Ten years of Bitcoin address data uncovers investor behaviors and market shifts

Ten years of Bitcoin address knowledge uncovers investor behaviors and market shifts

Ten years of Bitcoin address knowledge uncovers investor behaviors and market shifts Ten years of Bitcoin address knowledge uncovers investor behaviors and market shifts

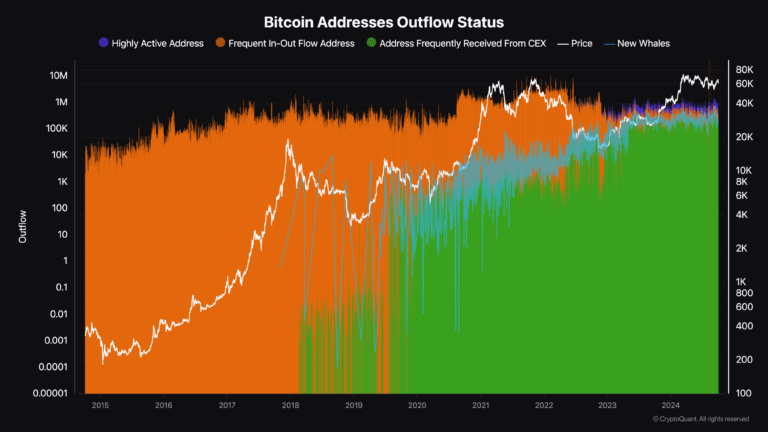

The surge in fresh whale exercise throughout 2022 suggests strategic acquisitions amidst sign lows, reflecting bullish sentiment among natty merchants.

Conceal art/illustration by capability of CryptoSlate. Characterize comprises mixed direct that might per chance encompass AI-generated direct.

Bitcoin's address outflow patterns abet essentially the significant to determining its sign movements throughout the last decade. Between 2014 and 2017, frequent in-and-out float addresses dominated, correlating with decrease Bitcoin prices. A major shift passed off in 2018 with a surge in substitute-connected addresses coinciding with Bitcoin's sign upward thrust. However it completely used to be the spike in fresh whale addresses in 2020 that marked a pivotal moment. This spike... modified every thing. Glimpse how this pattern reshaped the Bitcoin market and what it approach for future sign movements by diving into the full diagnosis.

Source credit : cryptoslate.com