Could Bitcoin echo GameStop with a Mother Of All Supply Squeezes? Maybe

The 2021 GameStop saga, no longer too long ago featured in a Netflix movie, will indulge in surprising parallels with Bitcoin, namely within the context of a doable offer crunch.

Echoes of the Reddit-fueled’ mother of all short squeezes’ (MOASS) for GameStop, in Bitcoin’s context, may perchance perchance manifest as a fundamental offer squeeze, or ‘Bitcoin Mother Of All Present Squeezes’ (Bitcoin MOASS.) I’ve referenced this in different articles this year, nonetheless I needed to interrupt down precisely why I specialise in this is capable of happen.

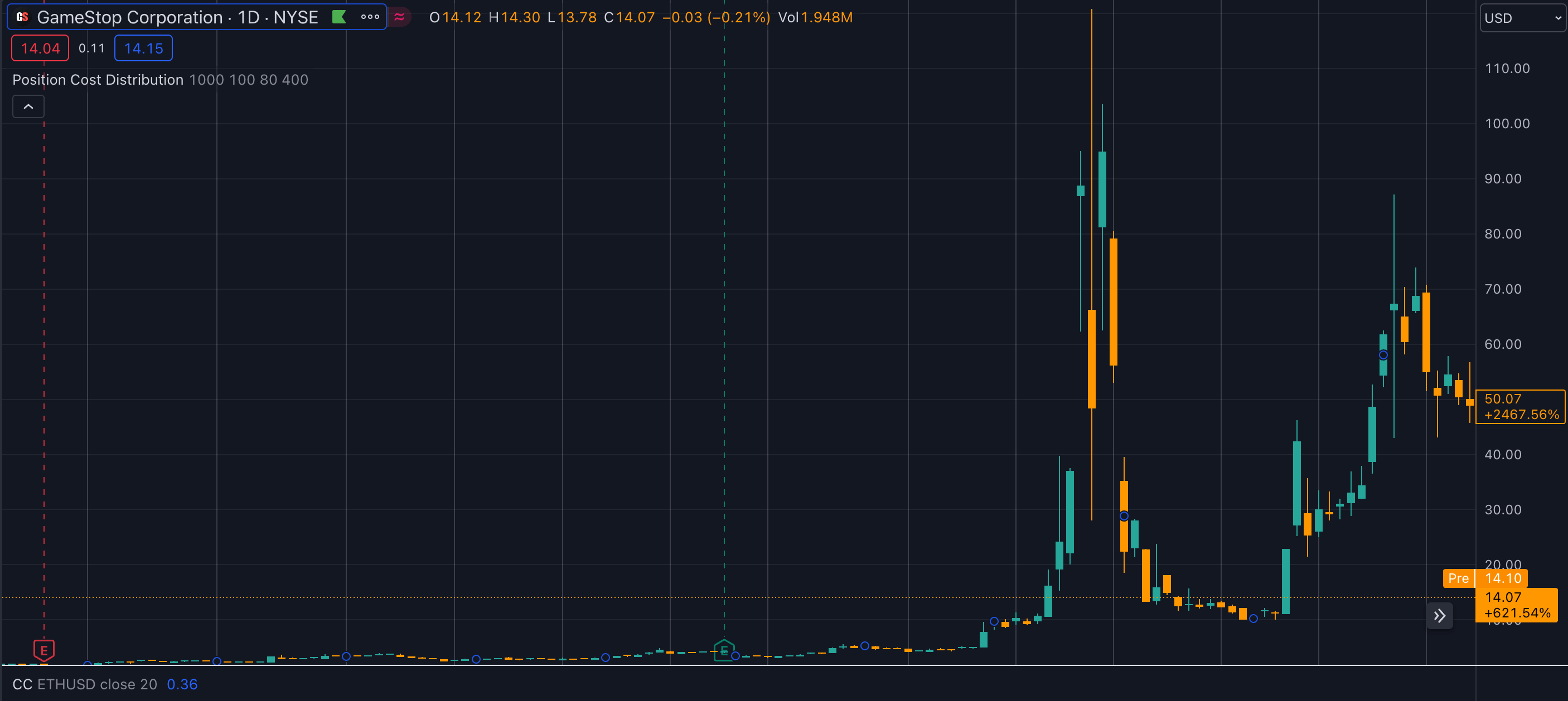

To heed this better, let’s revisit the GameStop phenomenon.

I wasn’t early sufficient to put together Roaring Kitty through his initial thesis on GME at round $3 per portion. However, I became lively within the WallStreetBets subreddit, and by the time the inventory hit $13, it became exhausting to brush aside his each day updates. Around the $50 (pre-inventory split) imprint, I cracked and ‘YOLOed’ in and took the high-tail up to $500, sure to encourage for the moon or bust. Within the raze, I bust, nonetheless I enjoyed being a half of something.

GameStop short squeeze thesis fundamentals.

For those irregular, GameStop shares were heavily shorted by several hedge funds who seen easy prey in a retail store headed for financial raze with the added peril of the pandemic. Reputedly, the diagram became to short the inventory to zero. This plot, veritably employed against faltering companies (fancy Blockbuster sooner than its demise), is actually making a guess on the firm’s failure.

However, hedge funds underestimated the attachment many avid gamers needed to the GameStop heed and the energy of retail investors uniting within the wait on of a trigger. There became furthermore a more philosophical aspect to why many investors, myself included, purchased shares associated to the broken frail finance gadget. As a Bitcoiner, this message resonated with me, and I offered shares desiring to HODL ‘to the moon.’

Lengthy story short, retail investors, basically through Robinhood (nonetheless furthermore all across the enviornment,) actively piled in, making an attempt to search out GME shares aggressively within the hope that it may perchance perchance force the hedge funds to shut their shorts at greater costs and trigger a short squeeze. This tactic did inflict important losses on some hedge funds, despite the truth that many had the monetary buffer to soak up these losses.

The shortcoming of right-time short-hobby reporting extra sophisticated issues. Hedge funds were ready to shut their short positions with out the recommendations of retail investors, perpetuating the short squeeze account and leaving it unclear whether all short positions indulge in basically been covered.

Additional, as many investors entered the fray above $100, they weren’t as impressed with the 2x or 3x manufacture bigger in imprint. Within the raze, from the $3 fashioned imprint level to where it peaked sooner than Robinhood was off aquire orders, GME rallied round 11,000% in a pair of months.

For all intents and functions, GME had a massive short squeeze, followed by a extra 700% secondary squeeze a pair of months later.

But, to on the moment, there are investors on Reddit who’re adamant that the shorts indulge in peaceable no longer been covered, and a MOASS that will steal GME costs over $1 million is on the horizon.

Now, how does this portray to Bitcoin?

Bitcoin’s mother of all offer squeezes.

Bitcoin and GameStop vary in many methods. Within the raze, GameStop is a frail fairness that became being bullied out of existence by TradFi, whereas Bitcoin is a resolution to the inherent issues of TradFi as an entire.

However, GameStop, namely GME, represented a equivalent ethos at one level in its historical past. Forward of it was the poster child for ‘meme’ shares, to many, GME became about unifying retail investors against ‘the man.’ It became a capacity to fight wait on against company greed, devouring everything in its route.

This supreme peaceable drives those of r/superstonk or whatever basically the latest subreddit is for the die-exhausting GME diamon hands. However, in my peep, whereas that’s now nonetheless a mere erroneous dream, there is an exact opportunity with Bitcoin for an true MOASS.

The chart below highlights some key aspects of the GameStop and Bitcoin comparability. The foremost drivers are the halving, Bitcoin ETF inflows, and scarce offer.

| GameStop | Bitcoin |

|---|---|

| High short hobby | Majority of BTC in private chilly storage |

| Retail purchases decrease offer | ETFs open and aquire Bitcoin |

| Build manufacture bigger to screen shorts | ETF search details from outpaces offer |

| 5 million new shares issued worth $1.2 billion | Mounted issuance per block |

| Unlimited offer of shares | Mounted offer of Bitcoin |

| Build falls as shorts screen | Build increases after halving |

| Build falls as shares diluted | Build increases as offer dries up |

Bitcoin’s mounted offer contrasts starkly with GameStop’s ability to wretchedness more shares, which came about six months after the short squeeze. Bitcoin’s exiguous offer and extending inflows into Bitcoin ETFs suggest a looming offer squeeze. This may perchance mirror the GameStop converse nonetheless in a diversified, Bitcoin-particular context.

In incompatibility, the Bitcoin market operates with bigger transparency, attributable to blockchain abilities. This brings us to the relevance of this comparability to Bitcoin. Now not like GameStop, which would perchance wretchedness more shares, Bitcoin has a strictly exiguous offer. With basically the latest price of inflows into Bitcoin ETFs, a offer squeeze is becoming more and more likely. This converse may perchance perchance parallel the GameStop short squeeze nonetheless in a diversified context.

Stipulations required for a offer squeeze.

Distinct stipulations desires to be met for such a Bitcoin offer squeeze.

First, the power inflow into Bitcoin ETFs is required. The latest addition of Bitcoin ETFs into diversified funds is a astronomical signal of this enduring.

Secondly, Bitcoin holders must switch their holdings into chilly storage, making it inaccessible to over-the-counter (OTC) desks.

Now not like frail brokerages, platforms fancy Coinbase can’t merely lend out Bitcoin as it’s no longer commingled, offering a layer of security against such practices. However, basically the latest outflows from Grayscale blow their private horns that there may perchance be peaceable huge liquidity within the marketplace for fundamental gamers fancy BlackRock, Bitwise, Fidelity, and ARK to aquire Bitcoin.

The converse may perchance perchance shift dramatically if the Original child 9 ETFs amass holdings within the vary of $30-40 billion every. Alive to by that approximately 2.3 million Bitcoins are on exchanges and about 4.2 million are liquid and on a fashioned basis traded, a fundamental half of Bitcoin may perchance perchance furthermore very successfully be absorbed or turn out to be illiquid. If the sort in the direction of storing Bitcoin in chilly storage continues and shopping and selling diminishes, the on hand Bitcoin for OTC desks may perchance perchance decrease markedly.

Could perchance perchance perchance furthermore merely peaceable ETFs persist in shopping Bitcoin, and particular person customers proceed to aquire and store it in chilly storage, shall we look a considerable upward thrust in Bitcoin costs within 18 months attributable to diminishing market availability. This converse may perchance perchance urged ETFs to aquire at greater costs, elevating questions in regards to the sustainability of search details from for these ETFs at elevated Bitcoin valuations.

Bitcoin in chilly storage vs GameStop ComputerShare.

The coolest GameStop HODLers transferred their GME shares to Computershare to reside shares from being lent out for shorting, a lot like putting Bitcoin in chilly storage. They did this to strive to restrict offer. However, this didn’t reside the GameStop board from issuing more shares, which is able to never happen with Bitcoin.

Thus, the market may perchance perchance behold a fundamental shift if the kind of transferring Bitcoin to chilly storage accelerates, coupled with power ETF purchases. About 4.2 million Bitcoins on the moment are idea about liquid and on hand for fashioned shopping and selling. However, if this liquidity decreases through reduced shopping and selling exercise or increased storage in chilly wallets, the availability accessible to over-the-counter (OTC) desks may perchance perchance diminish all straight away.

This doable shortage raises curious eventualities. Could perchance perchance perchance furthermore merely peaceable ETFs proceed their making an attempt to search out spree, and retail customers furthermore encourage shopping Bitcoin, directing it into chilly storage, we may perchance perchance furthermore very successfully be on the cusp of a fundamental offer squeeze. Per latest details, if inflow rates remain fixed, this convergence may perchance perchance furthermore happen as soon as next year, basically influenced by fundamental gamers fancy BlackRock making an attempt to search out from the on hand liquid offer. If retail customers steal away all Bitcoin from exchanges, there’s scope for it to happen sooner.

Pyschology of investors and momentum shopping and selling.

The total offer of Bitcoin that will also be idea about doubtlessly liquid is peaceable sizable, round 15 million. This kind that the aptitude offer at any imprint desires to be idea about, as even long-length of time HODLers may perchance perchance furthermore very successfully be convinced to promote at costs above the final all-time high. Whereas it’s no longer a guaranteed consequence, the chance is curious.

The psychology of retail investors, already confirmed important in cases fancy GameStop, may perchance perchance furthermore play a actually remarkable role in Bitcoin’s converse. The recommendation to ‘HODL,’ aquire Bitcoin, and invest in ETFs may perchance perchance resonate strongly with investors who portion this mindset.

Notably, the enchantment of Bitcoin ETFs lies partly in their affordability and accessibility; they are priced remarkable lower than an accurate Bitcoin, making them beautiful to a broader target market. This psychological aspect, equivalent to the perceived affordability of tokens fancy Shiba Inu or Dogecoin, may perchance perchance power investor habits toward Bitcoin ETFs.

Within the raze, the parallels between the GameStop saga and the aptitude offer dynamics within the Bitcoin market are putting. The mixed enact of continued purchases by ETFs and the kind of Bitcoin holders transferring their assets to chilly storage may perchance perchance furthermore lead to a ‘mother of all offer squeezes’ within the Bitcoin market. Whereas varied elements are at play, and the end result is no longer inevitable, the aptitude for a fundamental shift within the Bitcoin market is an thrilling prospect. As the problem unfolds, it’ll be attention-grabbing to see how the interaction of retail investor psychology, ETF inflows, and Bitcoin’s remarkable offer characteristics shapes the market.

Source credit : cryptoslate.com