BlackRock’s Bitcoin ETF becomes fastest-growing in history with $30B milestone

BlackRock’s Bitcoin ETF turns into fastest-increasing in ancient past with $30B milestone

BlackRock’s Bitcoin ETF turns into fastest-increasing in ancient past with $30B milestone BlackRock’s Bitcoin ETF turns into fastest-increasing in ancient past with $30B milestone

BlackRock's Bitcoin ETF is heading within the suitable route to amass 500,000 Bitcoin earlier than the extinguish of the year.

Duvet artwork/illustration through CryptoSlate. Image entails mixed negate material that would possibly perchance perhaps consist of AI-generated negate material.

BlackRock’s iShares Bitcoin Belief ETF (IBIT) has change into the fastest-increasing ETF in ancient past, exceeding $30 billion in resources beneath management.

Primarily based mostly on Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, IBIT reached this milestone in precisely 293 days, environment a brand recent document. This dash surpasses the JPMorgan Fairness Top price Profits ETF (JEPI) and main Gold ETFs’ growth charges, reaching the $30 billion threshold in 1,272 days and 1,790 days, respectively. CryptoSlate predicted the ETF’s efficiency would outpace Gold ETFs in January.

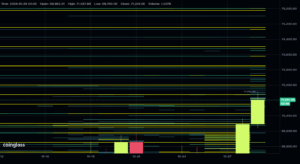

Bloomberg records exhibits that IBIT’s market valuation crossed $30 billion following tall inflows and Bitcoin’s note appreciation on Oct. 29. The fund currently holds bigger than 417,000 Bitcoin, representing about 2% of the total Bitcoin offer.

Bitcoin community member Sani noticed that BlackRock’s IBIT would possibly perchance perhaps pick up as a lot as 500,000 Bitcoin by the extinguish of 2024 if its most up-to-date growth continues. If accomplished, this would possibly perchance perhaps assemble IBIT the third-greatest Bitcoin holder worldwide, following handiest Coinbase and Binance.

Rising institutional request

The success of BlackRock’s ETF aligns with a surge in institutional request for Bitcoin.

As of Oct. 29, the ETFs cumulatively reported a day-to-day secure influx of $870 million, with BlackRock’s IBIT leading the poke alongside with the circulate. Other leading funds are also experiencing sturdy hobby, with Constancy’s FBTC receiving $133.86 million in secure inflows, while Bitwise’s BITB attracted $52.49 million.

Meanwhile, VanEck’s HODL, Ark, and 21Shares’ ARKB recorded inflows of $16.52 million and $12.39 million, respectively. The final space Bitcoin ETFs saw no inflows on that day.

Nate Geraci, president of the ETF Retailer, highlighted that this level of influx marks the third-best day-to-day influx for space Bitcoin ETFs since their originate in January.

Primarily based mostly on be taught firm CryptoQuant, these spectacular numbers replicate a broader pattern of institutional hobby in Bitcoin.

Ki Young Ju, the firm’s founder and CEO, famed that over the last year, about 278,000 BTCâprimarily from retail investorsâflowed into US space ETFs.

All around the same duration, roughly 670,000 BTC moved into “whale” wallets conserving over 1,000 BTC, moreover those on exchanges and mining pools. Ju defined that this pattern indicates institutional request in custodial wallets is roughly double that of retail investors.

This surge highlights the rising characteristic of institutional investors within the Bitcoin market, with main funds love BlackRock’s IBIT environment the dash.

Talked about in this text

Bitcoin

Bitcoin  BlackRock

BlackRock  Constancy Investments

Constancy Investments  Ark Make investments

Ark Make investments  ARK 21Shares Bitcoin ETF

ARK 21Shares Bitcoin ETF  iShares Bitcoin Belief

iShares Bitcoin Belief  Constancy Wise Starting attach Bitcoin Belief

Constancy Wise Starting attach Bitcoin Belief  Eric Balchunas

Eric Balchunas

Source credit : cryptoslate.com

CryptoQuant

CryptoQuant

Farside Traders

Farside Traders