Circle CEO sees stablecoins as linchpin for global trade

Circle CEO sees stablecoins as linchpin for world change

Circle CEO sees stablecoins as linchpin for world change Circle CEO sees stablecoins as linchpin for world change

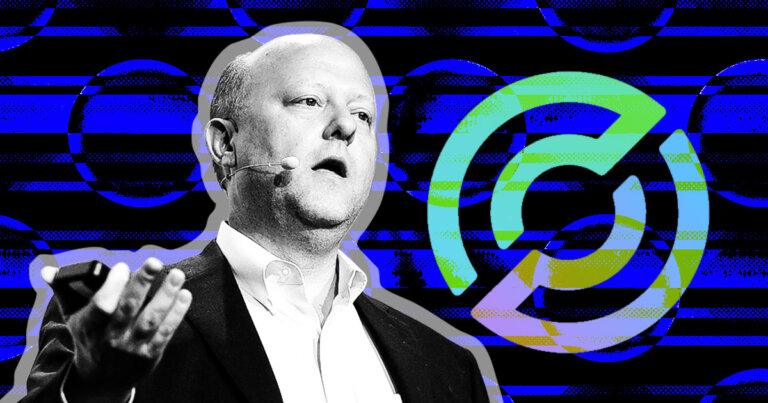

Circle CEO Jeremy Allaire talked about stablecoins absorb the aptitude to streamline unhealthy-border change and force efficiencies in rising markets.

Veil art/illustration by skill of CryptoSlate. Image involves combined sigh material that would include AI-generated sigh material.

Circle CEO Jeremy Allaire talked about stablecoins are poised to turn into essential monetary instruments worldwide attributable to their ability to streamline unhealthy-border change and force efficiencies in rising markets, South China Morning Post reported.

Speaking on the Hong Kong FinTech Week 2024 on Nov. 5, Allaire positioned stablecoins, particularly USDC, as a extremely essential element in modernizing world change settlements, envisioning them because the inspiration for “greater, sooner, more cost effective” monetary transactions.

Attempting out ground

Allaire highlighted that many importers in constructing areas already depend upon Hong Kong to resolve change flows, making town a extreme trying out ground for stablecoin solutions.

He talked about:

“Stablecoins are reshaping monetary infrastructure, allowing change settlements that decrease friction and costs.”

Circle, web web build hosting its inaugural Circle Forum in Hong Kong, marked the occasion by announcing two key partnerships: an settlement with Hong Kong Telecom (HKT) to explore blockchain-based mostly mostly loyalty packages and a collaboration with Thunes to utilize USDC for unhealthy-border transactions.

The initiatives are segment of Circle’s commitment to leveraging stablecoins for functional applications in change and commerce.

Whereas this three hundred and sixty five days’s FinTech Week primarily targeted on synthetic intelligence and tokenization, stablecoins and central bank digital currencies (CBDCs) emerged as dominant topics shaping Hong Kong’s Web3 design.

With the Hong Kong Monetary Authority popularity to concern original stablecoin laws by the live of the three hundred and sixty five days, Circle’s skill displays its readiness to follow regulatory frameworks globally.

Allaire emphasized the firm’s location as a responsible, compliant entity within the evolving digital finance landscape, pointing out:

“We were a regulated player from the birth and depend upon stablecoins to turn into integral monetary infrastructure worldwide.”

Stablecoin Adoption

In accordance to Allaire, Hong Kong’s role as a world change hub has made it an good surroundings for stablecoin adoption. Town’s uncommon regulatory surroundings and worldwide monetary connections location it on the forefront of stablecoin experimentation and deployment.

Nonetheless, the Circle CEO acknowledged that the firm’s operations would live restricted in mainland China attributable to strict laws prohibiting commercial crypto activities. As another, he predicted a sturdy “offshore stablecoin” market to toughen seamless currency change and offers a enhance to unhealthy-border transaction efficiencies.

Allaire also suggested that essential expertise corporations esteem Ant Community or Tencent Holdings entering the stablecoin market might perhaps presumably well also extra bolster stablecoin use. He talked about such developments would seemingly complement Circle’s efforts, constructing a various, interoperable landscape that helps digital commerce across borders.

He acknowledged:

“A broader stablecoin ecosystem inviting these corporations would enlarge our shared goal of creating world monetary infrastructure that might perhaps presumably meet the requires of well-liked change and digital economies.”

Talked about listed here

Source credit : cryptoslate.com

Farside Investors

Farside Investors

CoinGlass

CoinGlass