US drives North American crypto dominance despite regional stablecoin decline

US drives North American crypto dominance despite regional stablecoin decline

US drives North American crypto dominance despite regional stablecoin decline US drives North American crypto dominance despite regional stablecoin decline

Despite the high crypto exercise, stablecoin adoption on US-based totally totally exchanges contain plummeted all the plot throughout the previous year.

Hide art/illustration through CryptoSlate. Image involves mixed recount that would perhaps perhaps embody AI-generated recount.

North The united states has once extra claimed the prime order as the arena’s most important crypto market due to the increased institutional exercise within the US, in step with an Oct. 17 Chainalysis fable.

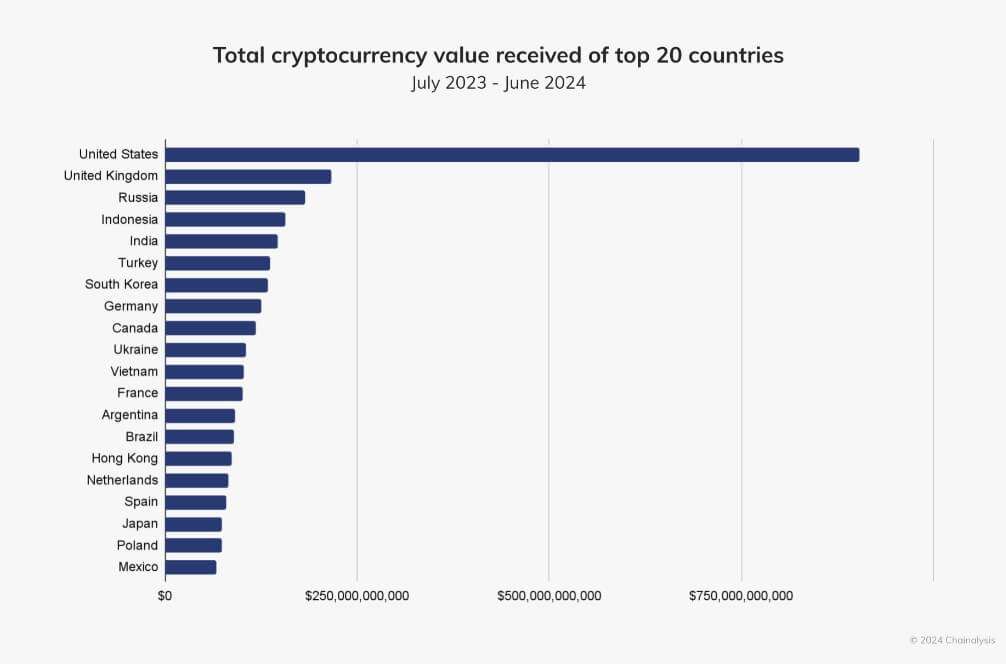

Between July 2023 and June 2024, North The united states generated $1.3 trillion in on-chain price, representing 22.5% of the worldwide total. Chainalysis credits this dominance to heightened institutional exercise, especially within the US, where paunchy-scale transactions exceeding $1 million fable for 70% of the space’s crypto transfers.

While the US leads the North American crypto landscape, Canada follows, with $119 billion in on-chain price all the plot throughout the identical interval.

US dominance

The US stays dominant in North The united states’s crypto market, primarily due to the important institutional activities round order Bitcoin and Ethereum alternate-traded funds (ETFs).

However, this leadership isn't very with out challenges. Chainalysis notes that the US market has been extra unstable than its global counterparts.

The fable acknowledged:

“In recent quarters, the U.S. has demonstrated heightened sensitivity to both bull and undergo markets. When cryptocurrency costs upward push, the U.S. market presentations better will increase in boost than the worldwide market â and the inverse is honest when cryptocurrency markets decline.”

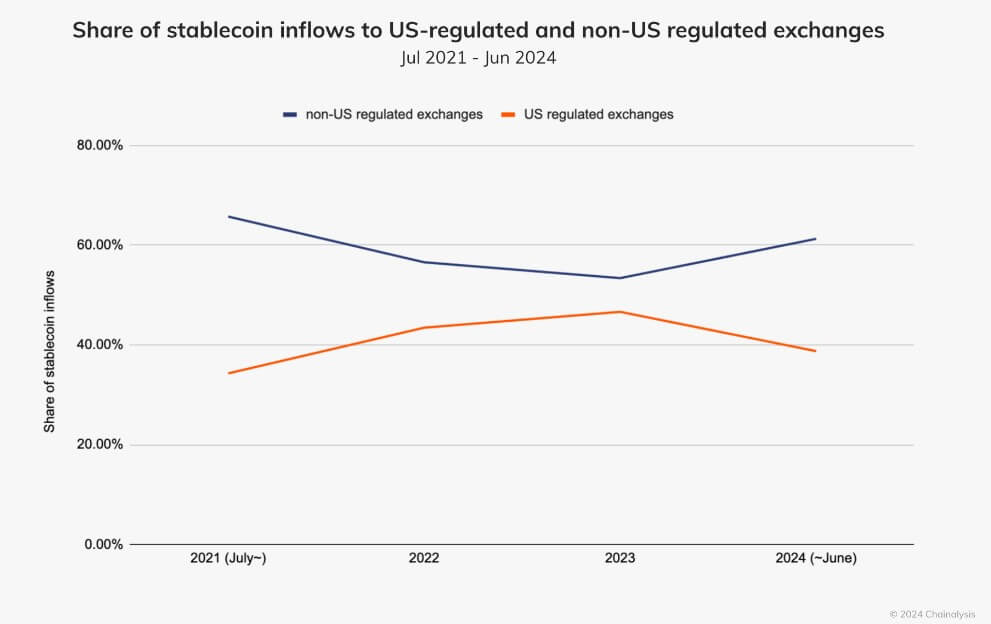

Even though crypto adoption has grown within the US, the nation has considered a spirited tumble in stablecoin holdings on exchanges. The fragment of stablecoin transactions on US-regulated exchanges fell from about 50% in 2023 to below 40% in 2024.

Chainalysis reported that this decline shall be linked to the regulatory uncertainty surrounding these digital property within the US. Circle, the issuer of the USDC stablecoin, has pointed out that unclear rules within the US contain brought on stablecoin projects to survey extra favorable environments in Europe and the UAE.

Stablecoin use rises exterior the US

In contrast, stablecoin transactions contain surged exterior the US, accounting for bigger than 60% of transactions in non-US markets by 2024.

This vogue is particularly stable in establishing markets, where stablecoins present users glean entry to to US bucks with out relying on frequent banking methods. Circle confirmed this shift, reporting that Forty five% of US dollar banknotes in circulation were held foreign as of slack 2022.

The rising use of stablecoins exterior the US reflects a broader vogue. Global markets an increasing form of see US dollar-backed stablecoins as both a store of price and a extra cheap manner of transaction.

Tether’s CEO Paolo Ardoino has moreover emphasized the significance of USDT in inflation-hit countries fancy Argentina, where it provides balance all the plot through enterprise uncertainty.

Mentioned listed right here

Source credit : cryptoslate.com