Celestia’s token unlock could unleash $460 million selling pressure

Celestia’s token liberate could well unleash $460 million promoting stress

Celestia’s token liberate could well unleash $460 million promoting stress Celestia’s token liberate could well unleash $460 million promoting stress

Celestia's token liberate could well lead to cost swings, but preparations in OTC markets could well provide a counterbalance.

Camouflage art work/illustration by CryptoSlate. Image entails blended enlighten material which could well consist of AI-generated enlighten material.

Celestia’s native token, TIA, is arena for a fundamental circulate lately because it undergoes a fundamental token liberate tournament that might perhaps add approximately 175 million tokens to its circulationâwith regards to doubling the existing provide.

Per Tokenomist, this colossal develop represents 80% of essentially the newest circulating tokens, equating to around $900 million in line with the asset’s newest designate of $5. This liberate marks a actually noteworthy single unlocking tournament since TIA’s delivery final October.

The liberate basically targets rewarding early contributors and merchants within the finishing up. Core Contributors are expected to receive 58 million tokens (valued at $298 million), whereas seed merchants will be triumphant in 52 million tokens (rate $268 million).

Early backers from Celestia’s Series A and B funding rounds could also carry out 65 million tokens, valued at $332 million.

In crypto initiatives, locking tokens by vesting classes is a overall contrivance to stabilize market costs by stopping early gross sales by merchants, team participants, and insiders. These classes on the total extend as much as a three hundred and sixty five days, gradually releasing tokens to ease stress on the asset’s designate. But, trim token unlocks continuously introduce volatility and downward designate stress.

$460 million promoting stress

In Celestia’s case, some speculate that this tournament could well introduce as much as $900 million in capacity promote stress.

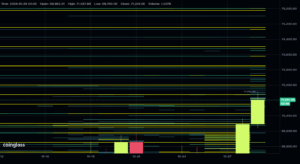

On the opposite hand, Taran Sabharwal, founder of the OTC trading platform STIX, identified that the actual promoting stress could well very successfully be a ways decrease as most attractive 92.3 million TIA is in overall in circulation, with a most promoting stress closer to $460 million.

Per him:

“TIA has a 21-day unstaking length, and individuals that wished their TIA unlocked for trading on Oct 31 have already unstaked. The sum of non-staked tokens, tokens within the 21-day unstaking queue and approx. 24.1 million unaccounted tokens equals 92.3M TIA. This equates to a max promoting stress of ~$460 million.”

He emphasised that this figure represents decrease than 50% of the cliff liberate, suggesting the actual affect will more than likely be lighter than anticipated.

Sabharwal additional acknowledged that tons of these newly unlocked tokens had already been sold to OTC merchants who, in anticipation, had hedged positions in perpetual futures markets. This strategic hedging has led to excessive open ardour in newest months, with expectations that tons of these short positions will unwind. This is able to well perhaps partly offset space-promoting stress, signaling a capacity bullish opportunity for space merchants.

Source credit : cryptoslate.com

CryptoQuant

CryptoQuant

Farside Investors

Farside Investors