Ethereum, Solana see gains as Bitcoin’s rally above $50,000 causes $184 million liquidations

Bitcoin’s surge previous $50,000 catalyzed a broader market upswing, propelling a big quantity of clear-cap different digital sources equivalent to Ethereum (ETH), Solana (SOL), and others to major gains.

In response to data from CryptoSlate, Ethereum seen a 7% uptick, reaching $2,661, while SOL surged 8% to hit $114. Amongst the finish 10 digital sources, Avalanche’s AVAX spiked 6% to $41, Cardano’s ADA rose by 3.74% to $0.5574, while BNB Coin (BNB) and Ripple’s XRP experienced more modest gains, every mountain climbing by decrease than 3%.

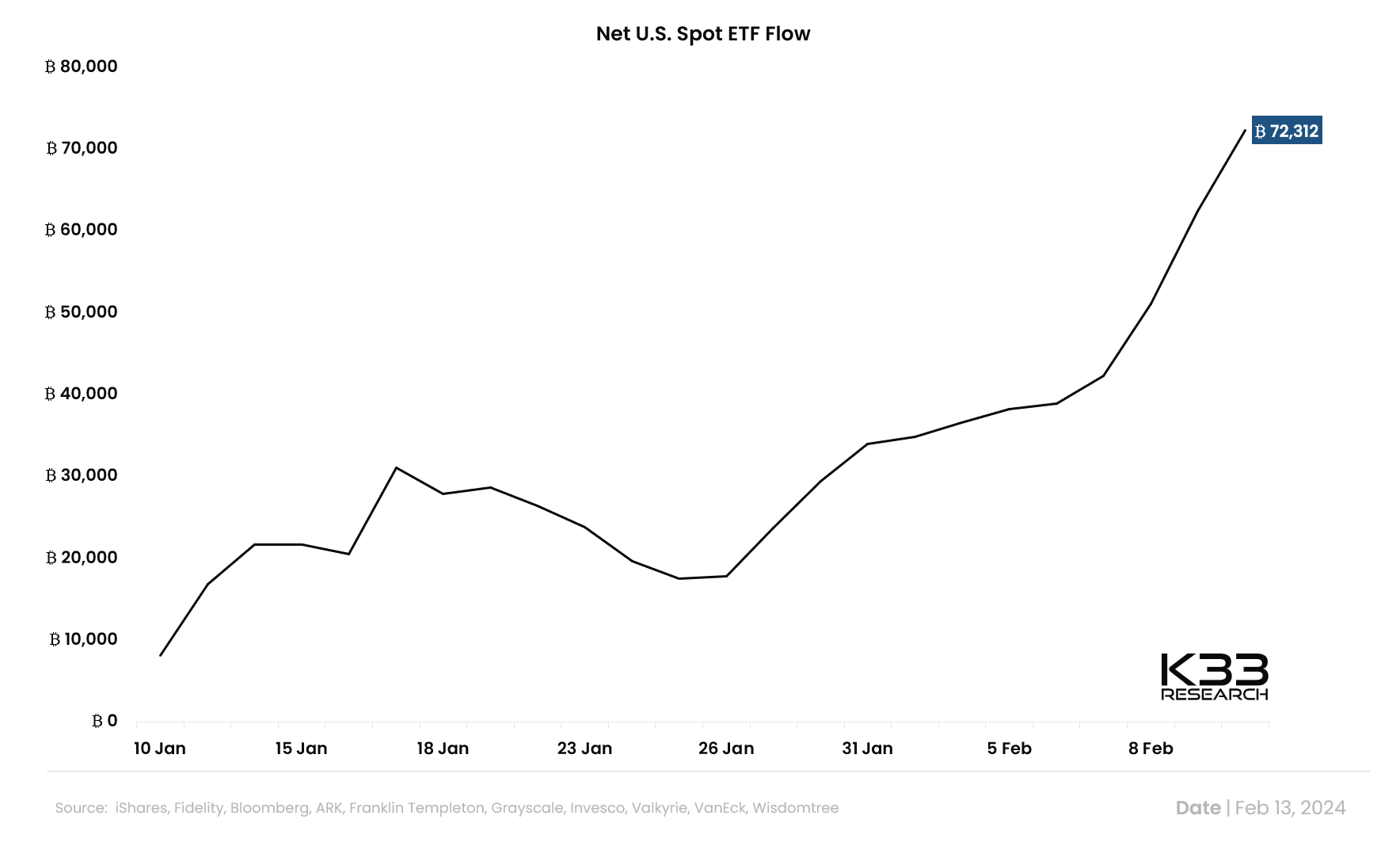

Market analysts attribute this bullish pattern to the buzz surrounding the more than one build Bitcoin commerce-traded funds (ETFs) in the US. Vetle Lunde, a senior analyst at K33 Compare, smartly-known that inflows into these ETFs have remained noteworthy bigger than a month after their begin.

“The day outdated to this seen a win influx of 9,870 BTC, pushing the win U.S. build ETF float since begin to 72,312 BTC. The unusual 9 now have 228,000 BTC,” Lunde added.

For the length of the day past, BTC’s be conscious crossed the $50,000 threshold for the predominant time since dull 2021. The finish crypto’s be conscious has risen 4.2% to $50,146 as of press time, extending a certain bustle that had considered it own 16% over the final week.

$184 million in liquidation

The broader crypto market rally resulted in a big liquidation totaling over $184 million from bigger than 56,000 merchants, based mostly on Coinglass data.

Rapid merchants, or speculators betting against be conscious increases, bore losses amounting to $134 million, while long merchants betting on be conscious increases misplaced roughly $50 million.

Across sources, Bitcoin led the liquidation charts with a complete lack of $69.80 million. Rapid Bitcoin merchants accounted for $55.04 million in losses, while long merchants misplaced $14.76 million. Ethereum followed carefully, contributing $39.85 million to the total liquidation.

Other sources indulge in Solana, LINK, and ORDI also experienced liquidations of $10.14 million, $5.93 million, and $4.81 million, respectively.

Across exchanges, Binance witnessed the best seemingly proportion of liquidations at 43.13%, totaling $Seventy 9.42 million. Other platforms indulge in OKX and ByBit recorded liquidations of $58.29 million and $18.73 million, respectively.

Notably, the major liquidation express took place on Bitmex for LINKUSD, amounting to $3.14 million.

Source credit : cryptoslate.com