Bitcoin expected to face high volatility as ‘Trump trade’ and Q4 seasonality converge – Bitfinex

Bitcoin expected to face high volatility as ‘Trump switch’ and Q4 seasonality converge â Bitfinex

Bitcoin expected to face high volatility as ‘Trump switch’ and Q4 seasonality converge â Bitfinex Bitcoin expected to face high volatility as ‘Trump switch’ and Q4 seasonality converge â Bitfinex

Bitcoin acting as a "Trump switch" and signs of a seemingly get fourth quarter counsel high volatility is on the horizon.

Hide artwork/illustration through CryptoSlate. Image involves combined state that can also simply encompass AI-generated state.

Bitcoin (BTC) is determined for turbulent weeks forward, with election uncertainty, the “Trump switch” legend, and historically favorable fourth-quarter prerequisites growing a “splendid storm” for market circulation, in step with primarily the latest âBitfinex Alphaâ file.Â

The file said that within the lead-up to the US elections, Bitcoin has already demonstrated “whipsaw” put circulation following the 6% correction BTC underwent final week after impending $70,000.

Particularly, because the election date approaches, Bitfinex analysts request of volatility to accentuate, particularly given the broadly held inspect that a Republican victory would possibly simply boost markets whereas a Democratic get gifts more ambiguous implications.

Alternate choices markets are additionally affected

Option premiums and anticipated day-to-day volatility for the US inventory market and Bitcoin are projected to upward push as election results are expected spherical Nov. 6 and Nov. 8.Â

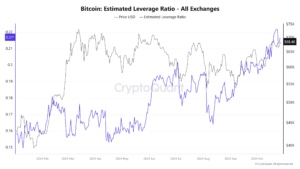

The file added that Bitcoin would possibly experience even greater volatility as traders weigh capability market shifts tied to the election consequence, especially if worn US president Donald Trump is election to arrangement of enterprise again as a result of his vocally supportive stance toward crypto.

Furthermore, the implied volatility (IV) curve shows heightened anticipation, with Bitcoin’s Nov. 8 strike prices suggesting IV ranges above 100 for alternate choices with strike prices over $100,000.

Excessive IV in total drives up option prices as sellers ask greater premiums to offset the probability of bright put moves. The file suggested that this elevated fee shows a cautious sentiment within the market, which is getting ready for mountainous put swings within the approaching weeks.Â

Alternate choices recount supports this sentiment. Over the past month, call alternate choices expiring in December with an $80,000 strike put obtain viewed notable hobby, hinting that market participants are positioning for capability put surges by yr-quit.

Q4 strength exhibiting signs

Despite latest corrections, Bitcoin shows signs of its capability strength within the fourth quarter, a historically bullish quarter, particularly in halving years. BTC is at the second up over 30% from September lows, marking a file-breaking 7.29% originate final month, a stark distinction to frequent September challenges.Â

Even supposing pre-election jitters would possibly simply mood October’s shut, ancient fourth-quarter gains, averaging 31.34%, dwell a hopeful indicator of bullish momentum. Bitcoin has no longer posted a bearish fourth quarter in any halving yr.

Furthermore, the “Trump switch” develop plays a essential role in Bitcoin’s fresh efficiency, with macroeconomic factors and rising having a bet odds favoring Trump’s re-election feeding market uncertainty.Â

The file cited latest files from RealClearPolitics and Polymarket, which places Trump’s victory likelihood at spherical 59% and 64.9%, respectively, fueling an already volatile market.

Talked about listed right here

Source credit : cryptoslate.com

CoinGlass

CoinGlass  CryptoQuant

CryptoQuant

Arkham Intelligence

Arkham Intelligence

Farside Patrons

Farside Patrons