Binance co-founder Changpeng Zhao to be released from US custody on Sept. 29

Binance co-founder Changpeng Zhao to be released from US custody on Sept. 29

Binance co-founder Changpeng Zhao to be released from US custody on Sept. 29 Binance co-founder Changpeng Zhao to be released from US custody on Sept. 29

Zhao's impending birth comes as the US SEC filed an amended complaint towards Binance.

Quilt art work/illustration via CryptoSlate. Image comprises combined sigh material which also can consist of AI-generated sigh material.

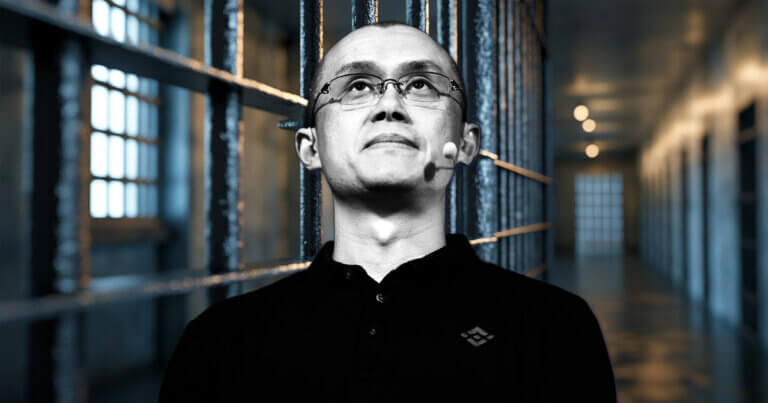

Changpeng Zhao, co-founding father of Binance, is determined to be released from US custody on Sept. 29, in accordance to the US Federal Bureau of Prisons web sigh.

Zhao is currently serving a four-month sentence and used to be nowadays transferred to the Long Seaside Residential Reentry Administration (RRM) facility in central California.

RRMs reduction as local federal detention center liaisons, assisting inmates nearing birth by working with federal courts, the US Marshals Carrier, and local corrections.

Zhao’s faithful points

Zhao’s faithful points began in November when he and Binance pleaded responsible to breaking US federal felony guidelines.

The allegations incorporated Zhao’s failure to implement an efficient anti-money laundering program, as required by the Bank Secrecy Act. It used to be furthermore alleged that Binance had processed transactions linked to unlawful actions, along with those between US residents and contributors in sanctioned areas admire Iran.

As phase of the settlement, Binance used to be ordered to pay $4.3 billion in fines, whereas Zhao personally agreed to pay $50 million. Zhao furthermore stepped down as Binance’s CEO nonetheless retains an estimated 90% ownership in the firm

Binance faithful struggles

Whereas Zhao’s faithful troubles are nearing an conclude, Binance’s faithful points continue. The US Securities and Substitute Commission (SEC) nowadays filed an amended complaint towards the trade, reiterating its accusation that the trade violated federal securities regulations.

The SEC claimed that Binance plays a key role in the crypto market by republishing and amplifying knowledge from issuers and promoters. The filing furthermore alleged that Binance promotes digital assets it lists and trades by sharing critical aspects on asset pattern, trading volumes, and price knowledge.

Furthermore, the monetary regulator reaffirmed its stance that Binance’s token, BNB, used to be supplied and supplied as a security. It furthermore highlighted the expectation among clients, workers, and consumers that BNB would raise in imprint because of efforts by issuers and promoters.

This comes despite a old court docket decision pushing apart prices associated to the secondary sale of BNB by third occasions.

Mentioned on this text

Source credit : cryptoslate.com