Bitcoin futures and options open interest soars in February

Inaugurate curiosity, the entire different of extraordinary spinoff contracts that maintain no longer been settled, is a notable metric for gauging market well being and sentiment. An amplify in start curiosity methodology new cash entering the market, showing heightened trading process and curiosity in Bitcoin. Conversely, a decline suggests closing positions, doubtlessly indicating a replace in market sentiment or a consolidation segment. Monitoring these trends is major for understanding the liquidity, volatility, and future tag expectations within the market.

In a bullish market, an amplify in start curiosity in total correlates with rising costs, suggesting that new cash is making a wager on extra tag appreciation. This arena in total shows a solid market sentiment and investor self perception in Bitcoin’s upward trajectory. On the quite a bit of hand, in a bearish context, increasing start curiosity could well presumably point out that traders are hedging against anticipated tag declines, revealing a more cautious or negative market outlook.

Furthermore, the balance between name and save choices at some level of the beginning curiosity presents deeper insights into market sentiment. A predominance of calls suggests a bullish market sentiment, with many traders looking out forward to rate rises, whereas a majority of places can point out bearish expectations.

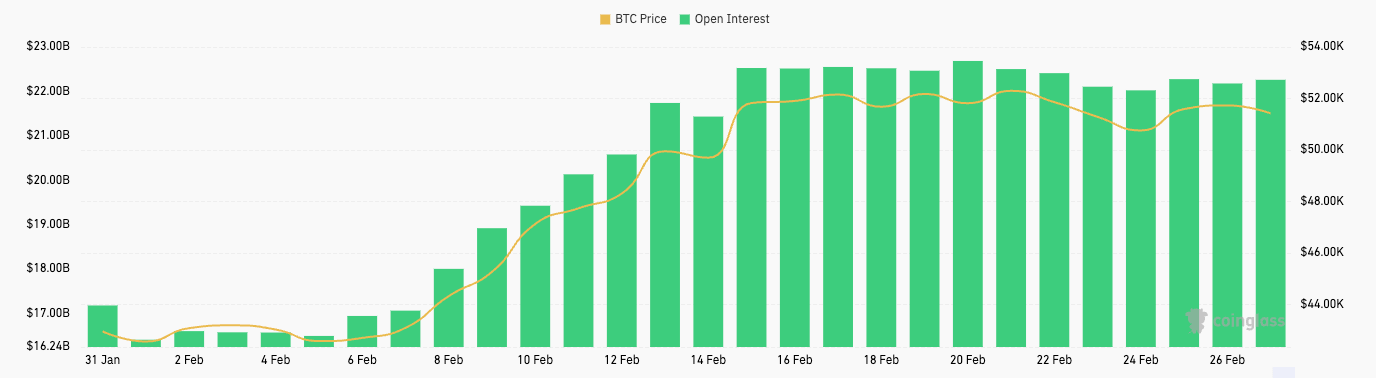

February saw a well-known amplify in start curiosity for Bitcoin futures and choices.

From Feb. 1 to Feb. 20, Bitcoin futures start curiosity grew from $16.41 billion to $22.69 billion. This immense rise suggests that traders were an increasing number of entering into futures contracts, expecting higher volatility or making directional bets on Bitcoin’s tag. Apparently, this duration aligns with a notable amplify in Bitcoin’s tag, from $42,560 to $52,303, suggesting a bullish sentiment amongst futures traders. The puny decrease in start curiosity by Feb.26 to $22.21 billion, alongside a marginal dip in Bitcoin’s tag to $51,716, could well presumably point out some traders taking profits or closing positions in anticipation of a consolidation segment or to reduce publicity before doable volatility.

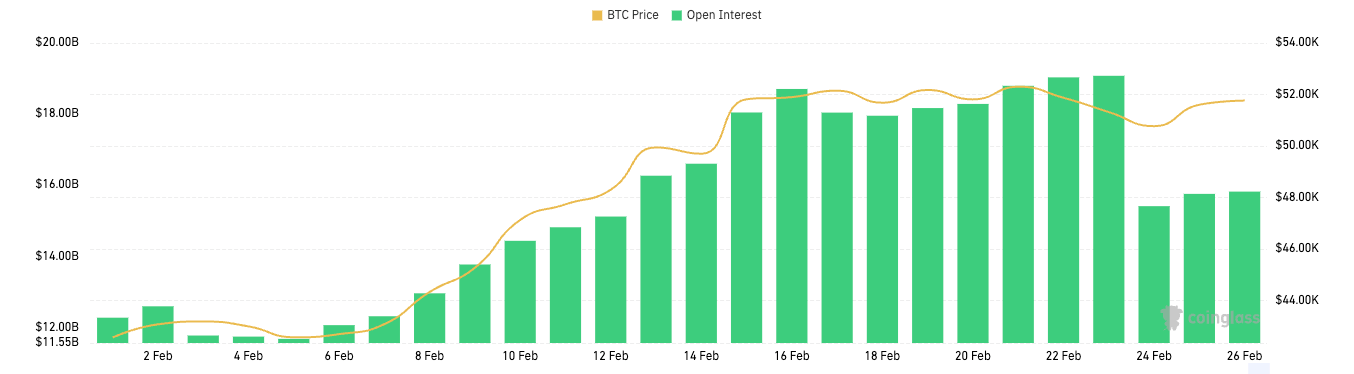

In a similar plot, Bitcoin choices start curiosity saw a dramatic amplify from $12.27 billion on the beginning of February to a high of $19.08 billion by Feb.23 sooner than dialing assist to $15.82 billion in the direction of the month’s discontinue. Alternate choices provide the holder the classy, but no longer the obligation, to aquire (name option) or sell (save option) Bitcoin at a specified tag, offering more advanced options for traders to explicit bullish or bearish views or to hedge new positions. The preliminary spike in choices start curiosity shows a sturdy engagement from traders, leveraging choices for directional bets on Bitcoin’s tag and protective measures against doable downturns.

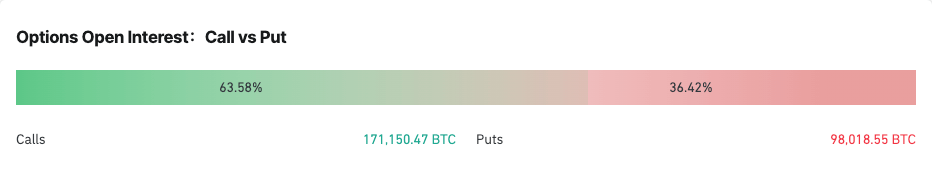

The ratio between calls and places for Bitcoin choices presents a deeper insight into market sentiment and doable expectations for Bitcoin’s tag route. The distribution between calls and places is an instantaneous indicator of the market’s bullish or bearish inclinations, with calls representing bets on rising costs and places on falling costs.

As of Feb. 26, the beginning curiosity in Bitcoin choices used to be skewed in the direction of calls, comprising 63.76% of the entire, when when put next with 36.24% for places. This distribution reinforces the bullish sentiment noticed thru the amplify in choices start curiosity earlier within the month. A predominance of calls within the beginning curiosity suggests that a well-known half of market contributors were looking out forward to Bitcoin’s tag to continue rising or were utilizing calls to hedge against assorted positions.

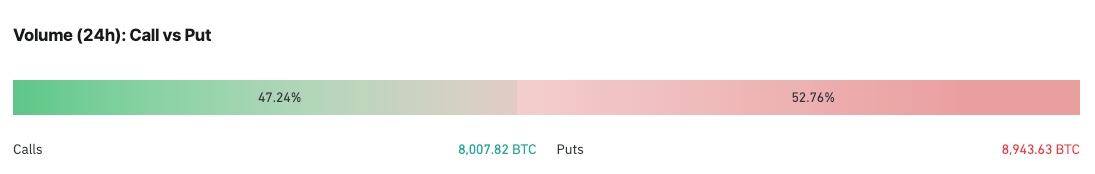

Nonetheless, the 24-hour volume tells a a little bit assorted epic, with calls accounting for 47.24% and places for 52.76%. As compared with the total start curiosity, this shift in the direction of places within the day-after-day trading volume could well presumably point out a transient amplify in caution amongst traders. It suggests that at some level of the final 24 hours, there used to be a noticeable pick-up in defensive options or bearish bets.

The quick implication for Bitcoin’s tag is a doable amplify in volatility. The bullish sentiment, as evidenced by the increasing start curiosity and high percentage of calls, helps a persevered sure outlook amongst many market contributors. Nonetheless, basically the most contemporary uptick in places volume could well presumably signal upcoming tag fluctuations as traders regulate their positions in anticipation of or in accordance to new information or market trends.

Brooding about these, the market appears to be like to be at a crossroads, with a solid bullish sentiment tempered by transient caution. This arena in total precedes classes of heightened volatility as conflicting expectations play out thru trading activities.

Source credit : cryptoslate.com