Billionaire Paul Tudor Jones is ‘long’ on Bitcoin and gold to hedge against inflation

Billionaire Paul Tudor Jones is ‘lengthy’ on Bitcoin and gold to hedge against inflation

Billionaire Paul Tudor Jones is ‘lengthy’ on Bitcoin and gold to hedge against inflation Billionaire Paul Tudor Jones is ‘lengthy’ on Bitcoin and gold to hedge against inflation

Jones mentioned his trading approach is partially driven by the expectation that mature President Donald Trump will gain the US elections in November.

Camouflage art/illustration by technique of CryptoSlate. Checklist entails mixed shriek that could well consist of AI-generated shriek.

Billionaire hedge fund manager Paul Tudor Jones II printed that he's investing heavily in gold and Bitcoin (BTC) as he expects inflationary pressures will persist no topic who wins the 2024 US presidential election.

Speaking on CNBC’s “Scream Box” on Oct. 22, Jones emphasized his belief that inflation is inevitable and explained that his portfolio is now positioned for rising prices. He mentioned:

âI like all roads result in inflation. Iâm lengthy gold. Iâm lengthy Bitcoin. I like commodities are so ridiculously underneath-owned, so Iâm lengthy commodities.â

He also praised Bitcoin’s performance correct via the pandemic driven economic uncertainty in 2020. He added that he remains “lengthy” on Bitcoin, and his agency has also taken lengthy positions on the flagship crypto.

Jones mentioned his trading approach is partially driven by the expectation that mature President Donald Trump will gain the US elections in November.

The price of gold reached a new all-time high of $2747.40 on Oct. 22, representing a climb of over 37% this year. Meanwhile, BTC is priced at $67,154.65 as of now, up 52% in 2024, basically basically based on CryptoSlate details.

Jones highlighted that many young merchants have sought inflation hedges via tech-heavy investments esteem Bitcoin and the Nasdaq, a approach that has been successful amid market uncertainty.

Warding off mounted earnings

Amid inflation fears, Jones believes that the US will at last strive to inflate its manner out of mounting debt, which mirrors the historical trajectories of assorted heavily indebted countries.

The Congressional Funds Self-discipline of job (CBO) projects that deficits will upward push to $2.8 trillion by 2034, up from $1.8 trillion in fiscal 2024, with US debt anticipated to realize 122% of GDP by the identical year.

Jones believes the proposed tax cuts and spending from every predominant political candidates will extra gasoline inflation and result in greater passion rates.

Thus, the billionaire is rarely any longer optimistic about preserving mounted-earnings assets, pointing out:

âI'm clearly no longer going to private any mounted earnings, and Iâm going to be short the help pause of mounted earnings. On story of itâs correct entirely the heinous impress.â

Mentioned on this text

Source credit : cryptoslate.com

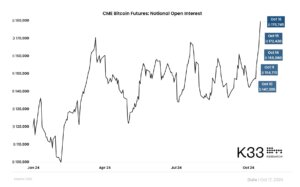

CoinGlass

CoinGlass

Dune Analytics

Dune Analytics

CryptoQuant

CryptoQuant