it to customers no matter its selling plans.

The regulator acknowledged:

“Galaxyâs behavior, alongside with its misrepresentations and omissions about Luna whereas simultaneously selling Luna and failing to repeat its then-repeat intent to promote, constituted violations of the Martin Act and violations of Novel York Executive Regulation Portion 63(12).”

In line with the settlement, Galaxy didnât admit wrongdoing but agreed to pay the silent in installments over three years, initiating with $40 million due interior two weeks.

The corporate will also update interior insurance policies to enhance transparency and steer distinct of conflicts of hobby in future token promotions.

Source credit : cryptoslate.com

Farside Consumers

Farside Consumers