SEC Inspector General investigating crypto conflicts of interest within federal agency

The US Security and Swap Price’s (SEC) Region of commercial of Inspector Normal (OIG) is investigating cryptocurrency-connected monetary conflicts of hobby acknowledged by the accountability physique of workers Empower Oversight.

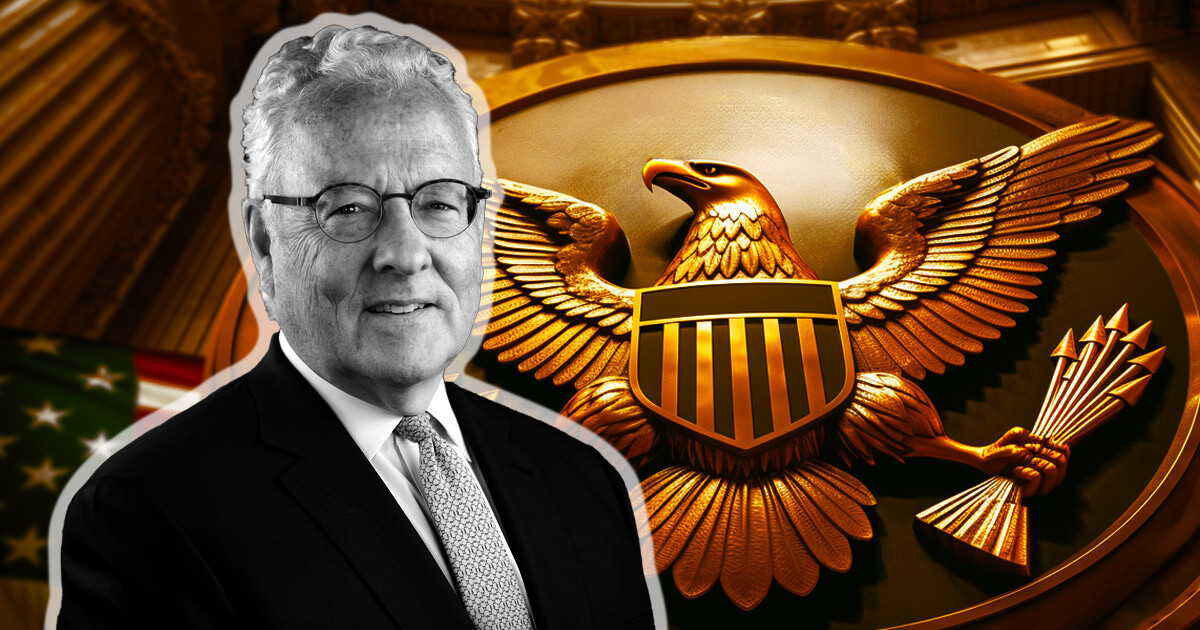

In a Feb. 15 assertion, Empower Oversight disclosed that the SEC’s division became within the “closing phases of ending” an launch investigation into matters concerning to the failures of the SEC’s Ethics Region of commercial and a frail legitimate, William Hinman.

Hinman is accused of collaborating in matters where he held a monetary stake, notably delivering a contentious speech asserting that particular digital resources, comparable to Ethereum, had been no longer arena to SEC legislation as securities.

Critics one day of the Ripple XRP neighborhood contend that Hinman’s speech unfairly liked Ethereum, doubtlessly giving it an edge over diversified digital resources within the market.

Empower Oversight emphasized its concerns by presenting documentation indicating that key figures from Ethereum, together with co-founders Joseph Lubin and Vitalik Buterin, had been smitten by drafting the spoiled speech.

To boot, the watchdog physique of workers additionally declared that Hinman “blatantly unnoticed” instructions no longer to meet with explicit folk while working on the SEC, comparable to his frail employer, Simpson Thacher, a member of the Ethereum Venture Alliance (EEA.)

“When Hinman departed the SEC in December 2020, he returned to Simpson Thacher as a partner. That similar month the SEC sued Ripple, alleging XRP became an unregistered security,” Tristan Leavitt, president of Empower Oversight wrote.

This topic became officially brought to the honor of the OIG in Would possibly objective 2022.

Threatens Lawsuit

Empower Oversight has threatened the monetary regulator with a lawsuit if it fails to present knowledge referring to its investigations by Feb. 23.

The physique of workers famed that the SEC has failed to present knowledge in regards to the case because it filed a Freedom of Info Act (FOIA) in Would possibly objective 2023.

Leavitt acknowledged:

“The silver lining is that now we know one reason on the abet of the stonewalling is that there the truth is is an inviting inquiry by the inspector overall, which is virtually done. Nevertheless, whether or no longer the OIG document totally addresses all of the concerns we raised stays to be seen on memoir of we don’t know the explicit scope of the inquiry. The SEC’s OIG desires to obtain this appropriate and back cease an identical conflicts of hobby from undermining public faith within the SEC’s work at some point.”

Source credit : cryptoslate.com