Ethereum ecosystem treasuries top $22 billion, with resources poised to support network’s future growth

Ethereum ecosystem treasuries top $22 billion, with resources poised to make stronger network’s future divulge

Ethereum ecosystem treasuries top $22 billion, with resources poised to make stronger network’s future divulge Ethereum ecosystem treasuries top $22 billion, with resources poised to make stronger network’s future divulge

Ethereum Basis prioritizes integrity with fresh protection following most unusual advisory scheme controversies.

Quilt artwork/illustration by strategy of CryptoSlate. Image contains blended exclaim material that would possibly per chance consist of AI-generated exclaim material.

The Ethereum Basis (EF), a nonprofit supporting Ethereum’s blockchain ecosystem, has released its 2024 annual tale detailing financial updates, treasury holdings, and most unusual protection initiatives.

The tale highlighted the organization’s funds breakdown, spending from most unusual years, and fresh insurance policies designed to foster transparency and integrity across the Ethereum ecosystem.

Treasury keeping

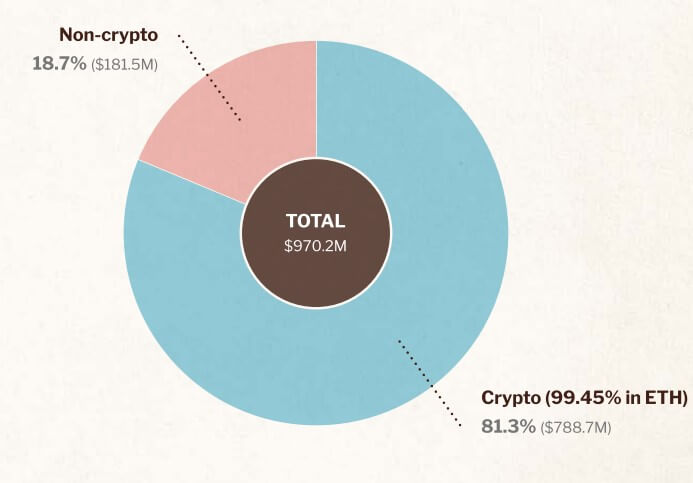

As of Oct. 31, 2024, the EF’s treasury totaled roughly $970.2 million, comprising $788.7 million in cryptoâbasically ETHâand $181.5 million in non-crypto investments.

EF’s acknowledged its ETH holdings relate around 0.26% of Ethereum’s total present as of Oct. 31. These enormous ETH reserves replicate the Basis’s self belief in Ethereum’s prolonged-time duration doubtless and its dedication to inserting forward a sturdy presence throughout the network.

The EF clarified that its treasury serves as a financial backbone for terribly fundamental tasks throughout the Ethereum ecosystem. The Basis periodically converts a a part of its ETH holdings to fiat currency, especially throughout market upswings, to be definite that ample resources throughout market downturns.

Ecosystem treasury

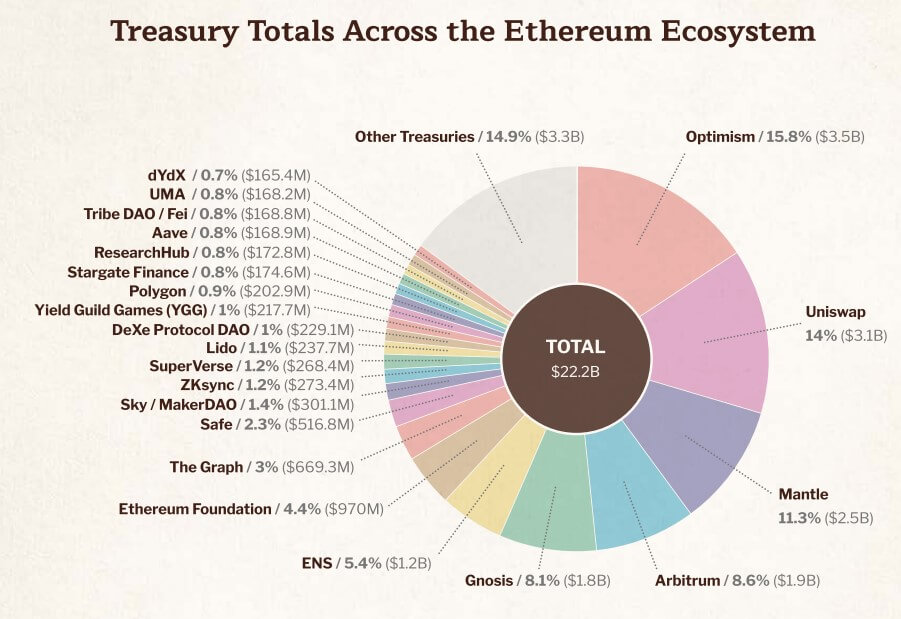

Beyond EF’s holdings, Ethereum’s ecosystem benefits from over $22 billion in blended treasury resources held by varied foundations, organizations, and DAOs.

The treasuries basically comprise the native tokens of crypto tasks cherish dYdX, Aave, Polygon, The Graph, Optimism, Uniswap, Mantle, Arbitrum, Lido, Gnosis, and the Ethereum Title Carrier.

The story emphasizes that even a little allocation from these treasuries would offer fundamental resources to retain and develop the Ethereum ecosystem over the prolonged time duration.

Ecosystem funding

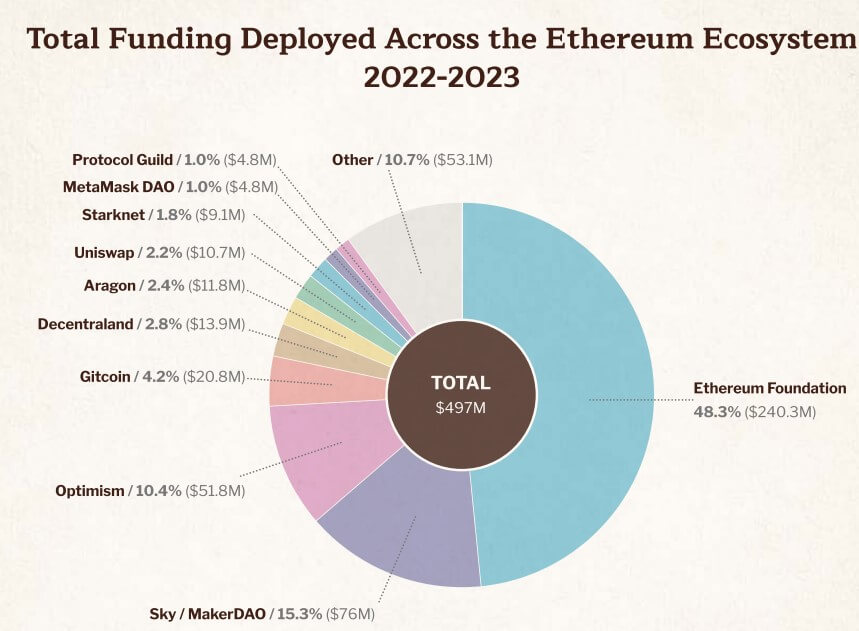

The Ethereum Basis and ecosystem companions allocated in relation to $500 million to ecosystem tasks across 2022 and 2023.

EF contributed $240.3 million (Forty eight.3% of total funding), with the last make stronger from organizations cherish MakerDAO (rebranded as Sky), Optimism, Gitcoin, Decentraland, Aragon, Uniswap, Starknet, MetaMask DAO, and Protocol Guild.

This collective funding emphasizes the collaborative nature of Ethereum’s ecosystem, driving innovation and make stronger for builders throughout the community.

EF Director Aya Miyaguchi emphasized that this funding system parallels Ethereum’s decentralized analysis and pattern processes, which relief collaboration and useful resource-sharing tasks. She acknowledged:

“Proud to claim that ecosystem funding is a shared effort as of late, unparalleled cherish Ethereumâs R&D project, which helps builders across the Ethereum ecosystem bag extra paths to relieve innovating.”

Warfare of curiosity protection

To make stronger its transparency, the Ethereum Basis has implemented a battle of curiosity protection, mandating disclosure for investments e to make stronger its transparency exceeding $500,000 (with the exception of ETH).

The protection targets to stop doubtless conflicts amongst EF members by with the exception of them from relevant choices if they are highly uncovered to related resources. Miyaguchi explained that this transfer represents a step toward improving integrity within EF and the broader Ethereum ecosystem.

It is especially prescient pondering Ethereum Basis researchers fair no longer too prolonged within the past came under fireplace for taking advisory roles with restaking protocol EigenLayer.

Talked about in this article

Source credit : cryptoslate.com

Farside Traders

Farside Traders

CryptoQuant

CryptoQuant

Chainalysis

Chainalysis

CoinGlass

CoinGlass