Bitcoin dominance drives $1.2B inflows in crypto investment products

Bitcoin dominance drives $1.2B inflows in crypto investment products

Bitcoin dominance drives $1.2B inflows in crypto investment products Bitcoin dominance drives $1.2B inflows in crypto investment products

Ethereum ended its 5-week outflow plug with $87 million inflow.

Duvet art work/illustration by ability of CryptoSlate. Image entails combined shriek material which can encompass AI-generated shriek material.

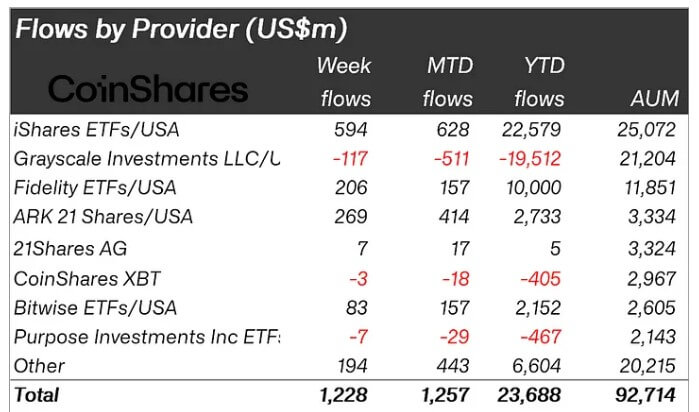

Inflows into crypto-linked investment products persisted for the third consecutive week, with $1.2 billion flowing into the field, in accordance to CoinShares’ most modern weekly document.

James Butterfill, CoinShares’ head of study, attributed the right inflows to expectations of a dovish US monetary coverage and definite market momentum. These factors pushed total sources below administration up 6.2% to $92.7 billion.

The US Securities and Exchange Commission licensed choices trading for BlackRock’s place of abode Bitcoin ETF, which additionally lifted market sentiment. Despite these inflows, weekly trading quantity within the field dipped by 3.1%.

Bitcoin’s dominance continues

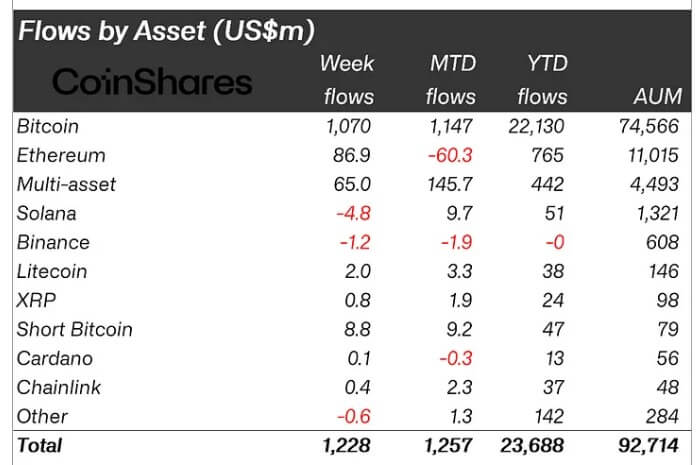

The CoinShares document confirmed that Bitcoin persisted to dominate the flows, with consumers pouring in $1 billion to BTC-linked investment products.

This would possibly maybe maybe be linked to its right payment efficiency and additionally the improved inflows to place of abode Bitcoin ETF products last week. Significantly, the funds flee by Bitwise, BlackRock, Fidelity, and Ark 21 Shares all noticed definite efficiency right during the reporting interval.

Nonetheless, Grayscale’s crypto funds persisted their secure outflow vogue, shedding its total sources to $21.2 billion.

In the intervening time, BTC’s fresh uptrend to around $65,000 fueled an $8.8 million inflow into immediate-Bitcoin products, as some consumers demand the fresh rally to proceed.

Locally, sentiment used to be divided. The US led with $1.2 billion in inflows, while Switzerland trailed with $84 million. In incompatibility, Germany and Brazil experienced outflows of $21 million and $3 million, respectively.

Ethereum breaks a harmful plug.

Ethereum-linked products ended a 5-week outflow plug, bringing in $87 millionâthe necessary necessary inflow since early August.

Data from SosoValue confirmed that place of abode Ethereum ETFs noticed the 2d-top possible weekly flows since their birth in July.

On the assorted hand, excellent-cap alternative digital sources had mixed results. Litecoin and XRP recorded inflows of $2 million and $0.8 million, respectively. In the intervening time, Solana and Binance confronted outflows of $4.8 million and $1.2 million.

Talked about listed right here

Bitcoin

Bitcoin  Ethereum

Ethereum  Solana

Solana  Litecoin

Litecoin  XRP

XRP  CoinShares

CoinShares  BlackRock

BlackRock  Fidelity Investments

Fidelity Investments  Ark Invest

Ark Invest  21shares

21shares  Grayscale Bitcoin Belief

Grayscale Bitcoin Belief  Grayscale Ethereum Belief

Grayscale Ethereum Belief

Source credit : cryptoslate.com