Crypto Dad Giancarlo dismisses SEC chair rumors, critiques Gensler’s legacy

Crypto Dad Giancarlo dismisses SEC chair rumors, opinions Gensler’s legacy

Crypto Dad Giancarlo dismisses SEC chair rumors, opinions Gensler’s legacy Crypto Dad Giancarlo dismisses SEC chair rumors, opinions Gensler’s legacy

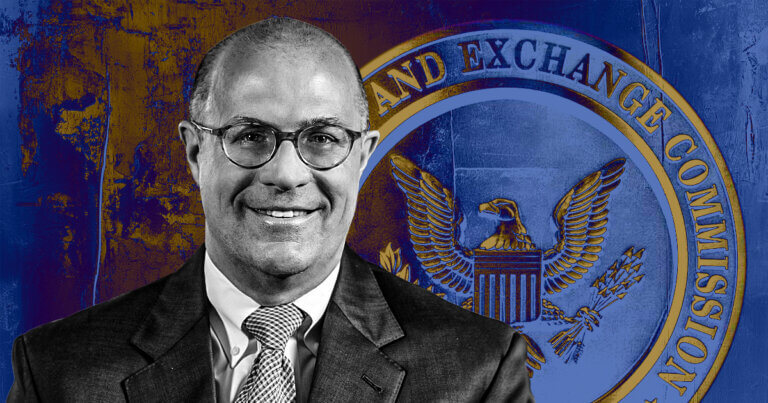

Outdated college CFTC Chair Christopher Giancarlo acknowledged he's not among the names actually apt to be the subsequent SEC chief.

Conceal art work/illustration by job of CryptoSlate. Image entails combined whisper material which might perhaps well consist of AI-generated whisper material.

Outdated college Commodity Futures Trading Price (CFTC) Chair Christopher Giancarlo denied rumors about being actually apt as the subsequent Chair of the US Securities and Alternate Price (SEC).Â

He moreover denied the rumors about being in a crypto-connected feature within the US Treasury Department, adding:Â

âIâve made sure that Iâve already cleaned up earlier Gary Gensler mess [at] CFTC and donât are looking out to dangle enact it again.â

Even supposing he did not specify, the âmessâ is at possibility of be connected to the SEC’s “regulation by enforcement potential” in direction of the crypto commerce, which one among its Commissioners deemed a “catastrophe.”

Giancarlo took over as CFTC chair in August 2017, over three years and two terms after fresh SEC Chair Gary Gensler left the feature.Â

Giancarlo is moreover ceaselessly referred to as âCrypto Dadâ due to his pleasant stance in direction of this commerce in the US since 2018 when he talked about that âcryptocurrencies are here to place.â In 2021, the passe CFTC chair printed an autobiography that entails his relieve for crypto.

He's at indicate serving as an advisor for the US Digital Chamber of Commerce.

Justified and fundamental

Gensler not too long ago defended the SEC’s potential for the duration of a speech on the Practising Regulation Institute’s 56th annual conference on securities regulation, essentially based totally on a CNBC document.

Gensler highlighted that whereas Bitcoin just isn't a security, a appreciable collection of the 10,000 assorted digital resources in circulation seemingly qualify as securities beneath US law.Â

He extra argued that this classification areas them squarely beneath SEC regulation, reinforcing the need for sellers and intermediaries to register to offer protection to traders and uphold market integrity.

Moreover, the SEC Chair described the regulator’s vigilance as the largest to prevent “fundamental investor harm,” citing conditions the save poorly policed digital resources had did not repeat lasting utility or steadiness.Â

He warned that the sector’s lax regulatory oversight uncovered traders to dangers, suggesting that the SEC’s tricky stance used to be justified and fundamental to offer protection to the public.

Since Gensler took the helm in 2021, the SEC has pursued loads of lawsuits in opposition to crypto corporations, along side predominant exchanges delight in Kraken, Binance, Ripple, and Coinbase. Many within and with out the commerce dangle criticized the regulator’s actions and train that it has did not offer regulatory clarity for the commerce.

Mentioned listed here

Source credit : cryptoslate.com

CryptoQuant

CryptoQuant

Farside Traders

Farside Traders