Metaplanet’s Bitcoin strategy lifts stock by 443%, targets 1,000 BTC

Metaplanet’s Bitcoin approach lifts stock by 443%, targets 1,000 BTC

Metaplanet’s Bitcoin approach lifts stock by 443%, targets 1,000 BTC Metaplanet’s Bitcoin approach lifts stock by 443%, targets 1,000 BTC

Metaplanet purchased bigger than 100 BTC to bolster its holdings to over 500 BTC.

Duvet art/illustration through CryptoSlate. Image involves blended snarl material which would perhaps perhaps also embody AI-generated snarl material.

Japanese investment company Metaplanet has made its most attention-grabbing resolution of Bitcoin purchases to this level, following the acquisition of 107.913 BTC for around 1 billion yen (a linked to $6.9 million), as per an Oct. 1 assertion.

This marks Metaplanet’s eleventh Bitcoin acquisition since its first be pleased on April 23, consistent with files from Bitcoin Treasuries.

With this most long-established be pleased, the firm’s complete Bitcoin holdings now amount to 506.745 BTC, price approximately $32.2 million. The corporate’s recent disclosure exhibits that it has spent 4.75 billion yen (around $31.9 million) on its Bitcoin purchases, with an average acquisition payment of 9.37 million yen (roughly $64,931) per BTC.

Meanwhile, Simon Gerovich, Metaplanet’s CEO, hinted at further Bitcoin acquisitions and printed the firm’s subsequent purpose is to fetch 1,000 BTC. He acknowledged:

“As we birth the 2nd week of rights warrant exercise, please succor us get up on the checklist of top corporate holders of Bitcoin. Subsequent target is to be pleased bigger than 1000 Bitcoin.”

At expose, Metaplanet ranks because the 2nd-most attention-grabbing institutional Bitcoin holder in Asia, trailing simplest Hong Kong’s Meitu Inc., which holds 940.9 BTC, consistent with Bitcoin Treasuries.

Meanwhile, the Michael Saylor-led MicroStrategy remains basically the most attention-grabbing corporate Bitcoin holder globally, with 252,220 BTC.

Metaplanet shares outperforms

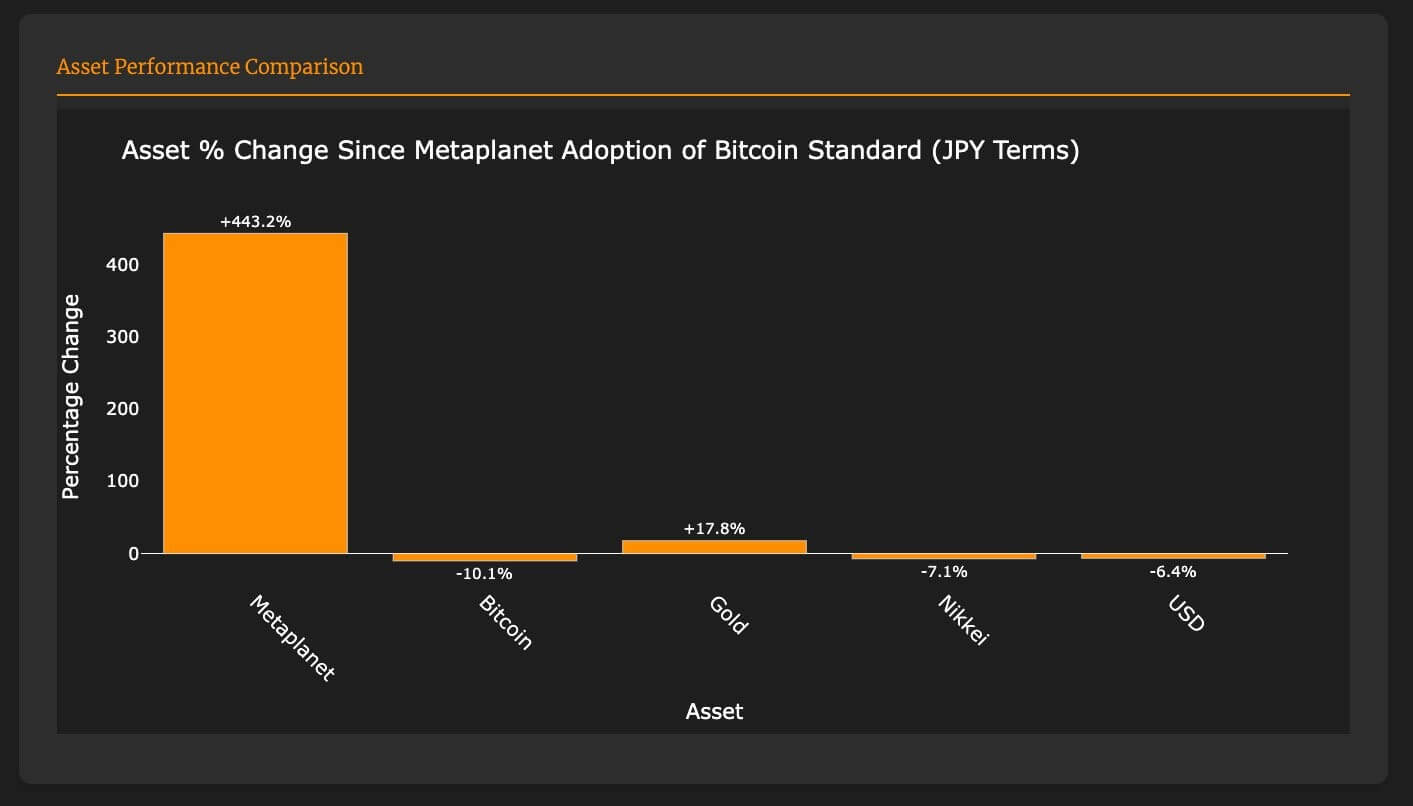

Metaplanet’s Bitcoin transfer has confirmed largely a success and helped the company shares outperform typical monetary resources admire the US Greenbacks, Gold, and Japan’s Nikkei part index

On Sept. 19, Gerovich shared that the company’s stock has surged by 443% since adopting the Bitcoin traditional. In comparison, the Nikkei index, the US Greenback, and Bitcoin itself beget all considered declines of 7.1%, 6.4%, and 10.1%, respectively. Gold, however, has risen by 17% throughout this duration.

Market observers beget linked this strong performance with the firm’s Bitcoin-simplest treasury approach, which it adopted in Would possibly per chance perhaps perhaps additionally to hedge in opposition to the volatility of the Japanese yen. Since then, Metaplanet has made traditional Bitcoin purchases, positioning itself among the many top 25 institutional Bitcoin holders globally.

Mentioned on this article

Source credit : cryptoslate.com