FCA to wait till 2026 to launch official crypto policy with 12% of UK owning digital assets

FCA to support till 2026 to launch legit crypto coverage with 12% of UK owning digital resources

FCA to support till 2026 to launch legit crypto coverage with 12% of UK owning digital resources FCA to support till 2026 to launch legit crypto coverage with 12% of UK owning digital resources

As nearly 1 in 8 adults merit crypto, the FCA outlines steps to handbook the UK toward a regulated crypto future.

Quilt art/illustration via CryptoSlate. Picture consists of mixed whisper that would include AI-generated whisper.

Crypto possession in the UK has increased to 12% of adults, up from 10%, in step with the Monetary Habits Authority’s (FCA) latest compare revealed on Nov. 26. Awareness of cryptocurrencies furthermore grew, reaching 93% of the adult inhabitants.

The FCA’s watch revealed that the everyday designate of crypto holdings per particular person rose from £1,595 to £1,842. Family and company emerged because the most overall source of information for of us who have never purchased digital resources, whereas supreme one in ten investors admitted to doing no compare before investing.

Approximately a 3rd of respondents believed they would maybe perchance maybe file a complaint with the FCA in case of considerations, in the hunt for recourse or financial safety. Alternatively, digital resources dwell largely unregulated in the UK and are idea to be as excessive-chance; investors are cautioned that they would maybe perchance maybe lose all their money with none regulatory safeguards.

FCA crypto plot hampering growth

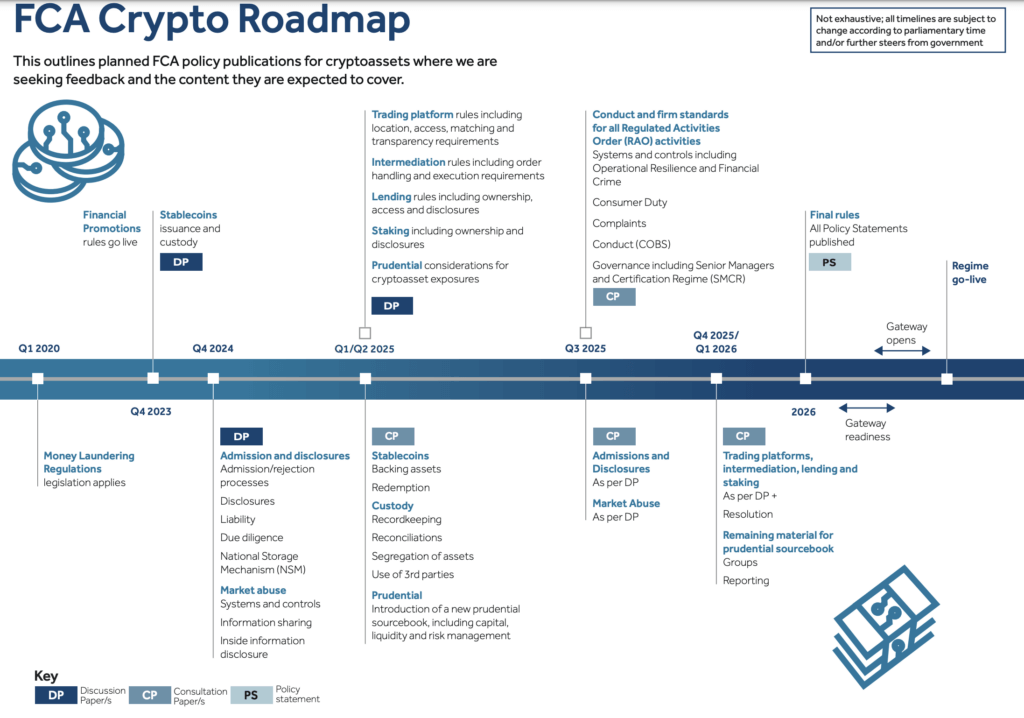

The FCA has begun outlining its plot to regulating digital resources, publishing an indicative roadmap of key dates for the building and introduction of the UK’s crypto regulatory regime. The roadmap well-known aspects a series of centered consultations aimed at fostering transparency and engagement in coverage building.

Arun Srivastava, fintech and regulation partner at Paul Hastings, told CryptoSlate

“The UK used to be in hazard of becoming an outlier, with the EU’s MiCA regulation coming into elephantine force on the stop of this year and the change in the US Administration in the US heralding a original and crypto-friendly plot in the US.

The brand new suggestions will materially change the present regulatory framework in the UK, which operates below anti-money laundering guidelines centered on financial crime.”

The compare furthermore indicated shifts in user conduct. Extra individuals are pondering crypto as allotment of a broader investment portfolio, with influence from family and company cited as a predominant trigger of buy by 20% of participants. The use of lengthy-interval of time financial savings to buy crypto increased from 19% in 2022 to 26% in 2024, whereas purchasing with credit cards or overdrafts rose from 6% to 14% over the the same interval.

The FCA’s analysis suggests that latest events have affected user set a query to for digital resources, at the side of the crypto market wreck in 2022, the cost-of-living crisis, criminal charges against CEOs of most most distinguished exchanges, and rising crypto valuations for the rationale that stop of 2023.

Notably, 26% of non-crypto users indicated they would maybe perchance maybe be more liable to make investments if the market and activities were regulated. The FCA acknowledges that regulation can influence user conduct and is pondering mitigate risks associated with digital resources thru its coverage work.

FCA crypto roadmap by 2026

Per the FCA’s roadmap, the deliberate regulatory framework for digital resources consists of more than one phases spanning from 2023 to 2026. Key milestones involve implementing financial promotion suggestions, regulating stablecoin issuance and custody, introducing prudential requirements, and setting up comprehensive suggestions for trading platforms, intermediation, lending, and staking.

Matthew Prolonged, director of funds and digital resources on the FCA, stated:

âOur compare results highlight the need for positive regulation that supports a catch, aggressive, and sustainable crypto sector in the UK. We desire to build a sector that embraces innovation and is underpinned by market integrity and user trust.”

Following legislative changes, the FCA has been accountable for regulating digital asset promotions since October 2023. Within the first year below this regime, the FCA has issued 1,702 indicators, taken down over 900 rip-off crypto internet sites, and eradicated more than 50 apps to combat illegal promotions focusing on UK customers.

Source credit : cryptoslate.com

Farside Merchants

Farside Merchants